This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- More than 50% beet planted in Michigan, Idaho.

- Red River Valley plantings to start imminently.

- Louisiana cane crop in good condition.

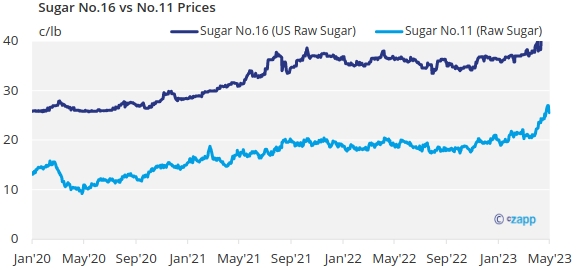

Sugar beet planting progressed unevenly during the week with growers in the key Red River Valley still waiting to get into their fields. Cash sugar prices were unchanged but firm. Raw and white sugar futures set fresh 11½-year highs.

Farmers in the Red River Valley were confident they could begin planting later this week amid favorable forecasts. While soil temperatures were well below optimal levels, focus was on getting into fields as soon as possible. Sources stressed that growers in the valley had time to get beets planted although they may miss their preferred window by a week or so. No beets had been planted at this time last year either. Montana was the only other state with no beets planted.

More than half of the crop was planted in Michigan as of April 23, the only state ahead of last year and the five-year average. Beets in Idaho also were more than 50% planted, but progress was behind last year and the average. Planting in Wyoming and Colorado lagged the five-year average, while Oregon was nearly finished.

The Louisiana sugar cane crop remained in good if not stellar condition with ratings as of April 23 the highest since 2017.

Beet sugar sales had noticeably slowed from March. Sources said most buyers who wanted to book sugar had done so with final deals getting wrapped up in April. Some smaller and mid-size buyers opted to wait and see if prices would drop in the coming weeks once beets were planted.

Cane refiners reported active sales this season. One refiner was about 75% sold, which was ahead average for the date. Others noted strong sales, in part as some buyers found beet sugar hard to find or at nearly flat prices with cane sugar.

Bulk refined beet sugar prices for 2024 were steady to firm with offers in the mid- to upper-50¢ a lb range in the Midwest and nearer 60¢ a lb on the West Coast. Bulk refined cane sugar prices for 2024 were unchanged at 60¢ a lb f.o.b. Northeast and West Coast, with prices in the Gulf and Southeast in the mid- to upper 50¢ range, mostly 56¢ to 58¢ a lb f.o.b.

Sellers noted that more buyers were looking to cover just the 2022-23 marketing year (through September) this season than in recent years when sales had been trending to more of a calendar year. Ideas were buyers were hoping prices for October-December 2024 (the first quarter of the 2024-25 marketing year) would be well below current prices for calendar 2024.

In the spot market, one major cane refiner offered sugar steady at 66¢ a lb f.o.b. at all locations. Spot beet sugar mostly was unavailable and priced nominally at 60¢ a lb. Beet processors said they may have small amounts of sugar to offer on the spot market in the coming weeks as some buyers have been slow to take all of their contracted sugar. Others were opting to store undelivered sugar for the tight summer period.

Nearby New York world raw sugar futures set fresh 11½-year highs on tight global supplies mainly due to lower-than-expected production in India and a slow start to Brazil’s 2023-24 harvest. Domestic raw sugar futures followed world raw futures higher.

Corn sweetener markets mostly were routine with numerous buyers still not fully covered for 2023 amid limited spot supplies.