This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Beet plantings are in line with the 5-year average.

- Soil temperatures remain too low for plantings in the Red River Valley.

- Spot sugar prices are unchanged this week.

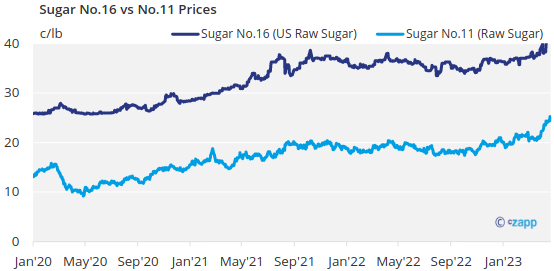

Sugar beet planting made strong progress in some areas but lagged the average pace in others. Cash sugar prices were steady to firm while raw sugar futures posted multi-year highs.

Sugar beet planting as of April 16 was 13% completed in the four largest beet-growing states, ahead of 7% last year and even with the five-year average, but that was due to strong progress in Idaho and Michigan, according to the US Department of Agriculture’s Crop Progress report.

No beets had been planted in the key Red River Valley and no plantings were expected until the end of April. Growers in the region prefer to have about half of their beets planted by the first week of May, and they can plant most of the crop in just a week or two if soil and weather conditions cooperate. The snow melt has been nearly ideal — slow enough to soak into the dry soil rather than run off and create flooding. Soil temperatures in the Valley have risen but remained well below the 50-degree target.

Bulk refined cane sugar prices for 2024 were unchanged at 60¢ a lb f.o.b. Northeast and West Coast, with prices in the Gulf and Southeast steady at 56¢ to 58¢ a lb f.o.b. Beet sugar prices for 2024 were steady to firm with some offers raised 1¢, to 57¢ a lb in the Midwest.

New sales for next year have slowed considerably since March. One beet processor was out of the market until harvest in October, but others were selling, some on a selective basis, and some outstanding deals still were closing. Most were comfortable with their sales to date, which have been earlier than average. Sales of refined cane sugar for 2024 also have been ahead of the average pace for the date.

Spot sugar prices were unchanged with one major refiner offering cane sugar at 66¢ a lb f.o.b. at all locations. Spot beet sugar mostly was unavailable and priced nominally at 60¢ a lb.

Some beet processors continued to indicate slower-than-expected deliveries of contracted sugar for the current year. Some sellers suggested a few buyers may have overbooked sugar to ensure they had adequate supplies after the shortfall from some processors the past couple years.

Should buyers not need all of their contracted supply, that sugar may be turned around and sold at higher spot prices than it was contracted for last year. A couple processors indicated they would store sugar to ensure they had adequate supplies during the tight summer months. Should processors opt to sell the sugar, it could help relieve the tight supply situation in the current market.

Nearby New York domestic raw sugar futures jumped to a high of 43.50¢ a lb, more than a 13-year high. World raw futures were at 11-year highs. Tight raw sugar supplies were supportive in both cases.

The corn sweetener market mostly was quiet with limited if any supplies likely to be available on the spot market.