This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Additional sugar supply met with limited buying interest.

- Beet acreage down 2.7% this year.

- US TRQ increased by 125k tonnes.

The cash sugar market was in a summer lull during the week ended July 7, but the market was anything but dull. Prices were unchanged.

Trade sources continued to indicate slow bulk sugar deliveries for the current season although not for all buyers or sellers. The additional sugar met with limited buying interest, and some traders said sellers may have to discount offers 2¢ to 3¢ a lb below current quoted prices to move sugar on the spot market. There were no indications of buyers clamoring for spot supply. At the same time, some beet processors were reluctant to sell extra supply until they were more confident of their 2023 sugar beet crops as they may need extra sugar in September if early harvest doesn’t materialize in all areas.

Sugar beet crop ratings as of July 2 were unchanged or higher than a week earlier and were mixed compared with a year ago. The lowest rated crop in Michigan showed notable improvement during the week but still was rated far below last year’s crop for the date. Ratings for the crop in the Red River Valley improved. With about 20,000 additional beet acres planted by a major cooperative in the Red River Valley, it was thought harvest may begin a week earlier than average to give extra time for slicing more tonnage even if sucrose content was lacking. Summer weather will help determine when harvest can begin.

Bulk refined beet and cane sugar prices for 2023-24 were unchanged. Buyers not yet covered appeared willing to wait until October when prices for the next year sometimes briefly decline until beet processors sell the remainder of their prospective sugar production once the beet crop size is well known. Two beet processors currently were out of the market or selling selectively for 2023-24 at least until October. Others indicated ongoing slow sales with most forward business wrapped up in March.

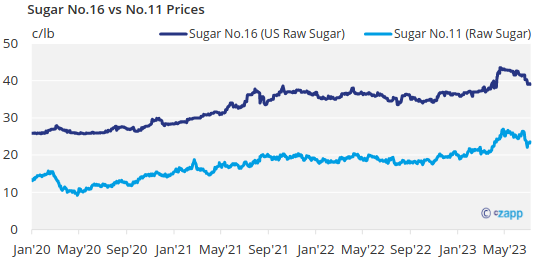

No. 11 world raw sugar futures, which declined nearly 4.5¢ a lb, or 16%, since mid-June, partly recovered from recent lows. It was thought strong cane harvest and exports by Brazil will limit further No. 11 futures price gains.

The June 30 US Department of Agriculture Acreage report brought no real surprises. The USDA forecast 2023 planted area at 1,128,500 acres, down 2.7% from 2022, and forecast harvested area at 1,110,700 acres, down 2.3%. The June 30 planted area tally was up 17,700 acres from the March 31 Prospective Plantings report due mainly to increases in Minnesota and North Dakota, which encompasses the Red River Valley.

Sugar cane area for harvest in the 2023 season was forecast by the USDA at 922,000 acres, down 8% from 2022 as decreases in Florida and Texas more than offset an 8% increase in Louisiana.

The USDA increased the raw cane sugar tariff-rate quota by 125,000 tonnes after determining that additional supplies were needed.

The USDA announced in the July 5 Federal Register the 2023-24 US raw sugar tariff-rate quota at the minimum needed to meet World Trade Organization commitments.

Supplies of 42% high-fructose corn syrup were readily available on the spot market, but supplies of glucose and other products were tight.