This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Buyers and sellers have been locking in business for 2023/24.

- Many buyers returned from the Intl Sweetener colloquium looking to book sugar.

- Prices remain about 25% higher than for 2022/23.

The cash sugar market was active during the week ended March 10 as buyers and sellers sought to lock up business for 2023-24 after returning from the International Sweetener Colloquium a week earlier.

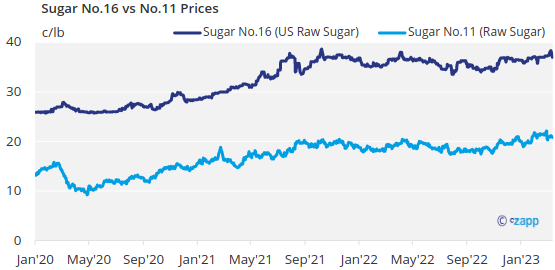

As expected, many sugar buyers returned from the colloquium ready to wrap up all or a significant portion of their 2023-24 needs. A few, including some large buyers, continued to balk at pricing, which was up about 10¢ a lb, or 25%, from what most sugar was sold at in 2022-23, but most were willing to lock in supplies that have become increasingly uncertain in the past couple of years.

Indications were sales of beet sugar rose to about 50% of prospective 2023-24 production, with some processors expected to approach 75% in the next couple weeks. At least one processor briefly stepped away from selling to assess its current sold position but was expected to resume activity in a few days. Others said they may do the same in a week or so once the current rush subsides. Some sellers are expected to step out of the market sooner than in past years due to supply uncertainty, which has been marked by four force majeures by beet processors since the fall of 2019.

Pricing was firm. While most processors held prices at pre-colloquium levels, some were considering price increases as their percentage of sales increases. Some also were quoting in a wider price range, including prices well above quoted values for buyers who insisted on an immediate price quote.

Bulk beet sugar prices for 2023-24 ranged from 52.50¢ a lb f.o.b. Midwest to more than 55¢ a lb for an immediate quote. Bulk cane sugar was offered from 57¢ to 57.50¢ a lb f.o.b. Northeast and West Coast for calendar 2024. Pricing in the Gulf and Southeast ranged from 54¢ a lb to 56¢ a lb f.o.b. depending on refiner and delivery period.

Spot sugar still was at 62¢ a lb f.o.b. for cane and nominally at 60¢ a lb f.o.b. for beet. Some processors indicated slower-than-expected deliveries of contracted sugar were making a bit more spot supply available, but it was limited.

The US Department of Agriculture in its March 8 supply-and-demand report made several major revisions from February. Some beet processors were surprised by the USDA’s higher 2022-23 beet sugar forecast. If realized, total sugar production would be record high.

US 2022-23 imports were forecast lower mainly due to a 171,000-ton drop in shipments from Mexico due to a sharply lower sugar production forecast, which was anticipated.

The USDA forecast a 100,000-ton increase in 2022-23 sugar deliveries for human consumption based on the strong pace of deliveries through January.

The 2022-23 ending stocks-to-use ratio of 13.5% was at the bottom of the USDA’s preferred range of 13.5% to 15.5%.

Trade sources noted some corn sweetener delivery delays in an already tight market for 2023.