This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Dry weather makes beet processors wary of selling 2023/24 sugar.

- Beet crops need more moisture, especially in Michigan.

- Rainfall is forecast for July in some areas.

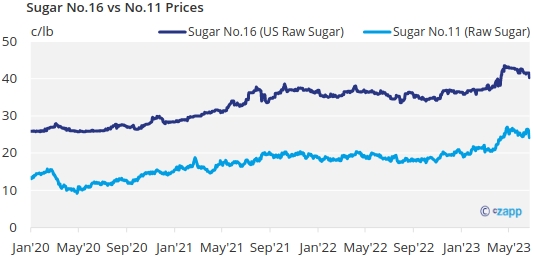

Trading in cash sugar was slow during the week ended June 23. The market uneasily watched dryness in some major sugar beet areas and were concerned about Mexico’s ability to meet its 2022-23 export commitment to the United States. Prices were left unchanged.

Slow deliveries of refined sugar for 2022-23 over the past few months resulted in some spot sugar supply available in an overall tight market. But shipments to Mexico, where prices were above those in the United States, or replacement of Mexican sugar not shipped to US buyers, were expected to absorb excess spot supplies. No US sugar users were clamoring for sugar, so the market appeared to be in a lull, or maybe a defining period, until the Mexico situation is sorted out and there is a better sense of weather’s impact on US beet crops.

Spot sugar prices were left unchanged with some indicating recent weakness may be transitioning back to a steady to firm market. It was mid-June to July a year ago that spot prices took a sharp turn higher and some beet sugar prices went “no quote” amid tight supplies. The situation is much different this year.

Beet crops in most areas needed moisture, especially Michigan. Good-to-excellent condition ratings varied widely, from above 90% to below 50%. More rainfall is forecast in July for some areas, but current dryness made beet processors wary about selling additional 2023-24 supplies until more is known about the crop.

Prices for 2023-24 were mostly unchanged with the range widening 1¢ a lb to the low side for beet sugar. Some beet sugar offered at posted levels for the October-December (2023) period were met with resistance from buyers. It was suggested that beet sugar may have to be offered below 55¢ a lb f.o.b. Midwest to find a buyer. At the same time, beet processors were reluctant to drop prices with a large percentage of prospective 2023-24 production already sold and increasing uncertainty about the 2023 beet crop.

Buyers who have held out due to high prices were not prompted to add coverage with the idea upside price potential is limited and more downside potential exists. It’s not uncommon for a brief window of weaker prices for the next year to open in October once processors know the potential for the beet crop. But this year that possibility depends on improving weather during the growing season.

The US Department of Agriculture in its June World Agricultural Supply and Demand Estimates report forecast 2023-24 US beet sugar production at 4.950 million tons, down 4% from 2022-23, and if realized, the lowest since 2019-20. Cane sugar production in 2023-24 was forecast at 4.177 million tonnes, up 1.2% from 2022-23. Both beet and cane forecasts were lowered from May, with some in the trade expressing concern that forecasts for 2023-24 are starting at a relatively low point with continued uncertainty about supplies from Mexico next year.

Some supplies of 42% high-fructose corn syrup were available on the spot market at prices even with contracted annual 2023 values, but supplies of other products, notably regular corn syrup (glucose), remained tight.