This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Sugar beet harvest starts in Red River Valley.

- Trade houses expect a good (but not bumper) beet crop this year.

- Louisiana cane crop continues to deteriorate.

Sugar beet harvest began in the Red River Valley this week and was nearing in other states. Crop condition ratings improved in two of the driest states while Louisiana sugar cane ratings dropped further. Spot and forward prices for bulk refined sugar mostly were unchanged.

Pre-pile of sugar beets was underway in the Red River Valley with four of American Crystal’s six processing facilities running. The Western Sugar Co. will begin beet harvest Sept. 4 and bring its processing plants online Sept. 5. Harvest was expected to begin in mid-September in Michigan.

Good-to-excellent ratings jumped 20 percentage points from a week earlier in both Michigan (to 56%) and North Dakota (to 64%) as of Aug. 13. The Minnesota rating remained high despite falling to 90% from 94%. Ratings in other sugar beet states were unchanged.

Most trade sources expect good but not bumper sugar beet crops this year. Dry conditions in the Red River Valley, mixed dry and too wet conditions in Michigan and a lack of heating degree days in some Western Sugar Co. states and in Idaho prevented higher production.

The Louisiana sugar cane crop continued to deteriorate, dropping to 47% good-to-excellent from 56% the prior week and compared with 74% at the same time last year. It was the lowest rating for the date since at least 2015. The US Department of Agriculture in its Aug. 11 World Agricultural Supply and Demand Estimates report forecast Louisiana 2023-24 sugar production at 2,053,899 tons, down 38,101 tons from July. Some expect the production number will be trimmed further unless timely rains arrive soon.

Spot trading of refined beet and cane sugar was light, as were forward sales for 2023-24, with most contracting for next year completed in March. Still, one sugar seller said he was surprised at the amount of uncovered business yet to be done for next year. Those who delayed may be rewarded this year as spot supplies are available due to slow deliveries of contracted sugar and good to above-average beet crops means most beet processors will be back in the market in October.

Slow deliveries of refined sugar for the current year were reflected in the USDA’s Aug. 11 WASDE report with a 25,000-ton reduction in deliveries for food use in 2022-23 bringing the total reduction since July to 100,000 tons. Some processors whose deliveries typically begin to increase seasonally in August said they have not yet seen a pick-up in shipments.

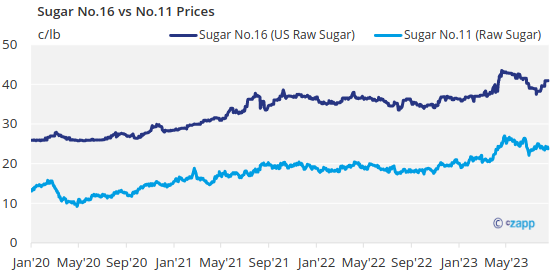

Beet processors and cane refiners have continued to hold offer prices steady even as demand appears to have softened. Some indicated beet sugar supplies were tight enough that they would carry a bit more sugar into the new marketing year rather than drop prices, at least until they were sure of their 2023 beet crops.

For next year, beet processors and cane refiners also were holding firm in their offers, with indications of cane sugar in the Southeast trading slightly above the recent quoted level. Those sellers may be rewarded amid indications that Mexico will not have a bumper cane crop in 2023-24 (though considerably better than 2022-23), and global sugar deficit forecasts are increasing.

Supplies of 42% high-fructose corn syrup were readily available on the spot market, but supplies of glucose and other products were tight. Prices were unchanged as the negotiating period for annual 2024 contracts was approaching.