This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Buyers and sellers prepare for International Sweetener Colloquium.

- Trading enquiries for 23/24 have increased amid firm pricing.

- Sales for the current marketing year are quiet.

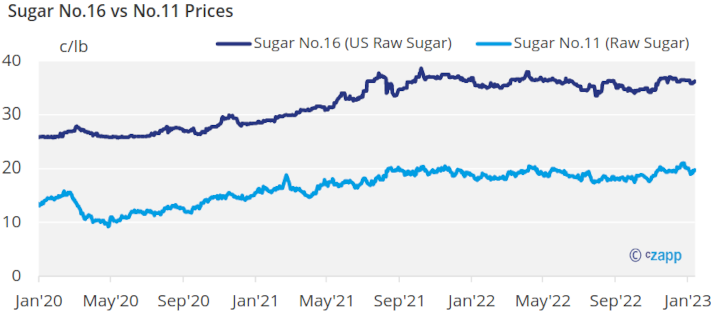

Spot sugar prices were unchanged in the week ended Jan. 27, and trading was slow for the current marketing year, but inquiries for 2023-24 increased amid steady to firm pricing.

Focus will continue to shift to the next marketing year as the International Sweetener Colloquium approaches. Buyers and sellers were actively setting up meetings that will take place on the sidelines of the Feb. 26-March 1 event.

Pricing indications for 2023-24 were mostly in line with recent quotes. Sugar still was offered at 51¢ a lb f.o.b. Midwest for beet sugar and at 52.50¢ a lb f.o.b. Southeast for cane sugar. Large users were able to buy sugar below those levels. At the same time, some processors were pricing beet sugar 1¢ to 3¢ above that level. Recent buyer inquiries were for the remainder of 2023-24 or for the 2024 calendar year as most October-December 2023 business has been done.

In some cases early sales were carrying a premium, unlike most past years when early sales were priced lower as processors sought to get as much sugar booked as early as possible. Recent weather-induced supply and logistics disruptions have prompted some sellers to adjust marketing tactics out of concern of over-selling potential production too soon. How much of an impact that will have on the market in which buyers appear ready to book early remains to be seen.

Sales for the current marketing year were quiet as most business was completed except for unplanned spot needs. Prices were unchanged. Limited quantities of sugar continued to be offered to select customers at around 60¢ a lb f.o.b. with some processors still out of the market. Cane sugar mainly was available from one major refiner at 62¢ a lb f.o.b.

The developing story for 2022-23 may be slowing deliveries. Sellers indicated the slowdown that started late last fall has continued into the new year. While January typically is a period of slow deliveries anyway, this year appears to some to be behind the average pace. Should users continue to lag on drawing their contracted sugar, the tight spot supply situation could begin to ease as the year progresses. Some sellers suggested the market already was beginning to feel less tight, although stocks were highly committed for later months. At the same time, buyers noted that spot prices have remained steady to firm, indicating supplies still are tight.

The USDA’s increase in its 2022-23 beet sugar forecast in the Jan. 12 supply-and-demand report continued to be debated. The USDA said the increase was due to “higher-than-expected sucrose recovery based on actual production data through November.” Some suggested it was too soon to raise the production forecast as much as the USDA did based on the early data.