This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Talk of slow sugar deliveries has become more prominent.

- Prices are so far unchanged.

- Reports that US sugar has been exported to Mexico.

Talk about slow sugar and corn sweetener deliveries became more prominent during the week ended June 9, including discussions at the Sosland Publishing Co. annual Purchasing Seminar in Kansas City. Prices were left unchanged, but many expect weakness in the spot market to develop.

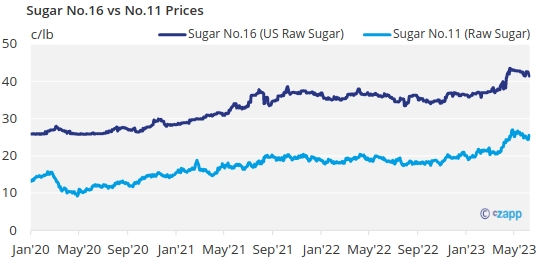

The market was in a period of transition, or at least looking for direction. Many in the industry perceived softer prices developing from current high spot levels as more sugar became available and as high-tier imports were competitively priced amid weakening world raw sugar prices.

The focus was on deliveries, which many see as below the US Department of Agriculture’s May forecast (which was raised from April). The USDA in its June 9 supply-and-demand report left its delivery forecast unchanged from May. Should deliveries continue below expectations through the summer, prices may weaken as processors seek to empty their bins ahead of the new crop.

The USDA lowered its forecast of 2022-23 imports from Mexico by 91,000 tons from May, partially offset by higher domestic production and high-tier imports, resulting in a drop of 51,000 tons in ending stocks and a stocks-to-use ratio of 13.1%, indicating tight supplies.

Adding to market uncertainty were indications US sugar was being exported to Mexico, which is expected to miss its US export quota due to lower-than-expected production this year. Refined and estandar sugar prices are record high in Mexico and were above US prices.

Spot sugar prices were left unchanged, but it was likely some supply was selling below quoted levels, especially in the case of cane sugar that competed with lower-priced high-tier imports. Beet sugar sellers indicated they were not at the point of lowering spot prices, pending deliveries as the summer progresses since the July-September period typically is the tightest supply quarter. Beet processors also have to assess the current crop and determine supply from early harvest.

As price weakness develops, it’s less likely 2023-24 prices will be pulled up to current spot prices later in the year. It’s not uncommon for next year’s prices to take a brief dip as processors re-enter the market in late September or early October when they have a better idea of what their production for the new year will be. This year some processors stopped selling for 2023-24 at a lower percentage of prospective production than in past years, which means they may have more sugar than usual to sell later in the year.

If deliveries pick up as the summer progresses, or if problems develop in the sugar beet and/or sugar cane crops, current price weakness may quickly evaporate.

Sugar beet planting was complete in all states except Montana, with market focus now on summer weather. Most areas, especially Michigan, need rain in June, but forecasts call for more rainfall in July and through the summer. The sugar cane crop was in stellar condition in Louisiana, but it too could do with a shot of water.

Bulk refined beet and cane sugar prices for 2024 were unchanged, and sellers will be slower to adjust values than in the spot market. One processor remained out of the market until October. Others were selling sugar for next year at steady prices. Both beet and cane refiners were well sold and were comfortable with their level of sales for next year.

As in sugar, trade sources indicated undelivered corn sweeteners were becoming available on the spot market, something that hasn’t been seen in corn sweeteners for a long time. Distributors indicated both 42% high-fructose corn syrup and dextrose, and possibly other products, were available due to slower-than-expected deliveries. Corn refiners have adjusted capacity over the years and demand from Mexico has increased in recent months due to record-high sugar prices and tight sugar supplies there. The material was offered at 2023 annual contracted price levels, sources said.