This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The International Sweetener Colloquium takes place Feb 26th – Mar 1st.

- Sugar sales could surge afterwards, following face to face meetings between buyers and sellers.

- Price indications for 23/24 are unchanged and firm.

Light sugar sales for the next marketing year were noted during the week ended Feb. 17 at steady to firm prices. Spot sales were limited, and some sellers said draw on contracted supplies was slower than expected.

Sales for 2023-24, mainly for January-September 2024 as the October-December 2023 quarter mostly was covered, continued within recent price ranges. Inquiries from buyers were moderate to active, held in check by planned face-to-face meetings during the International Sweetener Colloquium Feb. 26-March 1 in La Quinta, Calif. Many expect sales to surge shortly after the Colloquium. Some beet processors indicated sales for next year already were ahead of last year’s pace.

Pricing indications for 2023-24 were unchanged with a firm tone. Beet sugar was offered at 52½¢ a lb f.o.b. Midwest, and cane sugar was offered at 54¢ to 55¢ a lb f.o.b. Southeast. Large users were said to be able to buy sugar below those levels. Some cane refiners indicated they may enter the market in the 52¢ to 54¢ a lb range f.o.b. Gulf.

Sales for the current marketing year were nil as beet processors had no sugar to offer unless buyers failed to take contracted supplies, which could easily be resold at higher levels, although some processors opted to build up depleted stocks rather than resell undelivered sugar.

Spot sugar prices were unchanged. Cane sugar was available from one major refiner at 62¢ a lb f.o.b. at all locations.

Some traders continued to express doubt about the US Department of Agriculture’s 2022-23 beet sugar production forecast in the Feb. 8 World Agricultural Supply and Demand Estimates report. The USDA in its WASDE report raised beet sugar production by 52,000 tons from January based on strong sucrose recovery from the 2022 beet crop.

Should the beet sugar forecast fall short, supplies could tighten later in the year, especially if Mexico is unable to meet its current US export limit due to lower-than-expected sugar production. US imports of sugar from Mexico were strong in January, but average sugar prices in Mexico were near record highs and sugar production to date was well behind a year ago.

Total US imports of sugar in the first four months of the 2022-23 marketing year (October-January) were on track with USDA projections, although sectors varied widely. High-duty imports and World Trade Organization raw and refined sugar tariff-rate quota imports were well ahead of the pace needed to meet the projections, while free trade agreement TRQ imports, re-export program imports and imports from Mexico were well behind the needed pace, according to data from the USDA and the US Census Bureau.

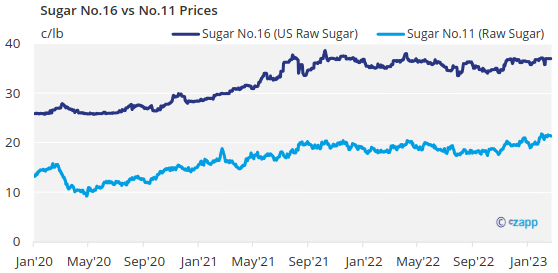

World raw sugar prices recently hit six-year highs amid near-term supply tightness. Prices were expected to weaken as the year progresses. A recent Reuters poll of 11 traders and analysts indicated they expect nearby world raw sugar futures prices to drop more than 10% by yearend to around 18.50¢ a lb.

Corn sweetener markets mostly were routine with numerous buyers still not fully covered for the year. Some high-fructose supply was available from distributors, but glucose and dextrose were in short supply. – Ron Sterk.