This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- High supply of beet and cane mean prices of bulk refined sugar are steady.

- Contracting continued to move slowly, only partially due to the Thanksgiving holiday.

- Corn sweetener sales for 2024 advanced.

Farmers Leave 45k Tonnes of Beet Unharvested

The sugar beet harvest was 92% to 100% complete as of November 12 with all beets lifted in Minnesota and North Dakota, where high tonnage resulted in farmers leaving about 45,000 acres of beet unharvested. In other states, the harvest was expected to be complete before Thanksgiving. Quality issues were noted in some acres in Montana after a recent freeze, but the beets were being harvested and processed quickly, limiting potential losses.

US bulk refined beet sugar offers for spot delivery were USD 0.59/lb to USD 0.62/lb FOB and for 2024 were USD 0.57/lb to USD 0.59/lb FOB Midwest, all unchanged this week. Spot refined cane sugar was offered at USD 0.68/lb nationwide through December 31. It was offered for calendar 2024 at 0.63/lb FOB Northeast and West Coast and in the range of USD 0.59/lb to USD 0.61/lb FOB Gulf and Southeast, also all unchanged.

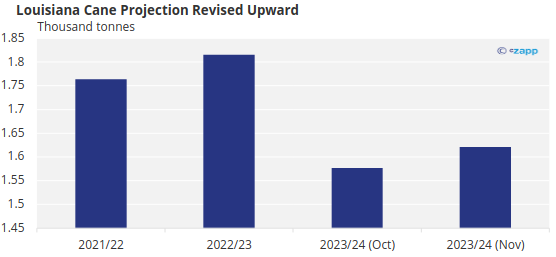

Louisiana Sugar Cane Forecast Raised

The sugar cane harvest in Louisiana was 35% complete as of November 12, slightly more than a week behind the five-year average pace of 45% for the date. Despite 100% of the state’s sugar cane crop in exceptional drought, and the lowest crop condition rating in at least a decade, the USDA projects higher sugar cane yields. In its November 9 supply-and-demand report, it raised Louisiana’s cane sugar forecast from October by 2.8%. However, the forecast is still down 11% from 2022.

Note: Figures converted to metric tonnes from short tons

Source: USDA WASDE report

Contracts, Deliveries Move Slowly

Sellers continued to report a mixed pace of contracted sugar deliveries. Some second-half November softness was noted by beet processors after a strong first half of the month with only part of the change attributed to the early Thanksgiving holiday. The slowness remained mostly in bulk shipments to food manufacturers as most agreed retail shipments were as expected or stronger. Concerns about sugar demand persist after flat deliveries for food in 2022-23 reported by the USDA.

Inquiries about pricing of sugar for 2024-25 continued with a few sales of beet sugar reported in the mid USD 0.50/lb range FOB Midwest, modestly below current 2024 prices. Most expect 2024-25 contracting will move slower than it did for 2023-24 when sales mostly were wrapped up in March 2023.

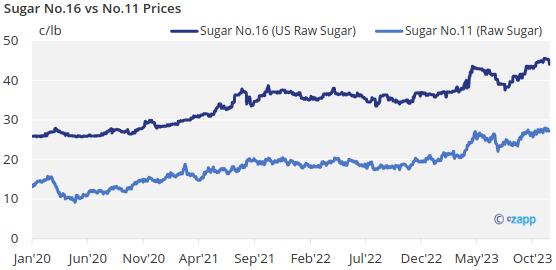

With sugar prices still historically high, some buyers are expected to add only partial coverage early in the year. Others may move ahead with full coverage early amid uncertainty about supplies and prices. One processor noted October-December 2024 coverage was lighter than in recent years.

Corn Sweetener to Complete by Thanksgiving

Corn sweetener contracting for 2024 moved forward with buyers hoping to complete bookings by the Thanksgiving holiday. Most business appeared to be done at about flat prices with 2023 with buyers citing record-high corn supplies and 25% lower corn prices than a year ago. But refiners noted higher labour costs, high domestic sugar prices and higher demand from Mexico, where sugar prices are at a record high.