1394 words / 9 minute reading time

A Brief Overview

Last week, this series shifted away from discussing the dairy market on a geographical basis and focussed on a specific commodity, skimmed milk powder (SMP). This week it’s the same deal, as we look at butter’s place in the dairy market.

- Butter, like SMP, is traded on all three exchanges offering dairy derivative products.

- Butter is produced from cream, the fatty liquid generated when whole milk is separated into skim milk/cream.

- This is important as it is the full value of the stream of products which supports butter production (e.g. if the SMP price is relatively high, as it is now, making butter can still be an appealing proposition for processors even if price of butter declines).

The Dairy Series So Far:

Key Differences in Commercially Traded Butter

Fat Content

- A key difference to be aware of when comparing prices is the different fat content of the US’ (CME) butter (80%) compared to Europe (EEX) and New Zealand’s (NZX) butter (both 82%). Prices must be converted to fat-equivalent prices to enable correct comparison.

- Note also that Anhydrous Milk Fat (AMF) listed on the NZX is ~99% fat, this too can be compared to all three butter contracts on a fat equivalent basis, but as it is a different product, fundamental supply/demand factors can cause the AMF price to diverge materially from the butter contracts on a fat equivalent basis.

Geographical Differences

- Butter in the USA is predominantly salted sweet cream butter (made from fresh milk).

- In Europe, lactic butter made from fresh cream that has been either flavoured or fermented with lactic acid dominates.

- The major butter exported from New Zealand is unsalted sweet cream.

Colour Contrasts

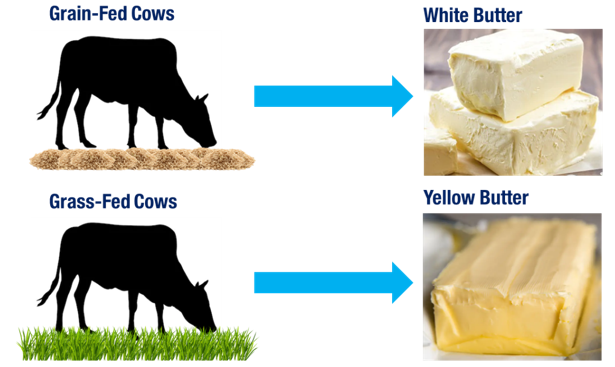

- The colour of butter is also important, particularly at a retail level.

- Yellow butter gets its colour due to the presence of beta-carotene in the milk, a pigment which appears when cows are grass-fed. When cows are grain-fed this pigment is less prevalent so the butter appears white.

- Different markets have different colour preferences, so products are not easily substitutable.

- When used as an ingredient, butter’s colour is less important, so commercial bakeries for instance, are able to switch to the cheapest source more easily.

- At the moment there appears to be a surplus of yellow butter in Europe (a white butter retail market).

Key Trade and Market Commentary

The USA

- The USA can swing between being a net importer or exporter of dairy fat. An increasingly large flow has been the import of butter from Ireland (almost 26kMT YTD and up 28%), while imports in general are also up.

- The majority of US butter exports go to Canada, but given the relatively high US price which has existed since February, we are seeing Canadian demand switch to cheaper supply options like New Zealand (US exports down 22% YTD), while exports in general are down.

- US production of butter is down 0.5% year-to-date (YTD), but if the year-on-year (YoY) gains observed between June-September continue, this may end the year broadly flat. The one bright spark has been the strength of domestic US consumption, which has led stocks to only build 2.8% YTD, but this should be enough to continue weighing on US prices. The basis is currently strongly negative and widening with cash ~10c/lb lower than the second futures contract, indicating that the local market is well-supplied and becoming increasingly so.

Europe

- Europe is also a large consumer of butter, consuming ~90% of the 2.2m tonnes they produce. Key destinations for exports are the US, China, Japan and Saudi Arabia. Exports to Turkey and the UAE have jumped substantially YTD, which may indicate some secondary flow heading to Iran, one of the world’s largest importers of butter (traditionally serviced by New Zealand supply).

- A key piece of market data for the EU butter market is the German retail butter tenders. Traditionally, these would be 3-6 month contracts, but of late the tenor has been much shorter as buyers have been in the more powerful position due to the abundant stocks. There is one more tender expected before Christmas and though some in market may expect the tenor to begin lengthening (indicating a healthier supply/demand balance), contacts are suggesting that it could stay short, especially given the bull-run that SMP is having. This would keep a ceiling on prices for the medium term (certainly below €3,750/MT where there is said to be depth on the sell side).

- Futures have come down to cash but still hold a slight premium, indicating possible further downside. A strong signal would be required to turn this market around, the only one which springs to my mind being a drought over the NZ shoulder period.

New Zealand

- New Zealand holds the majority of the Chinese market share for butter. Though exports to China are down substantially (-38% YTD), this has been made up by substantial demand increases for AMF exports to the US, South-East Asia (SEA) and Mexico. Providing an overall stable picture for fat ex-NZ at present, and further supported by stability in the butter price on GDT:

- Expect the flow of AMF to the US to slow if CME pricing continues falling. If this plays out then European competition in Iran, alongside slower Chinese demand, could cap price upside for the medium term (note, however, that NZX futures have caught a slight bid recently and are trading at a ~$250 USD/MT premium to the last GDT print).

Russia

- Russia is a major importer of dairy fat. Traditionally, this came from the EU but since the trade embargo, put in place in 2014, they have looked to Belarus, New Zealand, LATAM and their domestic producers to fill this void. A lift in the trade ban at some point in the future could materially impact the global butter market.

Sources: European Commission Milk Market Observatory, CLAL, USDEC, AHDB Dairy

Spreads

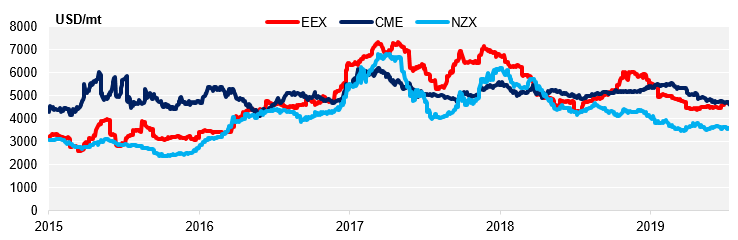

- The most extreme spread at present is CME/NZX at the 90th percentile (CME overvalued and NZX undervalued). Note though that this has been at or beyond the 65th percentile since the end of February 2019, so spread traders looking to take advantage from this must be wary of timing, as rolling a spread trade in the butter markets can be expensive given the relative illiquidity in these markets.

The butter spreads are more volatile and can diverge for longer periods than those of SMP. This is due to the compositional/visible differences noted above and also due to several other trade/consumption factors:

- The strong domestic market and generally balanced fat position means that the US butter market can often exist in isolation and diverge materially from other markets. As discussed in the USA Opinion, butter in the US is predominantly produced in the West but the main domestic demand pool is in the East, so logistics can play a large part in US butter price behaviour. In 2018, high freight rates prevented the flow of butter across the country as sellers chose to wait and stockpile.

- Both Europe and the EU have tariffs on butter imported from external countries.

- The general tariff rate into the EU is €1896/MT but New Zealand have a non-preferential tariff rate quota (TRQ) of €700/MT on 75kMT which is typically only filled in small parts.

- The US have a low 1% on ~7kMT of TRQ butter for all importers on aggregate which is largely filled. This then increases to 12.7% for imports over this TRQ volume. In addition, the 25% ad valorem tariff on some EU products implemented in October will impact this trade flow further.

- Fewer markets have competition from all three major suppliers in butter than SMP; often one supplier can dominate or only two are really present. Possibly the best place to look for the world clearing price would be Saudi Arabia as they are a major importer of USA, EU and NZ butter. South-East Asia and Taiwan are also reasonably hotly contested markets, while Morocco is an interesting market whose import presence typically indicates that a floor has been reached.

With SMP rallying in all markets, expect global butter prices to come under pressure, particularly ex-US. Support could come from a weather event in New Zealand or demand pull from China (who seem materially behind on their fat purchasing and on track for their lowest imports since 2016, even accounting for gains in fluid cream imports).