1435 words / 9 minute reading time

A Brief Overview

This week, we’re discussing one of the most complicated dairy commodities. It has been made in many cultures for thousands of years. Yes, it’s cheese.

- The story goes that it was discovered when milk was transported in an animal stomach in the heat and the rennet in the stomach lining caused the milk to separate into curds (protein/fat solids) and whey (residual liquid).

- Today, bacteria or enzymes are introduced to the milk to coagulate it; the curds are then the starting point for the cheese making process.

- Cheese mainly consists of casein (the main protein in milk) and fat.

- No strict definition exists for cheese, as so many variants exist. While high in protein, the fat content and moisture can vary by cheese type. Some cheeses can be consumed fresh while others require months or years of maturation.

The Production and Subcategorisation of Cheese

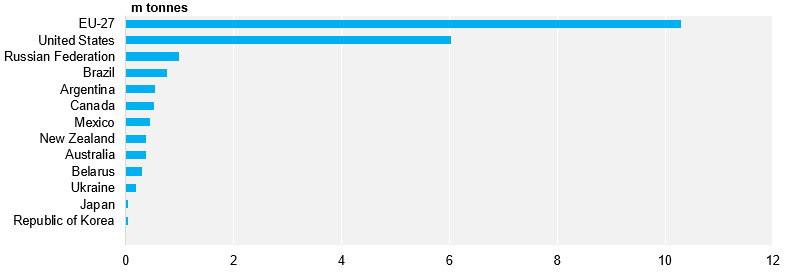

- The EU is one of the world’s most dominant producers and consumers of cheese. It produces ~10m tonnes annually, with Germany, France, the Netherlands and Italy the top four respectively, accounting for half of this production between them.

- Cheese production at scale is perhaps the most diverse in Europe, with each region priding itself on a unique varietal. Although cheese is the dominant use of milk in Europe, the enormous variety is likely to be a key reason why there is no listed derivative contract for European cheese.

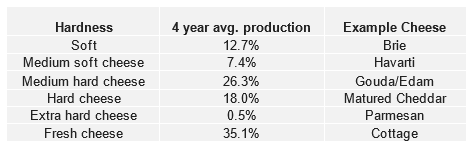

- A good, albeit loose, way to get a sense for the EU production split is by hardness, though some of the below examples can exist in several categories. Hardness relates to the moisture content in the cheese.

EU Production

- Over the past four years there has been a trend towards increased production of hard cheese at the expense of fresh cheese in the EU (and likely relates to exports). This trend is common in all markets.

- Developing countries typically find harder cheeses too flavourful, so softer and fresher cheeses are initially more popular. Then, as the palate of the market develops you will typically observe demand for harder cheeses rise.

- With EU production expected to continue growing at 0.2% per annum and domestic consumption forecast to be up as much as 1.4% (vs. 0.4% expected), only about 800k tonnes of EU cheese will make its way to the export market this year (excl. 50k tonnes to Switzerland).

- The US (~150k tonnes), Japan (~110k tonnes), South Korea and Saudi Arabia (~35k tonnes each) are the dominant importers with expected totals for 2019 in brackets.

USA Production

- The US is second in both production, ~6m tonnes/year, and consumption per capita. Production is split roughly 40/60 between “American” (Cheddar, Colby and Monterey Jack) and “Non-American” (Mozzarella, Parmesan, etc.) respectively. The vast majority of this would fall into the medium-soft to hard categories above.

- Although cheddar cheese is listed on the CME, mozzarella is now the most commonly produced cheese in the US. This trend is continuing with US cheese production up 0.8% YTD but cheddar down 2.7% YTD, though recent high cheddar prices have resulted in a rise in its production in October.

NZ Production

- New Zealand is a relative lightweight in the Cheese market, exporting only ~335k tonnes/year at present (down slightly from the highs seen in 2016/17 due to milk being diverted to WMP).

- Key markets are Japan, China and Australia respectively.

- While the dominant types produced are cheddar and mozzarella, also falling into the medium-soft to hard categories above.

Processed cheese is a separate category again. It is a heat-treated product where multiple different types of cheese are effectively melted together along with other binding agents and potentially the addition of other dairy or non-dairy fats/proteins.

Production by Country (2019 estimate)

Note: In many countries, this is consumed domestically.

Demand

Key Asian Markets

Japan

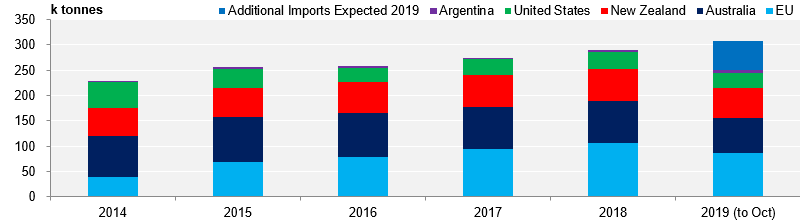

- Japan is the dominant cheese importer globally, with 260k tonnes of imports expected this year.

- Most Japanese importers hold six monthly tenders in unison, giving a good snapshot of the global cheese situation as all suppliers will compete.

- As Japan has high import tariffs on cheese, imports are dominated by those regions who have negotiated preferential access. Australia have traditionally enjoyed the dominant market share to Japan, but since 2017 the EU have dominated.

- Milk flow issues in Australia of late will further constrain their ability to capture increased Japanese demand, the EU continue to be the main benefactor of this and the EU-Japan Economic Partnership Agreement will only support this further.

- Given both the relatively high US cheese prices and NZ WMP prices of late, I would expect the bulk of the ~60k tonnes of expected remaining imports to be supplied predominantly by the EU.

Japan Cheese Imports

South Korea

- South Korea are also a large importer of cheeses with ~125k tonnes expected this year.

- The US are the dominant supplier, covering roughly half of this, but given the typically high value of this market expect the EU and NZ to continue to compete.

China

- China has the potential to be a huge cheese consumer. Currently, imports are only ~110kMT/year and growth for 2019 is only expected to be 6%, which is relatively small compared with double-digit lifts in most other dairy products.

- The increasing popularity of pizza and other dairy-rich Western foods is expected to drive a material increase in imports in the short-medium term, particularly for fresher cheeses like mozzarella.

- New Zealand dominate market share to China at just over 50%, while Australia the EU currently hold ~15% each.

- Prior to the US-China trade war, China was becoming an increasingly important market for the US.

- If tariffs are lifted then watch for US suppliers to re-enter this market strongly (Chinese imports of US cheese are down 40% in the year to October).

Largely Single-Supplied Countries

Mexico

- Mexico is the largest importer of US cheese, with >90k tonnes of product heading over the border each year since 2015.

- Though a weak economy/peso, trade tensions and strong Mexican milk flows have the potential for this trade to be below 90k tonnes in 2019.

Russia

- Russia are the second largest importer of Cheese, though their 200k tonnes demand is almost entirely covered by Belorussian supply, with additions from LATAM and Serbia.

Sources: TetraPak Dairy Processing Handbook, USDA, StatsNZ, AHDB Dairy, UN Comtrade.

The Importance of Whey

- Cheese production has by-products, which can impact the decision to make it.

- The cheese stream has many iterations but can be broadly thought of as cheese/whey.

- We have already discussed the various types of cheese, but whey too can be made into many products.

- Simply dried whey powder is a common stock food and is typically a low value by-product around 12% protein.

- Very high-grade whey powder can be used as an ingredient to infant formula, materially increasing its value.

- Whey can also be concentrated to products such as whey-protein-concentrate (WPC80) or whey-protein-isolate (WPI).

- This high value, easy-to-absorb protein is typically found in nutrition supplements and has become increasingly popular in recent time. The value of these products is often much higher than simply protein adjusting up the value of whey powder, so at times demand for WPC etc. can drive the production of cheese even if cheese prices are relatively low.

Some Things to Look Out For…

- EU gouda pricing is around $3450 USD/MT. Reports on cheddar are mixed in the range of $3450-3800 USD/MT with the market anecdotally tightening up for cheddar specifically.

- GDT cheddar prices have moved up in the past two events, with FAS pricing now ~$3800 USD/MT and in line with the top of the EU range. WMP will still be the favoured stream by about 80c/kgMS.

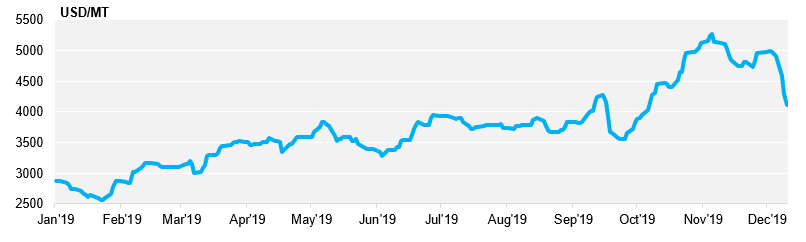

- CME futures prices are down almost $440 USD/MT from their highs in October. The January futures contract, along with spot blocks and barrels are all around the ~$4,185 USD/MT mark, the most converged we have seen in some time after barrels plummeted this week.

- Perhaps the US market has gained some confidence from the cheddar production gains in October? But if Europe is truly tightening, then perhaps we find some support at these levels with NZ production also likely focused elsewhere? An improvement in Mexican demand or surge from China could also pull prices upward. The key is knowing which type of cheese will see the pull, to my mind the product with the most short term price risk is cheddar.

Cheddar Barrel Prices Melting in Volatile End to 2019