1036 words / 6.5 minute reading time

A Brief Overview

So far in this dairy series, we have discussed the dairy markets of New Zealand and the USA. This week, we’re focussing on Europe, the world’s largest dairy exporter.

- Europe accounts for ~29% of global dairy exports, placing it just ahead of New Zealand.

- The dairy sector is the second biggest agricultural sector in the EU, accounting for more than 12% of the total agricultural output.

- Major producers are Germany, France, the UK and the Netherlands.

- These regions alone account for 56% of Europe’s total production.

- With just over 12,000 processing plants and hundreds of companies processing milk, Europe is far more constrained, in terms of optimising product mix, than New Zealand.

- If the milk flow is high, some processors only own one factory and must therefore process the excess milk into that product, regardless of its price.

- Europeans are also large cheese consumers, meaning many processors will risk adjusting their production towards cheese, as they know there is an existing demand for this within the EU. There’s little point producing other products for which they will have to find buyers for in the wider global market.

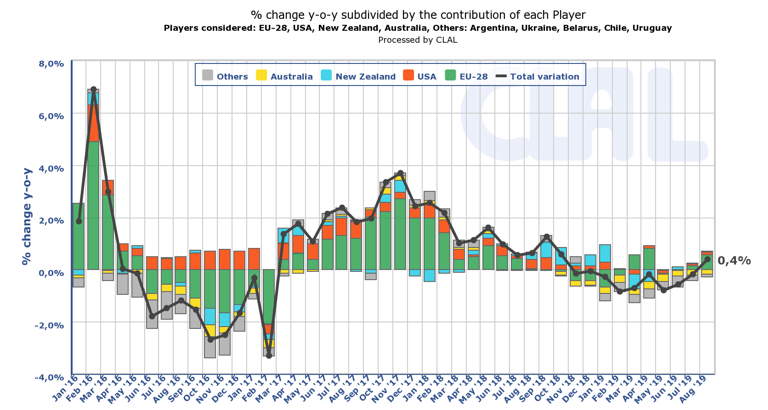

- Through August, EU dairy production was up 0.3% year-to-date (YTD), making it the key driver of global dairy supply expansion by major producers in August 2019.

World Global Supply Variation in the Key Exporters of Dairy Products

Fewer Cows Won’t Stop Europe

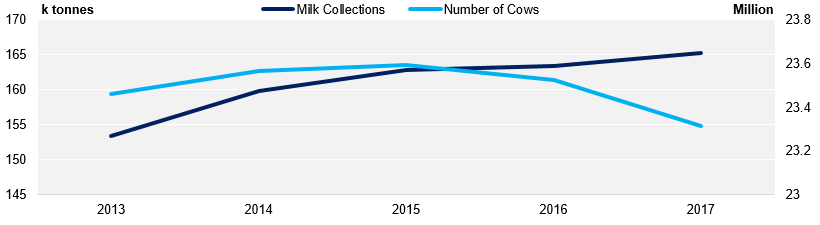

- Milk yields vary by country, but they have been steadily rising over time.

- The number of cows, however, has been falling at an increasing rate since 2015. This is because the dairy prices have entered a sustained low period, following the peaks seen in 2014.

- The largest falls have been seen in the Netherlands, as herds have been reduced to help meet the country’s phosphate limits and greenhouse gas targets.

- Heifer (un-milked cow) numbers are declining at a rate of 500,000 each year across the EU as well. Going forward, we should watch out for milking herds continuing to contract as a result of this.

- Stats from the European Milk Board in July 2019 indicated that German dairy production costs are only 77% met by current milk prices. This too may result in smaller farmers exiting the industry, the consolidation of farms (as we have seen in the USA), and it may perhaps provide another reason to believe that the cow numbers will continue to decline.

- Despite this, at a total level, yield gains have outweighed the declining cow number thus far.

- Eventually, yield gains will be unable to make up for these herd declines, which could impact total product availability on a global scale.

Milk Collections vs. Cow Numbers Overtime

New Faces on the Block: Ireland and Poland

- These two countries have long outgrown their label as “up-and-coming”. They have both experienced huge milk growth over the past few years and are up 8% and 2% YTD, respectively.

Ireland

- Ireland produces yellow butter, due to having grass-fed cows. This is different from the more typical white butter, which is prevalent in Europe, so largely only competes for manufacturing fat demand in Europe or global export demand.

- Therefore, the European butter price can still be high even when Ireland has stock, and this stock can materially impact the price in other yellow-butter markets, where it competes with the likes of New Zealand.

Poland

- Polish products have been characterised as being cheap over recent years, but with new factories this is becoming increasingly more unfair, as price and quality continue to converge more with their Western European peers.

- With large production of powders and relative affordability still, Polish products are becoming more prevalent in globally traded markets, most prominently Africa. A substantial amount of milk fluid is also now heading across the border into Germany.

The World’s Largest Dairy Exporter, But Why?

As we mentioned earlier, Europe is largest dairy exporter in the world. But why is this the case?

- The recent emergence and relative profitability of fat-filled milk powder (FFMPP, typically skimmed solids with palm oil) is an enormous dynamic to monitor ex-EU. FFMP exports were up 11.5% YTD through August (note: production of FFMP absorbs solids which would otherwise have been exported as Skimmed Milk Powder). Exports are largely cheap Whole Milk Powder substitution to West African and Middle Eastern markets.

- In saying this, SMP exports are also extremely high, up 29% YTD, with China gaining share and Nigeria, Mexico and the Philippines all being strong.

- Cheese exports are up 3.3% YTD and seem reasonably stable. As noted in last week’s USA edition, we should see a spike in exports to the US pre-tariff implementation.

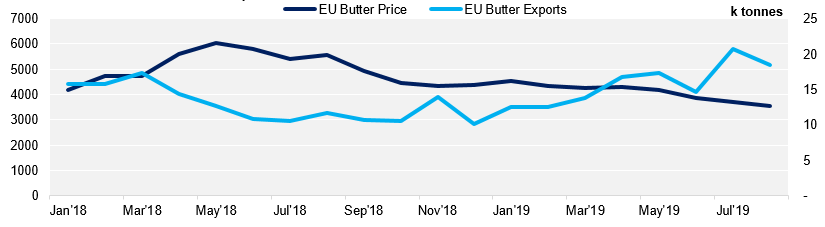

- Large stockpiles of EU butter are said to exist all around the continents, though exports are strong (up 21.4% YTD). Until they are fully drawn down, this stockpile possibly explains why butter prices in Europe and New Zealand are languishing around $4,100 USD/MT compared to $4,700 USD/MT seen in the USA.

- WMP exports are down 16% YTD, but are on a rebound. There was talk earlier this year of some European processors atypically turning this into inventory, given the higher returns WMP was exhibiting, relative to traditional European product streams.

EU Butter Price Index vs. EU Butter Exports

- Three commodity products are traded on the EEX: butter, SMP and Whey. These settle to the average of a survey completed in France, Germany and the Netherlands. A crucial point to note is that European dairy is priced in EUR/MT, so currency fluctuations can quickly make European products more or less competitive than their global peers.

- At present, EU SMP is broadly in line with the US pricing (~$2,600 USD/MT), but we expect this to continue chasing the New Zealand price higher, especially given that contacts describe all Q4 EU SMP production as sold, with demand enquiries remaining constant.

EU butter prices are trending flat at current levels, for all the reasons described above. Note: all published quotations can also materially diverge from traded cash market pricing at times.