833 words / 5 minute reading time

A Brief Overview

So far in this dairy series, we have focussed on some of the key producing regions in the industry. We’ve discussed New Zealand, the USA and Europe most recently. This week, we’re doing something different, as we’re talking about skimmed milk powder (SMP), the most fungible product in the dairy commodity complex.

- SMP is produced by the drying of skimmed milk; the fluid remaining when cream has been separated from milk.

- SMP produced in different locations will have differences in taste and performance, giving certain regions the upper hand.

- However, SMP is broadly the most substitutable product in the dairy market.

- Other competing products include non-fat dry milk (NFDM) and fat-filled milk powder (FFMP).

SMP vs. NFDM vs. FFMP

What’s the Difference?

- The difference between SMP and NFDM is that SMP’s protein can be adjusted to 34% by standardisation with milk retentate, milk permeate, or lactose.

- NFDM, on the other hand, is unstandardised dried skim milk, meaning the protein content may vary by bag.

- In the US, NFDM is the more dominant product, so much so that 72% of the total SMP/NFDM produced in the US is NFDM, where in most other geographies SMP is more prevalent.

- FFMP is a much broader spec again. It is typically skim milk (or reconstituted SMP) injected with palm oil to boost its fat content – this product is then dried.

- FFMP is more affordable than the whole milk powder (WMP) substitute. Despite this, it still competes with WMP at a consumer level, and with SMP/NFDM at a production level.

- The production trade-off decision between SMP/FFMP will come down to the cost of the vegetable oil and additional processing compared to the premium FFMP holds over SMP, where FFMP sales are typically done at “WMP minus”.

- Note: If a producer was deciding which of the two pure dairy products to make, their decision is based upon the value of the full stream of products able to be made from that milk. For a more detailed description of product streams, feel free to peruse another paper of mine.

*From here on, I will refer to SMP/NFDM as SMP for the sake of ease*

- SMP can be stored for long periods of time because of its relatively low-fat content.

- Manufacturers often label products with a shelf life of 18-24 months, but recent tests from the European Intervention have shown that these products can still perform “well” substantially beyond this time, if stored appropriately.

Correlation/Spreads

- SMP is traded on three exchanges globally: the Chicago Mercantile Exchange (CME), the European Energy Exchange (EEX) and New Zealand’s Exchange (NZE).

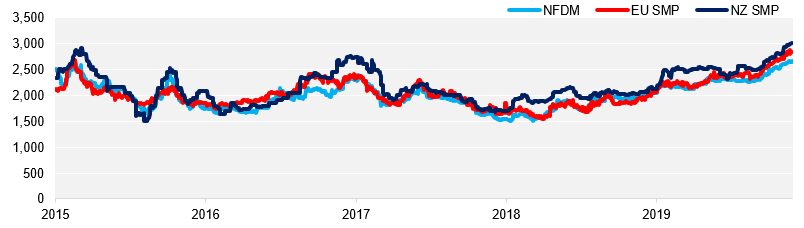

- Although representing the prices in their locale, given the interchangeability of SMP, the prices on these exchanges are highly correlated and empirically their spreads tend to mean-revert (move to the average price over time).

- There has been a heightened degree of convergence since 2015.

Rolling Second SMP Contract Prices (USD/MT)

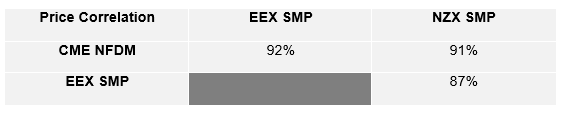

- The above correlations are based on the rolling second futures contract daily close price in USD/mt, February-11 to present, source Bloomberg.

- Tickers LE2 Comdty, FSP2 Comdty and PMA2 Comdty. Note that LE2 needs to be multiplied by 22.046 to convert from c/cwt and FSP needs to be converted to USD at the daily EURUSD cross close.

- The assumption is that the spread between different SMP contracts is normally distributed and mean reverting (though the data actually shows fatter tails).

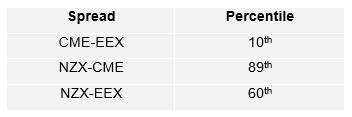

Current spreads as of 27th November 2019:

- The above table indicates that the CME is relatively undervalued compared to both NZX and EEX contracts. Note that these spreads can stay wide for long periods of time for fundamental reasons, so time horizon is critical for traders looking to benefit from a convergence.

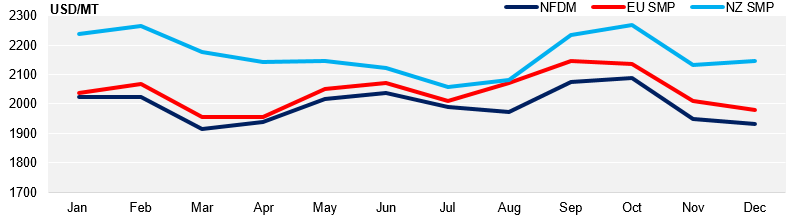

- Given that the production curve in New Zealand is much more seasonal than that of Europe of the US, there exists a degree of seasonality between the spreads too. One like reason for this is due to the weather risk that exists in the NZ summer, causing these futures contracts to hold a premium over this period. Spread traders may like to look at the spread in a given month relative to the spread observed in that month historically.

Average SMP/NFDM Prices by Month

Key Import Markets

- According to the Organisation for Economic Cooperation and Development (OECD), developing countries account for 88% of total SMP imports.

- Major import regions are Mexico, China, Algeria and South-East Asia.

- Europe dominates the SMP export market. Of the ~1.6mmt of exports seen between January and August 2019, Europe accounted for 43%, with volumes being up 29% year-to-date (YTD) over this period. The US holds 27% share, New Zealand holds 15%, and other exporters hold the remaining 15%.

- Mexico predominantly imports NFDM from the US (~89% share YTD currently, down substantially due to European competition taking ~8% share YTD).

- The United States Department of Agriculture (USDA) are forecasting 370kmt of exports to Mexico in 2019. If this competition continues and US production continues to rebound, look out for US producers switching from NFDM to SMP production, with competition increasing with the relatively expensive New Zealand supply in South-East Asia.

- Chinese SMP imports are up a whopping 30% YTD (through September) to 272kmt. While New Zealand maintains the lead market share to China, this is being eroded by exports from the EU, particularly Germany, France, Finland, Ireland and Belgium.

- The European market share is now ~44% YTD vs. ~31% this time last year.

Key Questions to Consider…

- If Chinese consumption slows, given New Zealand’s supply has been relatively steady over the past five years, will we see the flow of EU SMP slow?

- If so, will we see more EU protein solids appear in FFMP? Or even greater competition in other regions?

- If not, will New Zealand be forced to compete at a price level in China to maintain this channel, or will the competition occur in other regions? (South-East Asia being most likely ex-New Zealand).

- Imports into South-East Asia are also up materially YTD, around ~18%, with the EU gaining market share here too. The Philippines and Indonesia are the key importers to watch out for here; it seems like South-East Asia will be the market where SMP supply side competition will heat up the most in the medium term.