Insight Focus

- EUAs have fallen 30% since the end of 2023.

- Prices now touching two-year lows.

- Bank analysts see strong buying opportunity below EUR 50.

Weaker Fuel Prices Cut EUA Demand

EU carbon allowance prices have extended their early-year decline, reaching a two-year low last week as declining demand and bearish speculator positioning maintained the pressure on the market.

The benchmark December 2024 EUA futures contract slid to a low of EUR 55.41 on February 14, the lowest since prices briefly plunged to EUR 55.00 in March 2022, shortly after Russia invaded Ukraine and triggered a widespread sell-off.

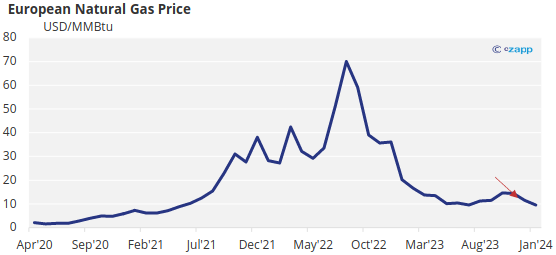

The market has tumbled by as much as 30% since the end of last year as participants eye sharp falls in demand for EU Allowances from utilities and industry. In addition, weakening natural gas prices have meant the fuel is replacing coal in power generation, cutting demand for carbon permits in half for every megawatt-hour of generation that switches from coal to gas.

Source: World Bank

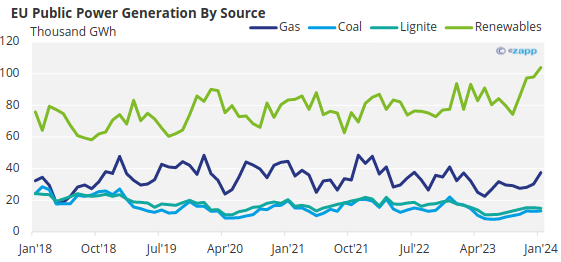

And not only is gas firmly entrenched as the more profitable fuel, but the steady and rapid growth of renewable generation is even cutting into gas’ share.

Data from the European grid operator’s agency show that in 2023 public renewable generation grew by 10% year-on-year, while gas output declined by 17%, hard coal power dropped by 26.5% and lignite generation fell 24%.

Source: Entsoe-E

The result is that demand for EUAs from the utility sector – the largest single sector in the carbon market – is expected to have fallen by around 20% last year, with industrial demand shrinking by less than 10%.

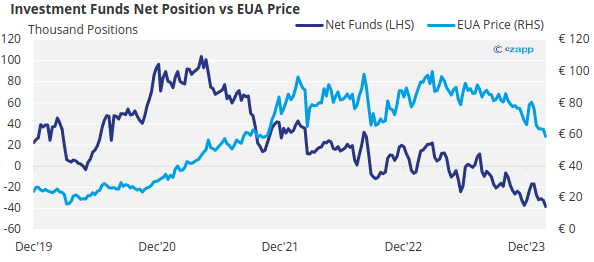

Specs Bet on Price Decline

Speculative investors have been bearish on carbon for more than six months. According to data from the two main exchanges, investment funds amassed a net short position in EUAs in mid-August, and that position has now swelled to the largest-ever bearish bet since data was first published in 2019.

Data for other categories of market participant also shows that so-called ‘commercial entities’, which is taken to refer to trading companies and some proprietary trading desks at larger industrials, currently hold the smallest net long position since 2019, and that investment firms and credit institutions (banks) have their smallest-ever net short position.

Since banks often buy physical EUAs and sell the futures to compliance entities, this is interpreted as a sign of the low demand among industrials.

Many analysts have suggested that the outlook for the first half of the year will see carbon prices remaining weak amid continued growth in renewables, improved output from hydropower and nuclear installations and an uncertain natural gas market.

Lower Interest Rates Could Spur Activity

However, the second half of 2024 may see a slight pickup in activity with experts predicting that interest rates may start to ratchet lower, potentially triggering an uptick in investment among industrials and a recovery in consumption.

Not only is the economic outlook thought to be about to turn around, but the addition of the maritime shipping sector to the EU ETS is also bringing new demand.

Shippers will be required to surrender EUAs matching 40% of their total EU emissions this year, rising to 70% in 2025 and 100% from 2026. The new sector will receive no free allocation of EUAs, unlike some industrials, and so their demand will influence the market.

Analysts at Swedish bank SEB have said that the low current prices for EUAs represent “one of the great opportunities of 2024” and predict that EUAs might drop to below EUR 50/tonne. However, “airliners and shipping companies, which will have difficulties in shifting away from fossil fuels… will need EUAs for years to come,” it wrote in a report earlier this month.