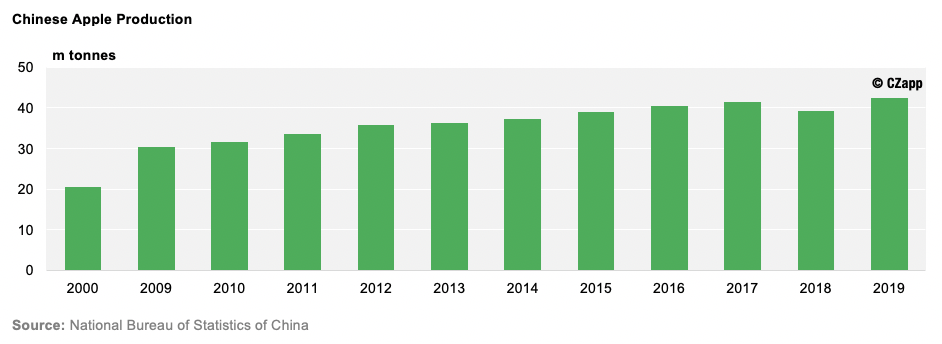

- China, the world’s largest apple producer, suffered frosty conditions in the peak of its growing season.

- This could reduce its apple availability to around 35m tonnes, leaving the US in search of other origins.

- With EU conditions looking promising ahead of its crop starting, will it able to fill this void?

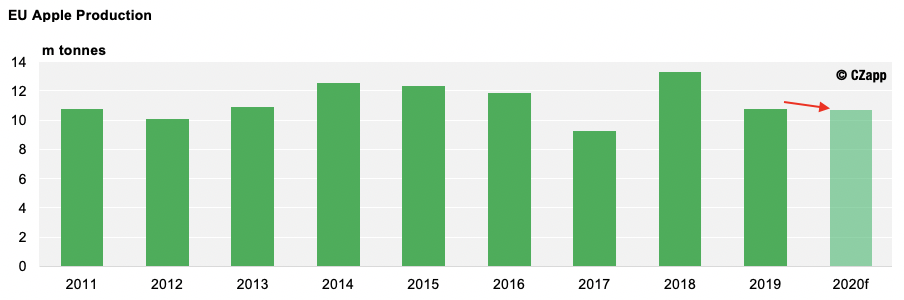

EU Apple Production Stays Strong

- The EU should produce around 10.71m tonnes of apple this season, marginally down from last season’s 10.78m tonnes.

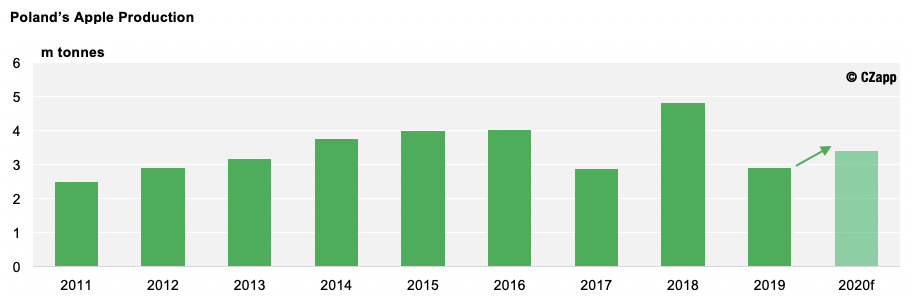

- Poland, the EU’s largest apple producer, should contribute around 3.4m tonnes to this, up 2.1m tonnes year-on-year (17%).

- However, its 2020 crop is yet to get going properly.

- At this early stage, the growing and harvesting conditions look favourable and COVID has not yet had any major impact on the harvest.

- This means the required workers will still be able to access Poland’s key apple-growing regions from the Ukraine.

Frost Reduces China’s Apple Yields

- In Asia, things are running a little less smoothly, as China suffered frosty conditions in the peak of its growing season.

- We therefore think production will be down 10-15% here year-on-year.

What Does This Mean for Global Trade?

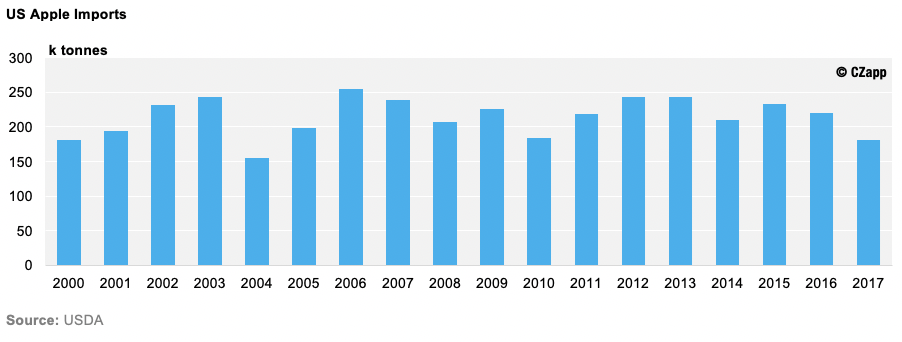

- China formerly dominated Apple Juice Concentrate exports to the US; one of the largest markets in terms of demand.

- However, in 2019, the US implemented 25% tariffs on a multitude of products imported from China, including apples.

- This allowed the EU to gain good market share as its production was strong and its exports to the US entailed no duty.

- Despite this, we don’t think the EU will be competitive enough, in terms of pricing, to export any of its apples to the US in 2020/21.

- This is because it is cheaper for the US to import Chinese apples (with 25% duty) than it is for them to import EU apples (with no duty).

- Note: When the EU’s production was so big in 2018, it was able to offer higher volumes at lower prices compared China. These conditions have since changed.

- This leaves the EU forced to carry more of its apples in 2021/22.

What if China’s Production is Worse Than Expected?

- If the frosty conditions in China have caused more damage to its apple crop than anticipated, the US may have to look for other, more economic, alternatives for its supply.

- This could mean it imports from Turkey, South Africa or Chile.

Turkey is the Likely Alternative

- We think Turkey will produce 3m tonnes of apple in 2020/21.

- This is because many of its orchards experienced their second consecutive year of a mild winter and a warmer spring.

- These conditions are optimal for flowering and fruit development.

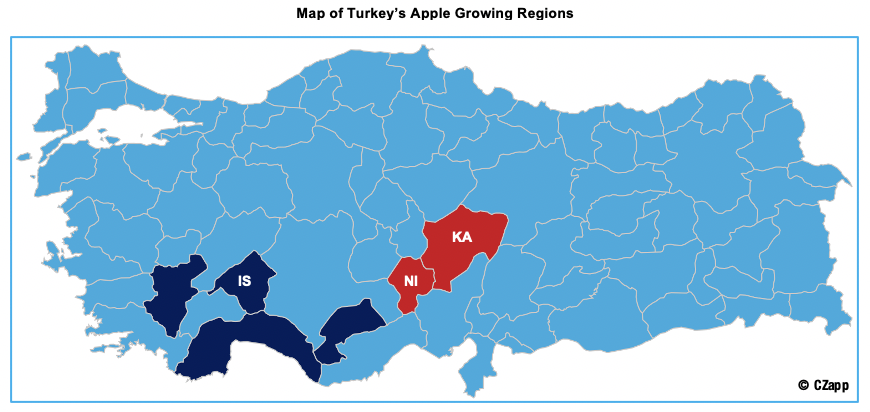

- However, some of Turkey’s central regions (Niğde and Kayseri) faced extreme cases of frost and hail in April and May, with temperatures dropping as low as -4°C.

- In these areas, production could reduce by between 20-50% year-on-year.

- Fortunately, Turkey’s key apple-producing region (Isparta), which accounts for 20% of Turkish apple production, has been unscathed by this extreme weather.

- 732k tonnes of apples came from the region last season.

Other Opinions You Might Be Interested In…