Note: All references to the EU include the United Kingdom.

- We recently questioned whether the EU would be able to capitalise on China’s reduced apple production in 2020.

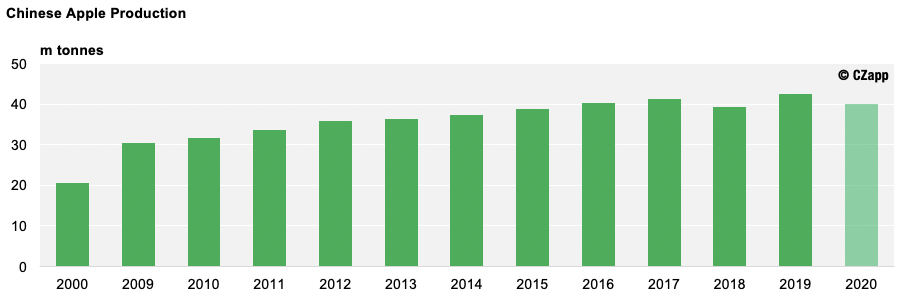

- The short answer is no, as China will produce 40m tonnes of apple in 2020, down 2.4m tonnes year-on-year.

- This smaller-than-expected production drop means it will still be able to meet a satisfy portion of global demand.

Frost Slightly Reduces China’s Apple Production

- We recently aired our concerns that China could suffer a 10-15% production loss next season as frosty conditions hit during the peak of its growing season.

- As it happens, the impact of the frost has been less severe than we first thought, with China only set to endure a 6% production decrease year-on-year (YoY).

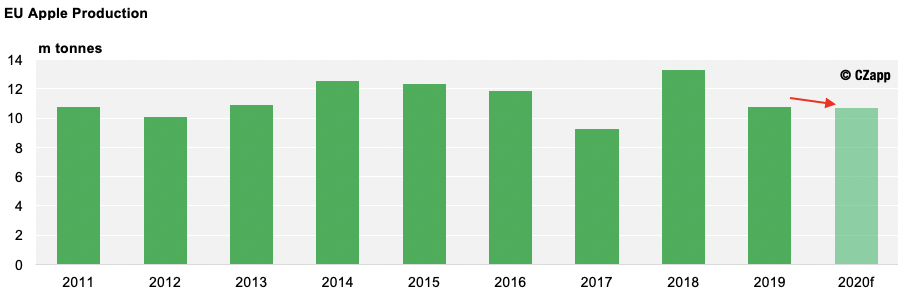

- Despite this loss, China remains the world’s largest apple producers, ahead of the EU, which is set to produce 10.7m tonnes of apple in 2020.

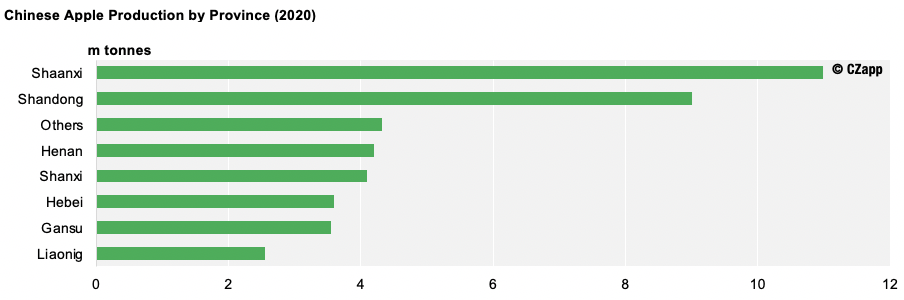

- In 2019, the largest proportion of apple came from China’s Shaanxi province; this will have likely remained the case this season.

Consumer Demand Quietened Down in Lockdown

- Although production looks as though it’ll turn out better than expected, the price of fresh apple in China dropped significantly this year.

- This is likely a knock-on effect of COVID-19, which caused demand for Apple Juice Concentrate (AJC) to slow significantly as buyers deferred shipments in response to weak consumer demand during lockdown.

- Despite this, next season’s demand could still be larger than that of 2019/20, where it totalled 530k tonnes.

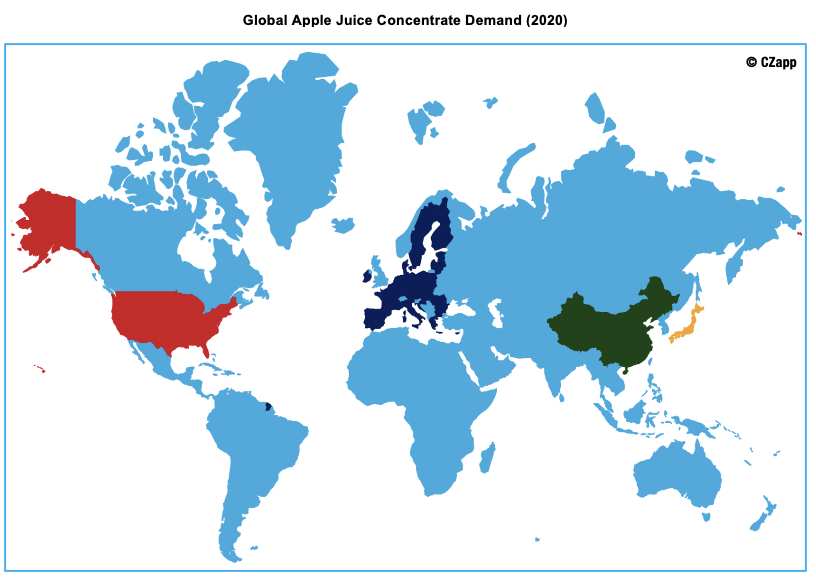

- We think it could soar as high as 560k tonnes and come from North America (230-250k tonnes), the EU (150-170k tonnes), China (75-85k tonnes) and Japan (45-50k tonnes).

Potential Challenges for the Upcoming Season

- The USA plans to keep import tariffs for Chinese AJC at 25%.

- However, this shouldn’t cause too many immediate problems for China as it’s still cheaper for the US to import Chinese apples (with 25% duty) than it is for them to import EU apples (with no duty).

- Therefore, provided there are no last-minute catastrophes, China will remain the US’ dominant supplier, forcing the EU to carry more of its apples into 2021/22.

Other Opinions You Might Be Interested In…

- Apples: Can the EU Pounce on China’s Reduced Production?

- Fruit Juice Focus: Poland: It’s More Than Just Apples

- Fruit Juice Focus: USA Juice Market Update