Insight Focus

February’s WASDE report highlighted weather concerns in South America. Although some projections were lowered, total soybean and corn production in the region remains at historically high levels. The situation mirrors 2023, when Brazil overcame severe drought to produce 154.6 million tonnes of soybeans and set a record for corn production.

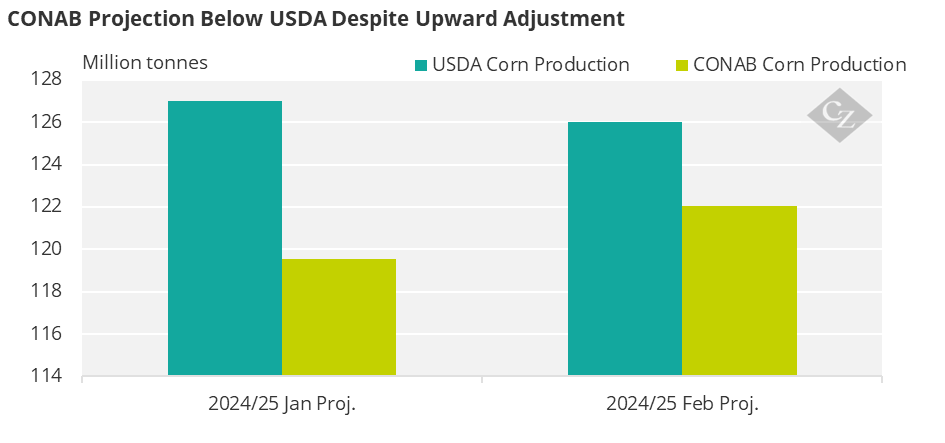

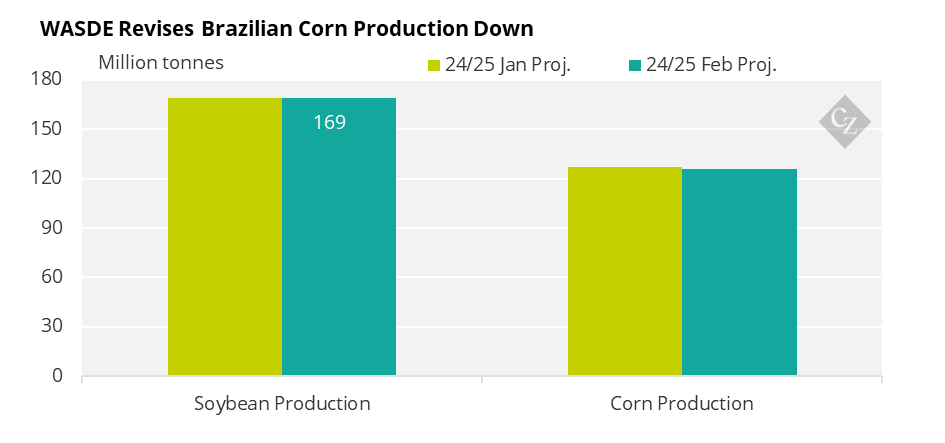

In its latest WASDE Report, published on February 11, the USDA reduced corn production estimates in Brazil to 126 million tonnes as a result of the slower pace of Safrinha corn crop planting.

Source: USDA

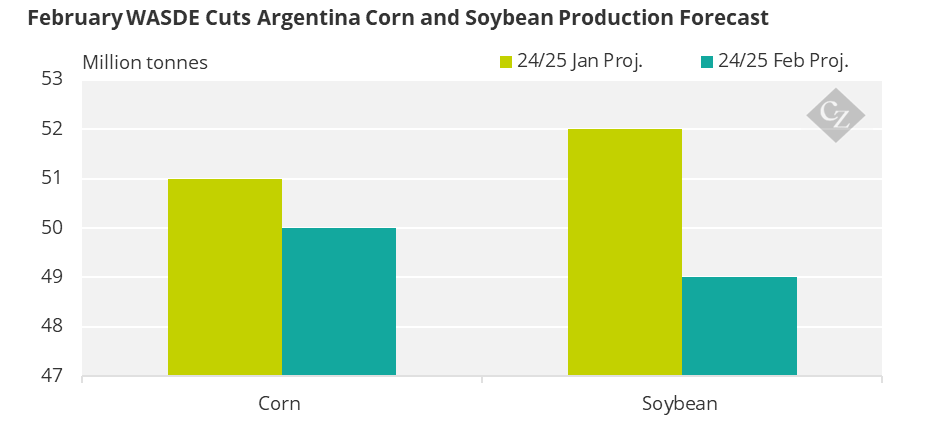

In Argentina, which is experiencing the most severe impacts of the drought, the soybean production forecast dropped 3 million tonnes to 49 million tonnes, while the corn estimate was reduced by 1 million tonnes, to 50 million tonnes. In Paraguay, the soybean crop forecast also saw a downward adjustment, falling by 500,000 tonnes to 10.7 million tonnes.

Source: USDA

In fact, across South America, the USDA’s soybean production estimate was revised downward to 229.2 million tonnes, while the corn estimate decreased from 178 million tonnes to 176 million tonnes.

But as soybean harvesting winds down, Safrinha corn planting is progressing. It still seems premature to significantly lower Safrinha projections solely based on planting delays, as the USDA has done. There is still a window for sowing until the end of February, and fieldwork has been progressing in several regions.

It is also worth noting that, despite the USDA’s reductions, production volumes are still considered historically high. Additionally, there is strong speculative interest in potential crop losses in South America, as this would help support corn prices at higher levels. However, the outlook remains far from being definitively settled.

Is the 2022/23 Crop Season Repeating Itself?

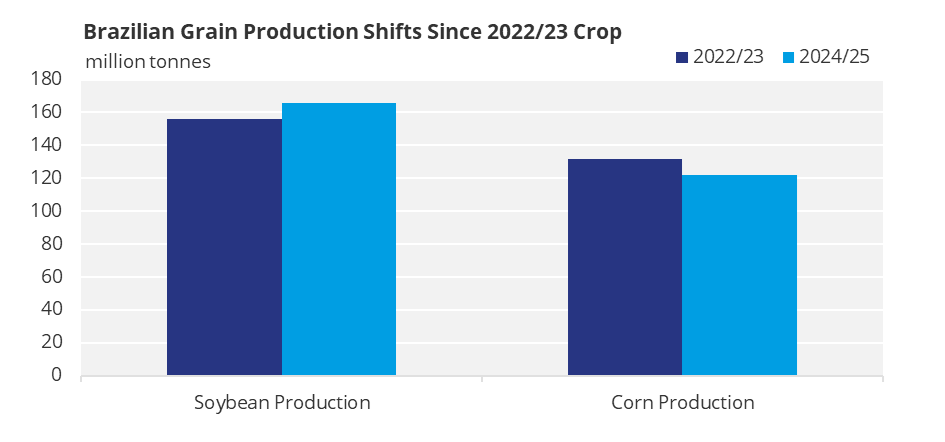

The numbers for this crop season do not differ much from those of 2022/23 season, nor does the weather pattern, as there was also a slight influence of the La Niña phenomenon at that time.

CONAB’s initial soybean projection for Rio Grande do Sul was 21.61 million tonnes but dropped to 13.02 million tonnes. However, this 8.6-million-tonne loss was offset by favourable rainfall in other regions of Brazil, ensuring a final production of 154.62 million tonnes.

In 2023, the same rains that benefited crops in the Central-West also delayed soybean harvesting and Safrinha planting, much like what is happening this year. However, favourable weather conditions from May onward allowed for a record corn harvest, meaning it surpassed 131 million tonnes over an area of 22.3 million hectares.

Expanding the analysis to South America, it is worth noting that Argentina’s 2022/23 crop also faced severe losses. By the end of 2022, the Buenos Aires Grain Exchange projected 48 million tonnes of soybeans, while the USDA estimated 49.4 million tonnes. However, final projections plummeted to 21 million tonnes and 25 million tonnes, respectively.

For corn, initial forecasts were 50 million tonnes (Buenos Aires Grain Exchange) and 55 million tonnes (USDA), but both fell to 35 million tonnes as the season progressed.

Despite Argentina’s losses, total South American production still reached 194 million tonnes of soybeans and 171 million tonnes of corn, according to the USDA.

Therefore, once again, betting against Brazil’s corn production could be premature. The country still has the potential to deliver strong results, with the main challenges remaining logistical, such as transportation and storage, which continue to evolve slowly and become more complex with each new harvest.

CONAB’s Adjustment Masks Regional Changes

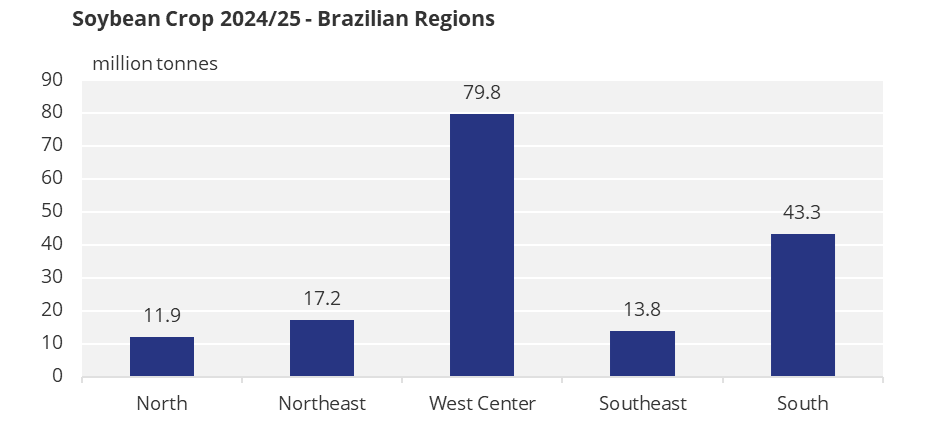

The estimates from CONAB indicated a slight downward revision in Brazil’s soybean production, decreasing from 166.3 million tonnes to 166.01 million tonnes. Although this adjustment may seem minor, it reflects significant changes in regional projections.

In Rio Grande do Sul, which has been severely affected by drought, the forecast dropped from 20.34 million tonnes to 18.45 million tonnes, and, in Mato Grosso do Sul, the estimate was reduced from 14.76 million tonnes to 13.53 million tonnes, resulting in a combined loss of 3.13 million tonnes across these two states.

However, these declines were almost entirely offset by positive adjustments in other states: Paraná (+1.03 million tonnes, totalling 21.77 million tonnes), Mato Grosso (up 955,000 tonnes, reaching 47.12 million tonnes), São Paulo (up 268,000 tonnes, reaching 5.02 million tonnes), and Minas Gerais (up 220,000 tonnes, reaching 8.83 million tonnes), along with smaller increases in Rondônia, Maranhão, Bahia, Goiás and Santa Catarina.

Source: Conab

In the case of corn, Bahia was the only state to see a significant reduction, with its forecast dropping from 3.09 million tonnes to 2.66 million tonnes. This loss was largely offset by increases in the southern states (Paraná, Santa Catarina, and Rio Grande do Sul), where revised production estimates rose from 21.92 million tonnes to 24.21 million tonnes.

Mato Grosso also saw a significant increase of 551,000 tonnes, bringing its projection to 46.64 million tonnes. As a result, CONAB revised Brazil’s total corn crop estimates upward, from 119.55 million tonnes to 122.02 million tonnes. Even with this adjustment, the projection remains below the USDA estimate and the average of private consultancies, which is around 128.5 million tonnes.