873 words / 4 minute reading time

- Fluid milk consumption is falling in developed markets, but dairy is still on the rise.

- Plant-based alternatives are growing strongly and have coped well so far in the global lockdown.

- Growth estimates for both dairy and plant-based alternatives hinge particularly on assumptions for Asia-Pacific.

Traditional Dairy

- The value of the global dairy market is $450 billion USD, 54% of which is fluid milk ($243b USD).

- While the dairy market is expected to grow by 1.8% in the next decade, the fluid milk market is on the decline.

- Fluid milk growth trends:

- The level of fluid milk consumption in Asia is significantly lower than that in developed countries, thus growth has been strong but off a low base.

- Chinese per capita milk consumption has grown at 6.5% CAGR (Compound Annual Growth Rate) over the past 10 years.

- At the same time, fluid milk consumption is declining in developed economies (though total dairy consumption continues to rise as demand for products which utilise a lot of milk in their production increase, such as cheese).

- Fluid milk sales in the US have steadily fallen at over 2% CAGR over the past 10 years.

Plant-Based Alternatives

- The value of plant-based dairy alternatives was $15.8 billion USD in 2019 and is estimated to reach $35.8b by 2026. This is equivalent to a 12.4% CAGR.

- 2019 global value of each plant-based alternative:

- Soy: $7.4b USD

- Almond: $5.4b USD

- Coconut: $1.6b USD

- Others (pea, cashew, hemp, flax etc.): $0.6b USD

- Rice: $0.5b USD

- Oat: $0.3b USD

- In the UK in 2018, plant-based options still only accounted for 4% of volume sales and 8% of value sales in the milk/milk alternatives category.

Growth Expectations and Trends

1. High growth is expected in almond- and oat-based alternatives, particularly in the beverage sector.

- Oat-based milk alternatives grew the fastest of the alternatives between 2017 and 2018 (global volume sales went up 71% over 2017-2018). In 2019 sales in the US grew by a whopping 686%!

2. Plant-based alternatives are more popular amongst younger consumers.

- Women aged between 16-24 currently represent the highest growth segment of the plant-based alternatives market.

3. The highest consumption is in the Asia-Pacific (APAC) area. The growth in this region is expected to continue strongly.

- In 2019, the APAC region held over 40% of the global alternatives market.

- APAC is expected to grow at 14.5% CAGR between now and 2026, meaning that its market share will be approximately 48% of the global alternatives market in 2026.

- China is expected to increase in prominence with growth estimates of 17% CAGR over the same period, increasing its global market share.

4. From 2015-2018 sales of plant-based beverages grew at 2.9% CAGR in the US.

What is Driving the Rise of Plant-Based Alternatives?

- The most commonly cited reasons for choosing plant-based dairy alternatives are:

- Allergies and Intolerances (to lactose or cow milk proteins)

- Environmental/sustainability/animal welfare concerns (note: oat milk is believed to have the lowest environmental impact)

- Vegetarian/vegan/plant-based diets

- Taste

- Perceived health benefits

- Note: One study has shown that plant-based consumers are statistically sensitive to pricing and may switch back to dairy if plant-based alternative pricing rises relative to dairy.

Coronavirus’ Impact on Dairy and Plant-Based Alternatives

- During the lockdowns in place in many countries, it is interesting to note that, while sales of traditional milk surged as people stockpile, sales of oat milk have spiked even harder.

- Sales for each were up 32% and 476% respectively for the week ending with March 14, 2020.

- This is believed to be because of oat-based milk’s longer shelf-life than milk, its ability to be stored at room temperature, and lower environmental impact of oat-based production vs. other plant-based alternatives.

What Does the Future Hold?

- The global population is set to continue growing at 1% per year over the next decade, with APAC accounting for one third of this growth.

- If young people continue to more readily adopt plant-based alternatives and stick with them, particularly in APAC where a firm base of consumers already exists, then the current short-term growth estimates of 12.4% CAGR do seem justified.

- However, this cannot go on forever and reversion to some lower growth rate will occur eventually.

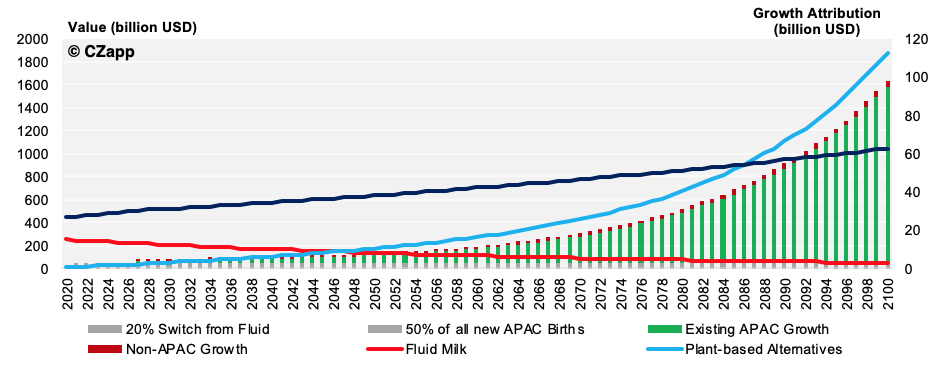

- If, we assume:

- Non-APAC demand for plant-based alternatives grows at 2.5%;

- Existing APAC demand grows at an aggressive 6.5% from 2026 (as per the growth in milk consumption in China over the past decade);

- 50% of the APAC population growth (~350m people over the next 30 years) consume one litre of plant-based alternative per week;

- 20%of the losses from fluid milk consumption switch to plant-based alternatives

- And dairy demand grows at just 1% from 2026;

- Then:

- In 2050, the plant-based market will be worth ~$140b USD vs. dairy at ~$675b USD, but will overtake fluid milk;

- Following this trend (which is unrealistic): the plant-alternatives market would overtake dairy in value terms the year 2090.

- As you can see below, these results place huge emphasis on strong sustained uptake in APAC. I expect that this growth rate would slow much sooner.

I think, more realistically, that:

- Demand growth for both will slow over time.

- Plant-based alternatives will continue to displace dairy in the fluid beverage sector.

- Further breakthroughs will be required for plant-based alternatives to meaningfully substitute dairy commodities (powders, cheese, butter etc.) and the nutrition density of dairy.

- Both can exist somewhat harmoniously until these breakthroughs necessitate reassessment.

To Conclude…

Fluid milk consumption has long been in decline, and plant-based alternatives are filling this void. But dairy commodities are far from being displaced and should continue to show solid growth going forward.

Sources:

- Cow Milk versus Plant-Based Milk Substitutes: A Comparison of Product Image and Motivational Structure of Consumption.

- By Rainer Haas, Alina Schnepps, Anni Pichler and Oliver Meixner.

- Institute of Marketing & Innovation, Department of Economics and Social Sciences, University of Natural Resources and Life Sciences, 1180 Vienna, Austria

- Published in “Sustainability” Journal

- Report Overview of: Dairy Alternatives Market by Source (Soy, Almond, Rice and Other Sources), Application (Food, Beverages, Dairy-free Probiotic Drinks and Others), Distribution Channel (Large Retail, Small Retail, Specialty Stores and Online): Global Opportunity Analysis and Industry Forecast, 2019-2026

- By Sumesh Kumar , Roshan Deshmukh

- https://www.alliedmarketresearch.com/dairy-alternatives-market

- https://www.foodspark.com/Trends-People/8-key-stats-on-the-rise-of-milk-alternatives

- https://www.statista.com/statistics/693015/dairy-alternatives-global-sales-value-by-category/

- https://www.statista.com/topics/4649/dairy-industry/

- Consumers Preferences for Dairy-Alternative Beverage Using Home-Scan Data in Catalonia

- By Mohamed Laassal and Zein Kallas

- Published in “Beverages” Journal

- A winning growth formula for dairy

- By Christina Adams, Isabella Torres Maluf, Ludovic Meilhac, Miguel Ramirez, Roberto Uchoa de Paula

- Published by McKinsey & Company

- Reducing food’s environmental impacts through producers and consumers

- By J. Poore, T. Nemecek

- Published in Science (01 Jun 2018)

- MILKING THE VEGAN TREND: A QUARTER (23%) OF BRITS USE PLANT-BASED MILK

- Mintel Press Team

- USDA

- National Public Radio www.npr.org – quoting Nielsen data