Insight Focus

- Unwinding of COVID restrictions is driving a resurgence in spending.

- Major beverage bottlers dash for additional PET due to strong demand growth in June.

- Restocking could tighten availability, in turn supporting export margins.

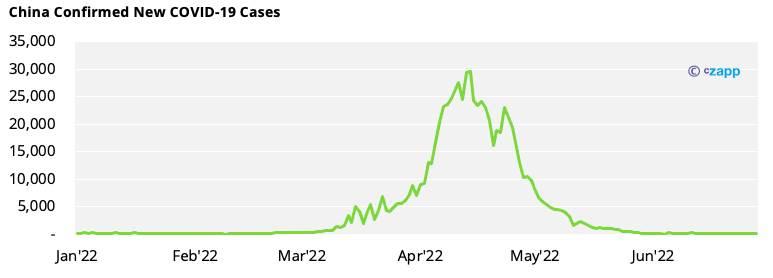

After months of crippling disruption, China cautiously unwound many of its COVID restrictions in June.

Nationwide, China is reporting the lowest number of new cases since early February, and consumers are responding to the new freedoms with a rise in travel and revenge spending.

Of its top 50 cities by economic size, only one district in Shenzhen, bordering Hong Kong, has widespread restrictions in place. Other recent outbreaks in Beijing and Inner Mongolia look, for now, to have been controlled.

The remaining restrictions in Shanghai and Beijing continue to be eased, with dining-in to resume in Shanghai from 29 June, and schools in Beijing returning to in-person teaching.

Entry rules for foreign visitors are also being relaxed, with the number of international flights increased, and quarantine time shortened for certain destinations within China.

Revenge Spending Expected to Lift Beverage Sales

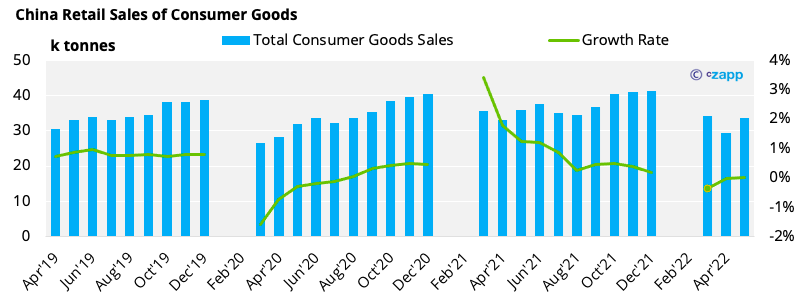

Recent lockdowns have not only placed strain on the national economy, but with stores shut and stay at home orders in place, China’s domestic consumption of PET packaged goods has been hit hard.

China’s total retail sales of consumer goods, which include catering services, fell 6.7% year on year in May, the steepest drop since March 2020.

However, as regular virus testing and other stringent controls are eased, consumer activity is poised to spring back over the remainder of the summer.

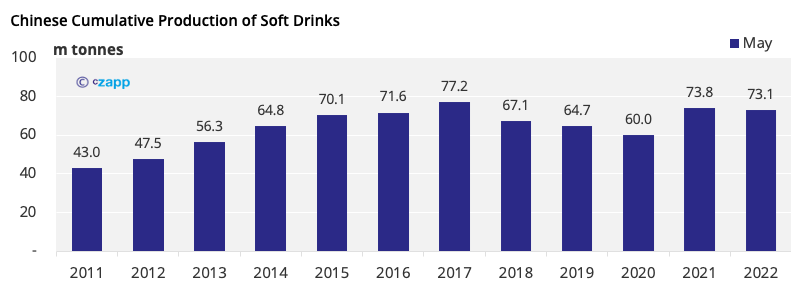

Whilst beverage production fell 7% in May, cumulatively, Chinese beverage production for the first five months of the year was only a fraction below 2021 levels.

Despite the lockdowns, production had already surpassed 2019 pre-COVID levels for the same period by 13%, indicating strong underlying demand.

With restrictions easing in June, population centres, such as Beijing and Shanghai, are already experiencing an unleashing of pent-up consumer demand.

The food and beverage industry is already back into full swing, with the public flooding back to shopping malls and restaurants, in a wave of revenge spending.

China’s Swire Coca-Cola recently noted “very positive growth following the gradual resumption of work and production in Shanghai since June”.

And as an indication of confidence in recovery of the Chinese market, the company plans to invest more than 5.5 billion yuan ($819 million) in plant infrastructure over the next five years, adding 20 new production lines.

Major Bottlers Dash for Additional PET Supplies

June’s consumer rebound has also precipitated fresh PET resin demand.

Over the last week, at least 4 to 5 large-scale converters have placed additional orders for bottle-grade PET resin, totalling more than 100k tonnes.

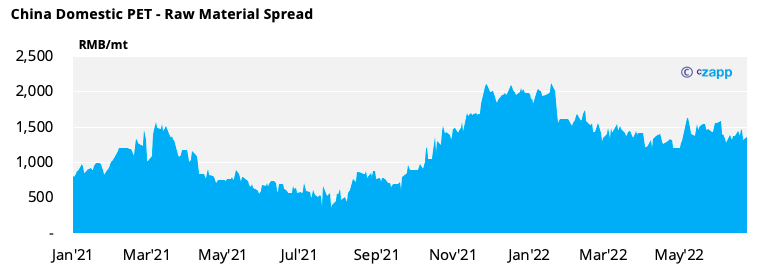

Stronger demand is also resulting in increased domestic PET resin margins.

Having reached a 2022 low at the end of April, the spread between feedstock cost and the Chinese domestic PET resin price strengthened through May, with the moving average now trending upwards into July.

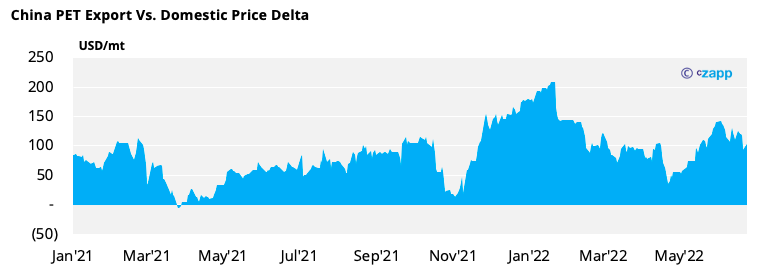

The delta between export and domestic PET pricing (converted into USD) has also risen over the last month, from a bottom at the end of April, indicating relative strength in the domestic market.

Narrow deltas between the two sets of prices tend to coincide with higher relative strength in the export market, and/or periods of low domestic demand.

Market Outlook & Concluding Thoughts

- With availability, particularly for export already constrained, sustained strong restocking in the domestic market could tighten availability further.

- Whilst PET export margins have fallen 15-20% since April, PET export margins could stabilise through July and August.

- Whilst some short-term margin support may be evident, forward feedstock costs are expected to decline gradually through H2’22 (see our latest Weekly Futures report), pointing to continued weakness in PET resin prices through Q3.

- Increased PET resin supply in H2, stemming from higher operating rates as well as new and restarted units, has the potential to weigh on markets and margins.

- However, increased price competitiveness and arbitrage opportunities for Asian material into foreign markets, is expected to generate strong demand in Q4; following a similar pattern to Q4 2021.

Other Insights That May Be of Interest…

European PET Market View: Will Revenge Spending Boost European PET this Summer?

PET Raw Material Futures Outlook: PTA, PET Producers Struggle to Pass on Feedstock Price Rises

PET Resin Trade Flows: EU PET Imports Surge Despite Chinese Export Constraints