Insight Focus

PTA futures were lifted by rising crude and China’s plan to ‘moderately loosen’ economic policy. PET resin export prices also firmed through the week, averaging USD 800/tonne by Friday. As CNY approaches, some Chinese PET resin producers are announcing sold out Jan’25 shipments.

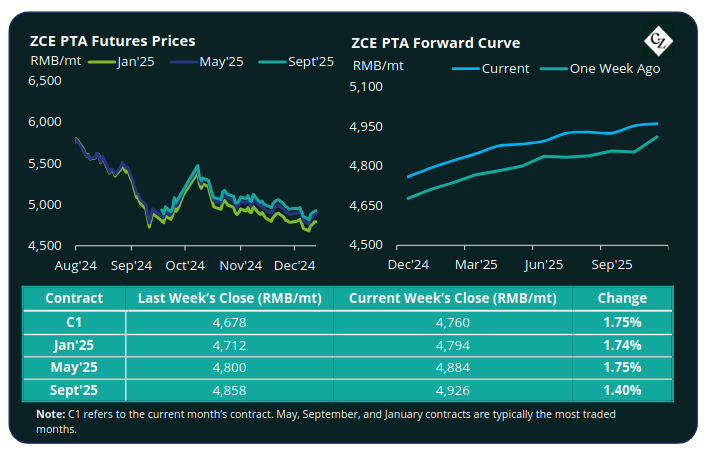

PTA Futures and Forward Curve

PET futures rebounded from last week’s lows, with main month contracts increasing around 1.75%, driven higher by rising crude oil prices.

By last Friday, Brent crude oil prices had risen to over USD 73.50/bbl, up around USD 2/bbl from the previous week’s close, supported by a series of policy announcements.

OPEC+’s decision to delay a rollback of production cuts led some traders to view to a tighter supply picture in 2025. The US is also believed to be considering additional sanctions against Russia and Iran. Whilst last week, China announced plans towards a more proactive, looser fiscal policy in 2025.

PX-N narrowed by around USD 7/tonne, after showing some improvement the previous week. Whilst the PTA-PX CFR spread improved very slightly, up USD 2/tonne to USD 79/tonne.

PTA supply and demand fundamentals remain relatively balanced, with some unplanned shutdowns leading to a slight reduction in overall PTA operating rates, counterbalanced by an easing of downstream polymerisation rates.

The PTA forward curve remained relatively unchanged, with the May’25 contract at a RMB 90/tonne premium over the Jan’25 contract. The Sept’25 is at a RMB 132/tonne premium.

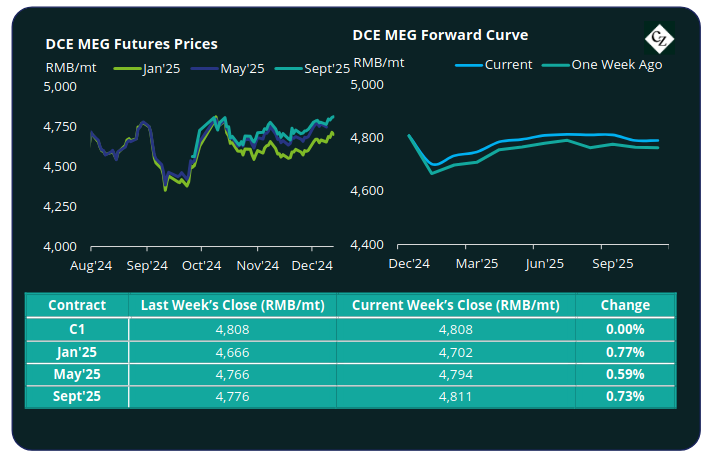

MEG Futures and Forward Curve

MEG futures continued to eke out positive gains, with main month contracts adding a further 0.5-0.75% last week.

East China main port inventories continued to shrink, amid a drop in import arrivals and increased daily offtake. Inventory levels decreased 4.3% to just 459,000 tonnes by Friday.

Overall, MEG inventories remain low, with short-term market sentiment buoyed by any unplanned temporary shutdowns.

Whilst spot liquidity is expected to remain tight through December, easing of polyester operating rates may lead to a steady increase in MEG availability through to CNY in late January.

The MEG Futures forward curve also remained relatively unchanged, at flat to a slight carry, with only a modest upward curve through the next 12 months.

The May’25 contract held a RMB 92/tonne premium over the main Jan’25 contract and the Sept’25 held a RMB 109/tonne premium.

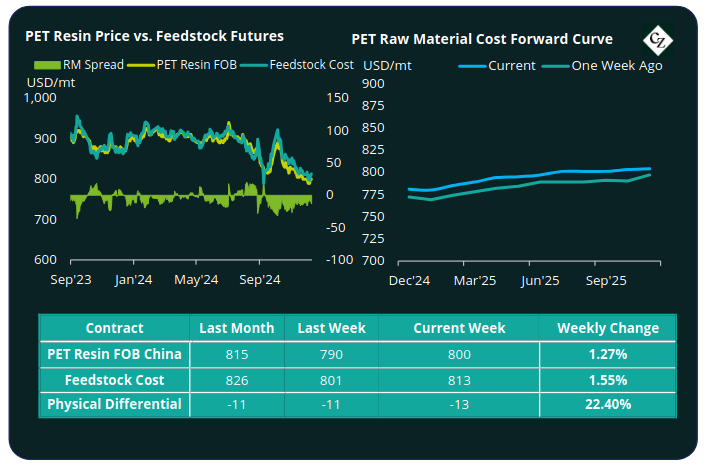

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices slowly firmed through the back half of last week, increasing USD 10/tonne back up to a USD 800/tonne average by last Friday.

The average weekly PET resin physical differential against raw material future costs improved only very slightly to negative USD 10/tonne last week. By Friday, the daily differential was back at negative USD 13/tonne.

The raw material cost forward curve has maintained a slight contango through 2025 with May’25 holding a USD 15/tonne premium over Jan’25, and Sept’25 USD 21/tonne, with little change versus the previous week.

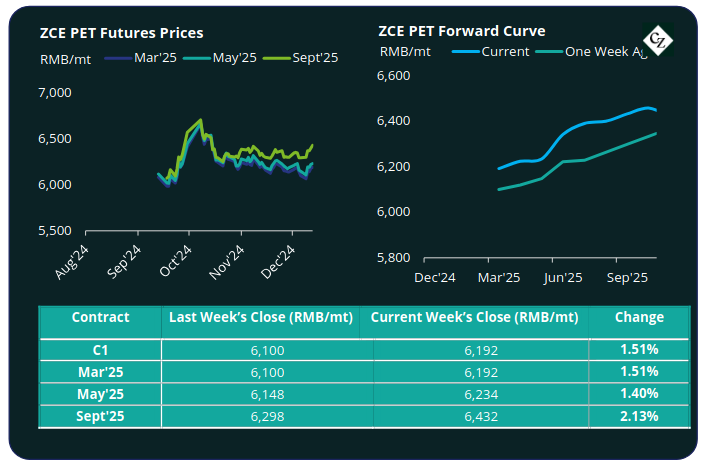

PET Resin Futures and Forward Curve

PET Resin Futures rebounded around 1.75% last week — the first solid upward movement in several weeks.

The Mar’25 contract, the first contract month of these new futures, increased to RMB 6,192/tonne (USD 850/tonne), equating to an FX adjusted gain of USD 11/tonne for the week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased slightly to USD 30/tonne, up USD 2/tonne. By Friday, the daily premium was USD 29/tonne.

The PET Resin Futures forward curve remains in contango. May’25 holds a RMB 42/tonne (USD 6/tonne) premium over the main Mar’25 contract. Sept’25 held a RMB 240/tonne (USD 33/tonne) premium.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

The Asian PET resin export market continues to track upstream raw material costs. Although the physical differential over raw material futures has improved considerably since its lows in September, it remains subdued, in negative territory.

Chinese PET resin export prices keep in a tight range, close to the USD 800/tonne average. With forward orders now coming up against the Chinese New Year some producers are claiming to be sold out for January shipment.

Forward offers for 2025 through to Q4’25 are also broadly in line with both the PET and raw materials forward curve, which shows very little upside through to early peak season at around a USD 35/tonne premium for Q4’25.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.