Insight Focus

PTA futures continued their slump following weakness in PX prices and increasing PTA supply. PET resin futures also fell, mirroring softer PET resin export spot physical prices. PET resin fundamentals kept steady, with prices dominated by upstream volatility and a limited forward premium.

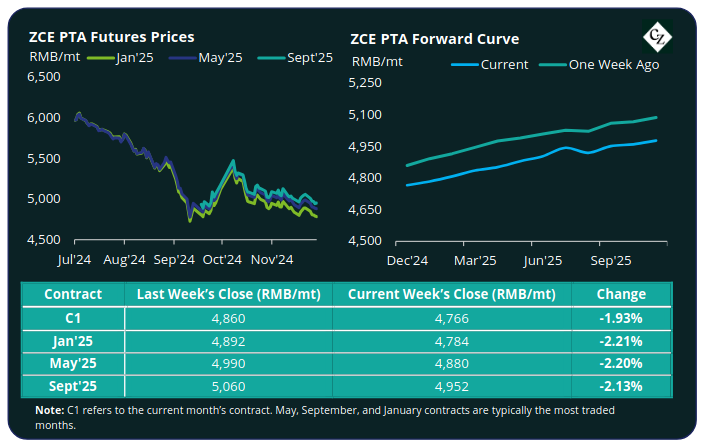

PTA Futures and Forward Curve

PTA futures continued to slide, as the main contract months dropped around 2%, reapproaching September’s lows.

It was a relatively calm week for oil prices despite plenty of developments on both the geopolitical and fundamental front, with Brent crude oil prices at USD 71.5/bbl on Friday, up a fraction of a percent on the previous week’s close.

OPEC+ has also delayed its upcoming policy meeting to December 5 and is reportedly discussing postponing the anticipated output hike due to start in January 2025.

PX generally tracked feedstock costs through the week, lacking further support the average weekly PX-N spread narrowed by USD 6/tonne.

The PTA-PX CFR spread also shrank marginally by USD 2/tonne to USD 76/tonne as PTA operating increased following several major PTA plants restart. The potential easing of polyester operating rates may place modest additional pressure on PTA demand going into Q1’25.

The PTA forward curve maintained a slight contango, with the Mar’25 contract at a RMB 96/tonne premium over the Jan’25 contract. The Sept’25 contract has a RMB 168/tonne premium.

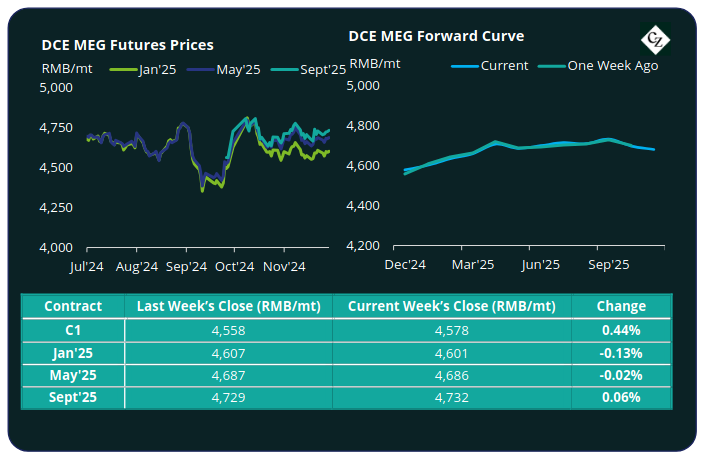

MEG Futures and Forward Curve

MEG futures main contract months continued to tread water, with very little overall directional movement in prices.

East China main port inventories dropped sharply due to delays in import arrivals, down by 13% to 511,000 tonnes.

Upcoming domestic maintenance turnarounds are also likely to keep inventory growth in check, supporting MEG fundamentals in the near term.

The MEG Futures forward curve remained flat to slight carry, with only a modest upward curve through the next 12 months.

The Mar’25 contract held a RMB 85/tonne premium over the main Jan’25 contract. The Sept’25 contract held a RMB 131/tonne premium.

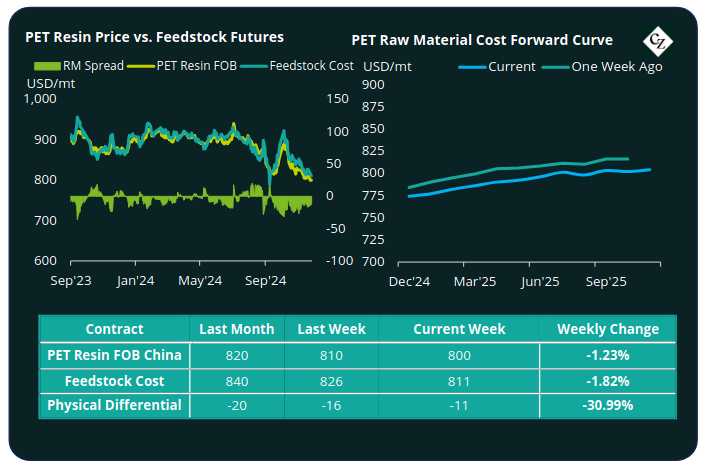

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices softened further through last week, with pricing from several major exporters now below the USD 790/tonne level. By Friday the average China FOB price was around USD 800/tonne.

The average weekly PET resin physical differential against raw material future costs kept relatively flat at negative USD 13/tonne last week. By Friday, the daily differential was negative USD 11/tonne.

The raw material cost forward curve has kept a slight contango through 2025 with May’25 holding a USD 15/tonne premium over Jan’25. The Sept’25 premium was USD 26/tonne, with little change versus the previous week.

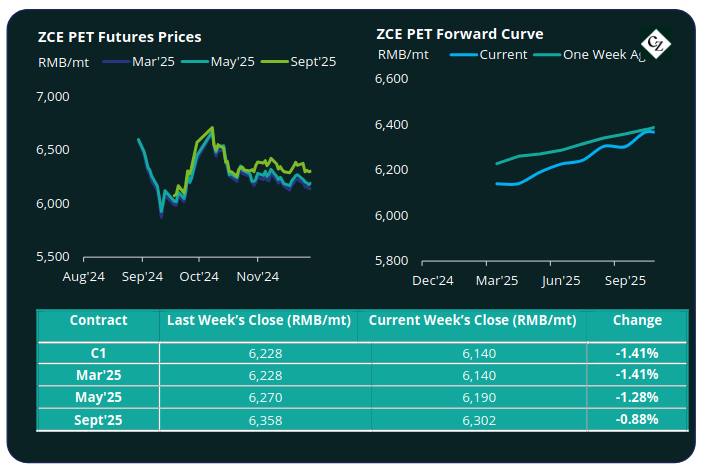

PET Resin Futures and Forward Curve

PET Resin Futures also fell by around 1.4% with the Mar’25 contract (the first contract month of these new futures) down to RMB 6,140/tonne (USD 848/tonne), equating to an FX adjusted loss of USD 4/tonne for the week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased slightly to USD 27/tonne, up USD 3/tonne. By Friday, the daily premium was also USD 27/tonne.

The PET Resin Futures forward curve remains in slight contango, showing a modest increase in steepness over the last week. May’25 now shows a USD 7/tonne premium and Sept’25 a USD 23/tonne premium over the main Mar’25 contract.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

PET resin export prices continued to weaken, largely led by falling feedstock costs, as PET producers failed to hold ground above the USD 800/tonne mark.

Both crude and downstream PET resin prices look set to slow their decline, instead keeping rangebound ahead of the next OPEC+ meeting and the next geopolitical news cycle.

Reported planned maintenance at CRC’s Changzhou and Zhuhai plants may also help support the current PET resin supply-demand balance from deteriorating any further.

Looking ahead, the forward premiums for both raw materials and PET resin are well correlated, showing limited upside to PET resin export margins through the next summer’s peak season.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.