Insight Focus

PTA futures suffered declines this week. Crude dipped towards USD 70/bbl, driving raw materials lower. PET resin futures and physical offers also shed value, as spot export prices drop below USD 800/tonne. PET resin fundamentals look range bound, with crude direction the key near-term driver.

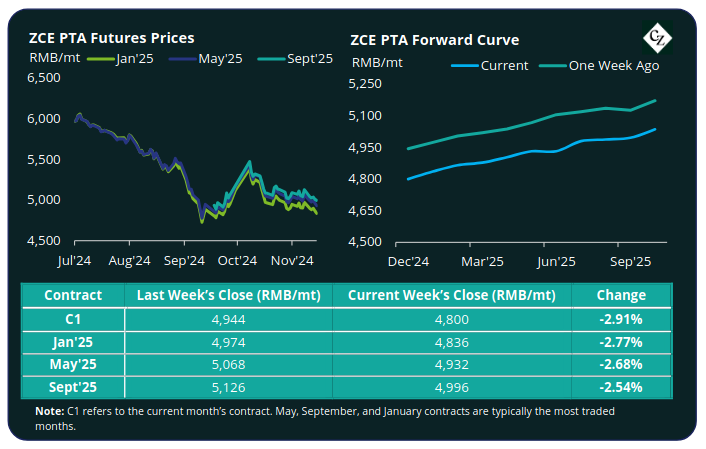

PTA Futures and Forward Curve

PTA futures fell sharply once again last week, with the main Jan’25 contract dropping by nearly 3%.

Brent oil prices feel close to USD 71/bbl on Friday after another choppy week of trading. Latest pressure on oil prices followed weak data from the Chinese refining sector and a stronger US dollar in the wake of Trump’s election victory.

While PX fundamentals remain weak due to oversupply, a sharp drop in gasoline inventories gave support, resulting in a modest recovery in the PX-N spread, increasing by USD 12/tonne.

PTA fundamentals also remain well balanced with a slight increase in PTA production offset by high polyester operating rates. The PTA-PX CFR spread increased USD 4/tonne to USD 84/tonne.

Slight easing of inventories and stabilising of liquidity also supported PTA fundamentals.

The PTA forward curve kept a slight contango, with the Jan’25 premium at RMB 36/tonne over the current month’s contract. May’25 had a RMB 132/tonne premium.

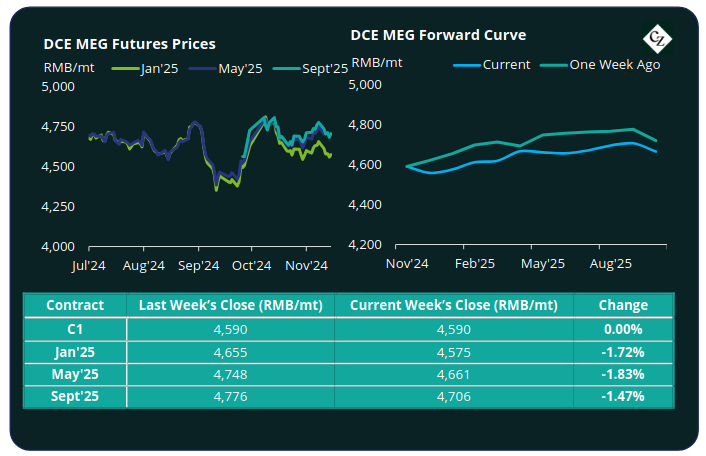

MEG Futures and Forward Curve

MEG futures also weakened but to a lesser degree, with main contracts down by less than 2%.

East China main port inventories decreased by around 5.8% to 577,000 tonnes. However, last week experienced a concentration of new arrivals, which will constrain any further drawdowns.

Whilst high downstream polyester operating rates give support to MEG fundamentals, MEG supply pressure is expected to intensify through to year end with an increase in US arrivals.

Additionally, higher MEG prices are driving added domestic coal-based production potentially giving way to a weaker supply-demand balance on the near-term horizon.

The MEG Futures forward curve was flat to slight carry, with only a modest upward curve through the next 12-months. The Jan’25 contract held a RMB 85/tonne premium over the current month. The May’25 contract held a RMB 171/tonne premium, both of which had increased marginally over the last week.

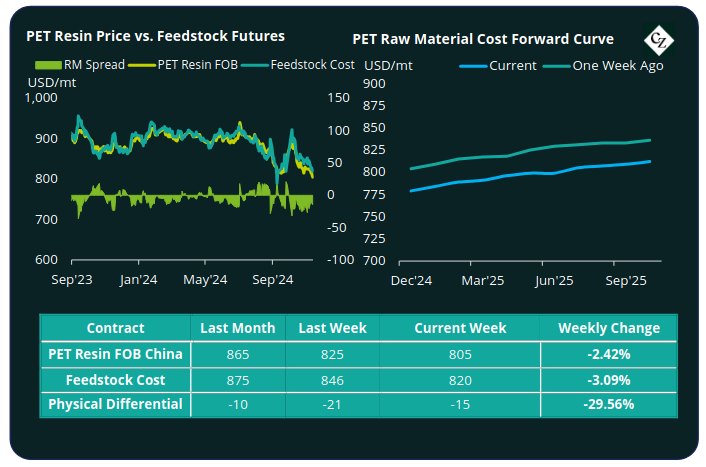

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept steady for most of the week before pluming to new lows. By Friday the average China FOB price was around USD 805/tonne. However, offers from some major producers had fallen below the USD 800/tonne level, crossing a key psychological barrier.

The average weekly PET resin physical differential against raw material future costs improved by USD 7/tonne to negative USD 12/tonne last week. By Friday, the daily differential was negative USD 15/tonne.

The raw material cost forward curve has kept a slight contango through 2025 with May’25 holding a USD 15/tonne premium over Jan’25, and Sept’25 USD 25/tonne.

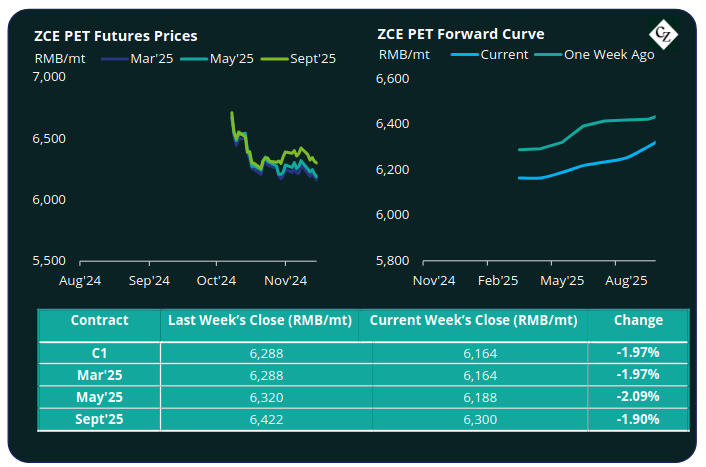

PET Resin Futures and Forward Curve

PET Resin Futures also fell by around 2% with the Mar’25 contract, the first contract month of these new futures, down to RMB 6,164/tonne (USD 852/tonne), equating to an FX adjusted loss of USD 22/tonne for the week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased slightly to USD 24/tonne. By Friday, the daily premium was USD 26/tonne.

The PET Resin Futures forward curve remains in slight contango, and is broadly unchanged since the previous week, with May’25 showing a USD 3/tonne premium and Sept’25 a USD 18/tonne premium, over the main Mar’25 contract.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

With some Chinese PET resin export offers having crossed the key psychological barrier of USD 800/tonne, prices may be poised to break lower if crude weakens further.

Although the physical differential against raw material futures showed slight improvement, fundamentals remain relatively unchanged, with values showing some short-term distortion on daily crude volatility.

However, PET resin demand may see additional support as domestic Chinese beverage producers begin coming out of the traditional maintenance season.

As a result, any meaningful reduction in PET resin operating rates in the near term may be unlikely. As a result, margins will continue to keep within range pressured by continued oversupply.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.