Insight Focus

PTA futures firmed as upstream costs were boosted by the recent crude rally. PET resin export prices flat, as Asian producers face deteriorating margins. Chinese PET resin export prices to keep in a tight range, with a limited forward premium through Q1.

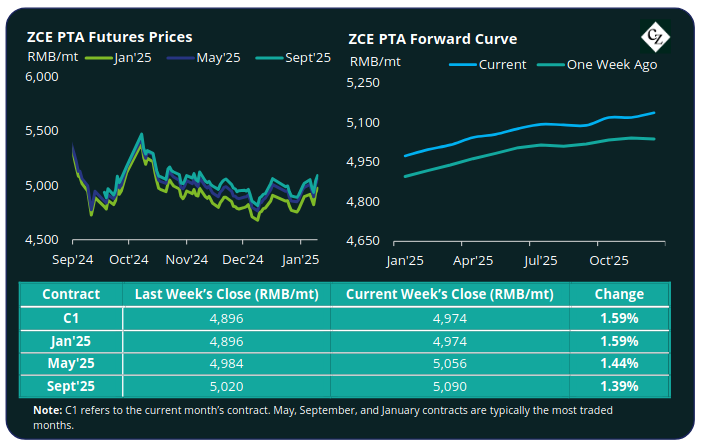

PTA Futures and Forward Curve

PTA Futures increased by over 1.5% last week, having contained to gain ground since mid-December on the upstream crude rally.

By last Friday, Brent crude oil prices had risen to over USD 79/bbl and look likely to break through the USD 80/bbl mark early next week.MEG futures have softened since the start of 2025, with main contract months losing a further 0.6-1% last week driven lower by moderate inventory build-up.

Dwindling US stockpiles, cold weather and a fresh round of sanctions targeting Russian oil tankers have contributed to the price rally. Volatility is also being stoked ahead of President Trump’s inauguration.

The PX-N CFR spread steadily improved through last week, recovering some of December’s lost ground. The weekly average was just USD 156/tonne. The PTA-PX CFR spread also gained in the first full week of 2025, up USD 9/tonne to USD 80/tonne.

PTA supply and demand fundamentals weakened through the second half of December and into 2025 as polyester operating rates continued to decline, leading to modest PTA accumulation.

The PTA forward curve remained relatively unchanged, with the May’25 contract at a RMB 82/tonne premium over the Jan’25 contract. The Sept’25 contract traded at a RMB 116/tonne premium.

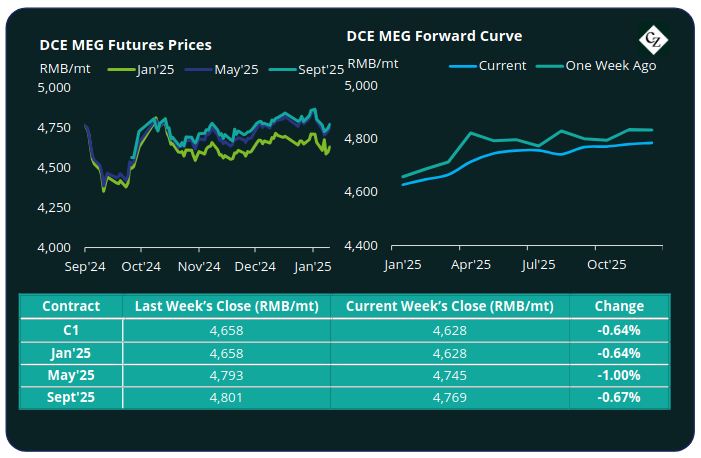

MEG Futures and Forward Curve

MEG futures have softened since the start of 2025, with main contract months losing a further 0.6-1% last week driven lower by moderate inventory build-up.

East China main port inventories leapt nearly 20% last week, as inventory levels increased to 502,000 tonnes by Friday, up by around 40,000 tonnes over the last month.

MEG operating rates continue to ease in early 2025 alongside that of downstream polyester rates, with MEG inventories expected to build over the next month.

The MEG Futures forward curve remained relatively unchanged, flat to slight carry, with only a modest upward curve through the next 12 months.

The May’25 contract held a RMB 147/tonne premium over the main Jan’25 contract. The Sept’25 contract was at a RMB 141/tonne premium.

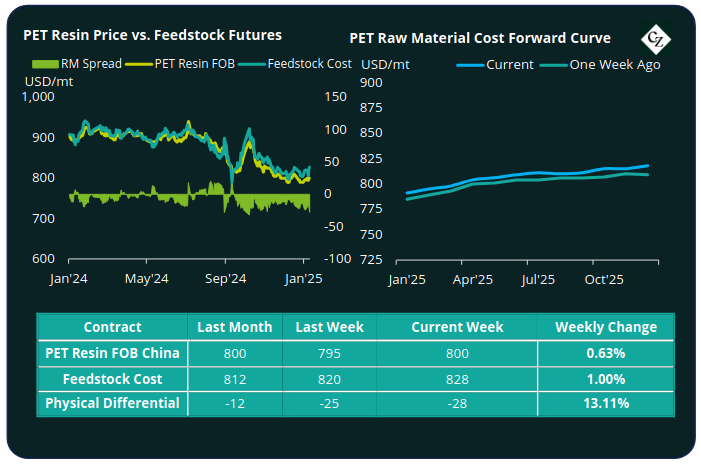

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices have stagnated around the USD 800/tonne mark since the beginning of December and showed no appetite in breaking out, despite the upward move in crude oil in recent weeks. By Friday, the China PET resin export price continued to average USD 800/tonne.

The average weekly PET resin physical differential against raw material future costs has fallen sharply against higher upstream costs to just negative USD 19/tonne last week.

This level is unchanged from the previous week but around USD 10/tonne lower than a month earlier. By Friday, the daily differential was negative USD 28/tonne.

The raw material cost forward curve has kept a slight contango through 2025 with May’25 holding a USD 15/tonne premium over Jan’25, and Sept’25 a USD 20/tonne premium.

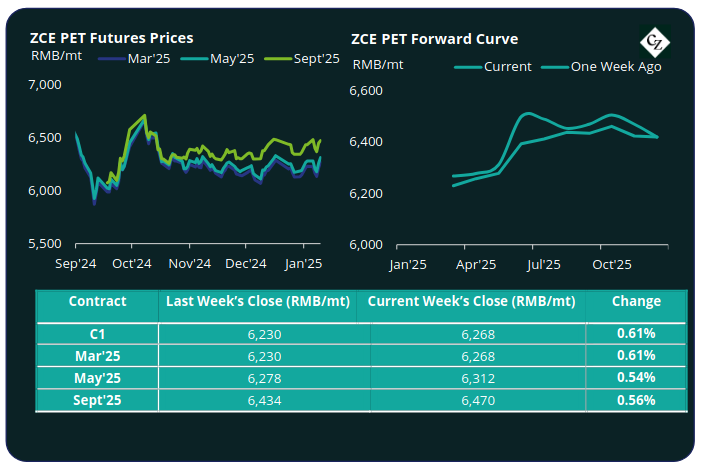

PET Resin Futures and Forward Curve

PET Resin Futures kept relatively range bound last week, although main month contracts were up by around half a percent versus the previous week.

The Mar’25 contract, the first contract month of these new futures, increased to RMB 6,268/tonne (USD 855/tonne), equating to an FX adjusted gain of just USD 5/tonne since pre-Christmas trading.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures had fallen to around USD 21/tonne, down from USD 30/tonne a month ago. By Friday, the daily premium was USD 20/tonne.

The PET Resin Futures forward curve remains in contango and relatively unchanged. May’25 holds a USD 6/tonne premium over the main Mar’25 contract. The Sept’25 contract is at a USD 27/tonne premium.

Concluding Thoughts

With the pre-Christmas and pre-CNY export rush over, Asian PET resin export demand looks to have substantially weakened with the physical differential dropping sharply.

Chinese PET resin producer margins are expected to have also retreated, edging towards loss making.

Higher container freight in December, and initial indications that rates were to firm into the new year has also impacted export demand. Although some routes have begun to ease.

Elsewhere, other Asian PET resin exports have lacked competitiveness versus local production due to the strong USD. For example, European PET resin producers are currently benefitting from the collapse in the Euro.

Looking forward, Chinese PET resin export prices are expected to remain in a tight range, with a limited forward premium through Q1, and only minimal upside through to early peak season.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.