Insight Focus

- Centre South Brazil mills have been less active in hedging their sugar recently.

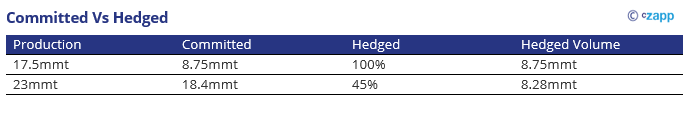

- We think less than 50% of 2023 sugar production has been hedged.

- This is despite the recent rally in the raw sugar market.

We have recently written about the outlook for Centre South (CS) Brazil next season, which starts in April. Due to the depressing view for ethanol, we believe producers will focus on maximizing sugar production.

But how much sugar mills have actually hedged?

Hedging and Committing Sugar are Two Different Things…

Usually, mills negotiate physical sugar sales up until September each year, selling (committing) their sugar to Trade Houses who in turn then offer futures market access to enable mills to hedge. Most mills can price 12 months forward, while 30-40% can access pricing up to 18 months ahead.

However, something interesting is happening this season. Despite higher sugar production expected for 2023/24 (at 35mmt), the volume of committed sugar has not increased at the same level. This does not mean that mills don’t wish to maximise sugar output. It is just that by not committing on a contract they can sell spot sugar and capture higher physical differentials next season.

But this means that mill hedging is behind where you’d expect it to be as fewer mills have access to the futures market today.

How Much Ahead?

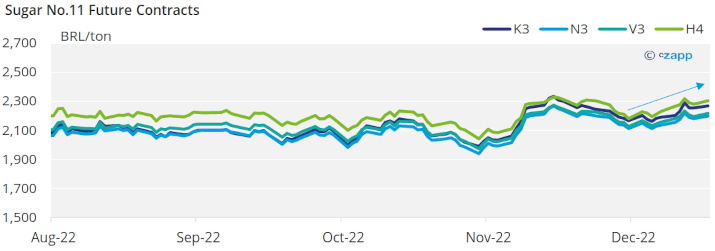

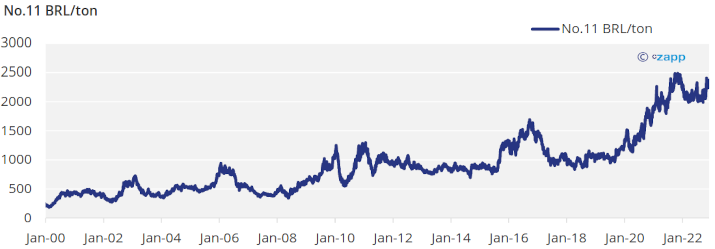

We estimate that CS Brazil is around 45% priced for 2023/24 season, versus 59% last year. Just recently prices have rebounded, offering returns above BRL2200/ton. Last year, prices were north of BRL2400/ton thus mills were more actively hedging their volumes.

But don’t be alarmed. Close to 50% priced this time for next year is high, when comparing to the recent past. Sugar prices are still at the highest levels for Brazilian millers, and the outlook for ethanol makes it difficult for the biofuel to rebound enough to compete with the sweetener.

Less hedging this time means producers are waiting for a better opportunity to lock in higher returns…