Insight Focus

- Fertiliser supply lines have been disrupted by Russia’s invasion of Ukraine.

- In this week’s Ask the Analyst, we discuss how fertiliser disruption could hit the world’s sugar crops.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

Are Sugar Crops Fertiliser Intensive?

High fertiliser prices and supply strain following the Covid pandemic and Russia’s invasion of Ukraine has made understanding crop input requirements even more important for cane and beet farmers.

This is especially true in regions like Thailand, where cane competes with other crops for acreage every season.

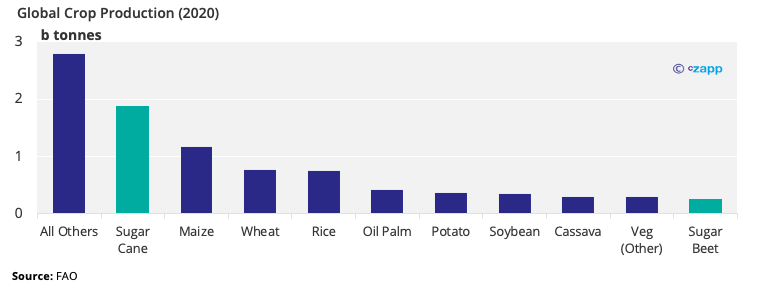

The world produced nearly 10b tonnes of crops in 2020, 20% (1.9b) of which was sugarcane, with sugar beet accounting for a smaller 3% (0.25b).

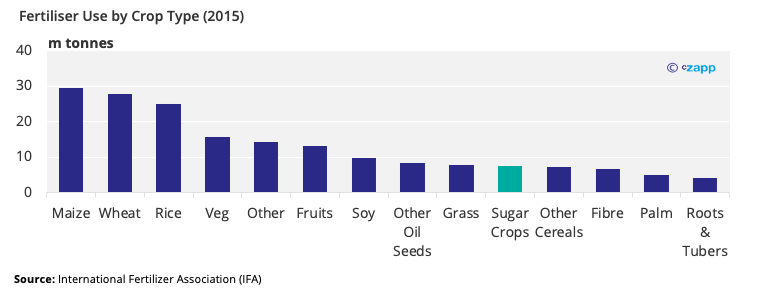

Despite this, both sugar crops account for just 4% (7.5m tonnes) of global consumption of the key nutrients, Nitrogen (N), Phosphorus (P2O5) and Potassium (K2O) in 2015.

This makes them comparatively efficient in terms of the amount of fertiliser used versus the final mass of the crop.

This is especially true against cereal crops (Wheat, Rice, Maize, etc), which use around half of the common N, P2O5, and K2O based fertilisers to produce a third of the total crop mass.

Furthermore, with sugarcane, most of the plant mass is used productively, with the waste material that’s left once the cane juice has been crushed out (bagasse) commonly burned for energy production.

Some mills in Brazil have also reported that by decreasing fertiliser usage but increasing irrigation volume, yields are only mildly worsened.

This all suggests that sugar crops may not be in an unreasonable position to weather this period of fertiliser supply uncertainty.

Other Insights That May Be of Interest…

How Farmers are Working Around High Fertiliser Prices and Shortages

Explainers That May Be of Interest…