Insight Focus

- China is a major raw sugar buyer.

- Raw sugar futures have fallen 18% from their peak.

- When will Chinese refiners buy?

China to the Rescue?

Raw sugar futures have now fallen by around 18% since they peaked above 27c/lb in late April.

The market ran out of buyers at the highs. Speculators had built a long position at the end of 2022 at below 20c. The commodity trade had built a long position in Q1’23. Consumers panic bought in Q2’23. This left everyone long and few buyers in the market, leading to the current correction.

Source: Refinitiv Eikon

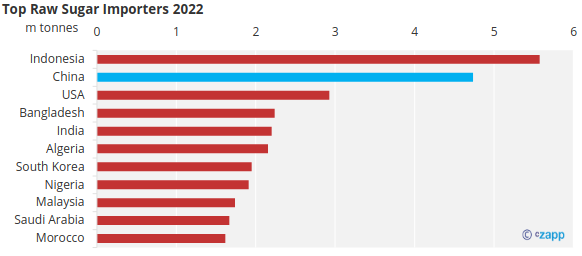

However, there is still one major buyer that could shape the raw sugar market in the coming weeks. China is one of the largest buyers of sugar in the world.

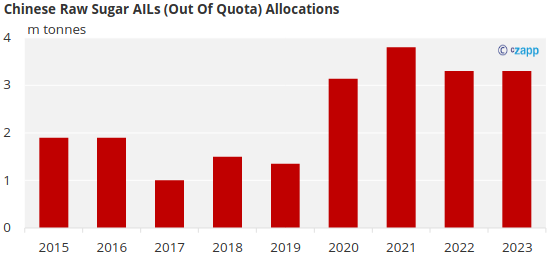

Chinese refiners are allowed to import sugar in-quota, paying 15% import duty. Quota volume is limited to around 1.5m tonnes raw sugar. They can also buy out of quota sugar at 50% duty, but volume is also limited by government issued Automatic Import Licences (AILs). We think this year refiners will use around 3.5m tonnes of AILs.

But so far they’ve used almost none: rising raw sugar futures prices have made import margins negative.

The recent futures price weakness could be the opportunity the refiners have been waiting for. Another thing that may work in the favour is that we believe some of the refiners have already hedged the FX on their AIL imports, and did so before the recent devaluation, achieving ~6.9.

Source: Refinitiv Eikon

It’s possible that some brave refiners seek to buy below 23c/lb, but it’s more likely that refiners opt to buy the bulk of the AILs at 20-22c/lb, which according to our models is close to breakeven versus the domestic sugar market.

These levels are far above the 17.50c that refiners were buying 2022 AILs at. The question is whether the refiners will act if the market falls to their target levels, or if they’ll wait in the hope it gets cheaper still, allowing them to make a positive margin on the imports.

Source: Refinitiv Eikon

One thing that works in the refiners’ favour is they don’t need to move as a crowd. In previous years, those refiners who didn’t use their AILs lost allocation in the following year. However, this year the Ministry of Commerce may not punish refiners who don’t use their AILs, allowing them to be more aggressive in their buying targets.