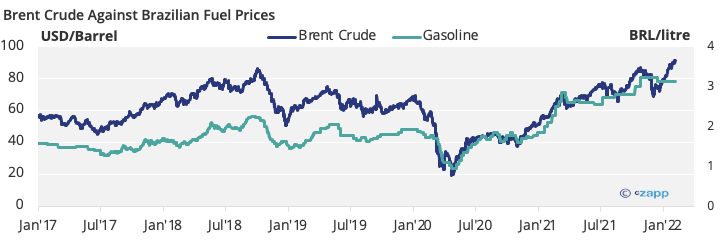

- Brent crude’s most recent rally began in late November, and the price now sits above 90 USD/barrel.

- In this week’s Ask the Analyst, we briefly discuss why this hasn’t been reflected in Brazilian fuel prices.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

Brent Crude is Rallying. Why Aren’t Brazilian Fuel Prices?

Fuel prices in Brazil are set by Petrobras, who partially base the price on current world market oil prices. As both gasoline and ethanol can be chosen at the pump in Brazil, the two fuels are related – this relationship can influence whether Brazilian mills prioritise sugar or ethanol production.

However, this price environment is not dynamic; Petrobras updates the price on an ad hoc basis and, since Petrobras is partially state-owned, it means political interference can further delay the process. Just this time last year, President Bolsonaro ousted then CEO of Petrobras over fuel price hikes…

This all means current oil prices aren’t yet reflected in Brazilian fuel prices, though an adjustment is expected.

Fuel prices are currently at record levels in Brazil and the rising Brent price threatens further increase. This means that, with a Brazilian presidential election looming in October, fuel prices have become a key political football. Incumbent President Bolsonaro and his current main challenger, Lula, both have strongly differing views on how to manage fuel prices going forwards.

This means that, due to the interrelations between gasoline and ethanol fuels, attention should be paid to which candidate wins in October as this will likely spill over into the wider sugar space.