Insight Focus

- ‘Food nationalism’, restricting exports to cap domestic prices, has been spreading.

- This has been proposed by Mexican ministers for several consumer items.

- However, we do not believe world market sugar export ban is likely.

The cost of the “basket of staples” in Mexico increased by over 8% year on year in April, the largest increase in 20 years. Food nationalism has become a recurrent theme in several countries as a mechanism to control inflation by keeping domestic prices low and ensuring sufficient supply. The government has removed tariffs on pork, beef, and poultry as well as discussed curbing price increases with domestic agricultural industries.

Other recent examples include Pakistan’s sugar export ban, Indonesia’s temporary ban on palm oil exports to keep domestic cooking oil prices in check and India’s restrictions on wheat exports as well as a cap on sugar exports.

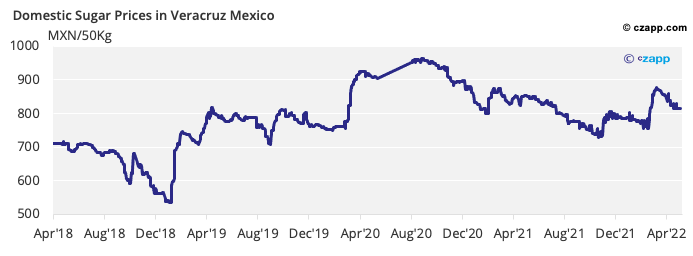

However, in Mexico, sugar is an outlier as the average price has been steady, and even falling year on year since record prices in 2019/20, after drought caused a large production shortfall. Apart from a spike in March (due to an increased US quota allocation) the price has been steady and below the 2021 prices.

On top of this, sugar is a hugely political talking point in Mexico: strikes by farmers to maintain high prices are common every year.

Because sugar has not been a leader in inflation in Mexico, and the political importance of the sugar cane industry, we do not believe the product will come under price or export controls.

Export bans are used by Governments to ensure the supply of goods remain in country, meaning prices remain lower than they would otherwise be. This is positive for domestic buyers, however it reduces the amount of supply available to the world market; this year we think Mexico will export about 700k tonnes of sugar to the world market.