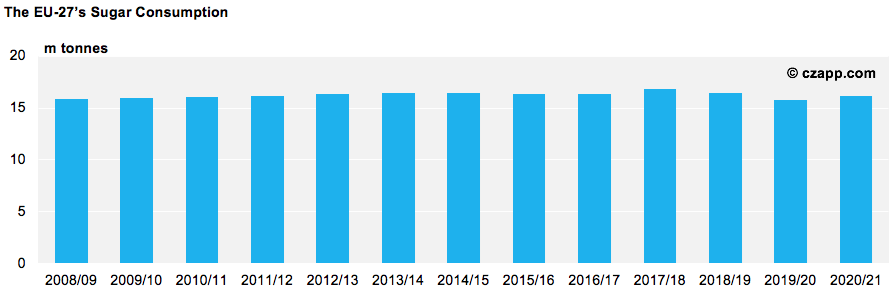

We think the EU-27 will consume 16.2m tonnes of sugar in 2020/21, up 500k tonnes year-on-year but down 200k tonnes from pre-COVID levels.

Whilst there’s some uncertainty surrounding how much sugar consumption has been lost due to COVID and its lockdowns, it’s now becoming clearer that consumers and businesses have adapted and found new ways of operating.

Examples of this include a noticeable increase in takeaway services and big brands, such as Pepsi and Mondelez, reporting much stronger online sales in their annual reports.

This should mean sugar consumption is less impacted now by lockdowns; vaccination programmes across the world should only serve to support sugar consumption in Europe as travel, hospitality and large events start to become possible.

These sectors are important for out-of-home sugar consumption; in the UK, around 6% of sugar is consumed in the food services sector (restaurants, bars, cafés, etc), whilst soft drink and ice cream consumption is linked to travel, tourism and larger events. Whilst we believe in-home sugar consumption increased through more home baking and more snacking, we don’t think this was enough to offset the loss in out of home consumption.

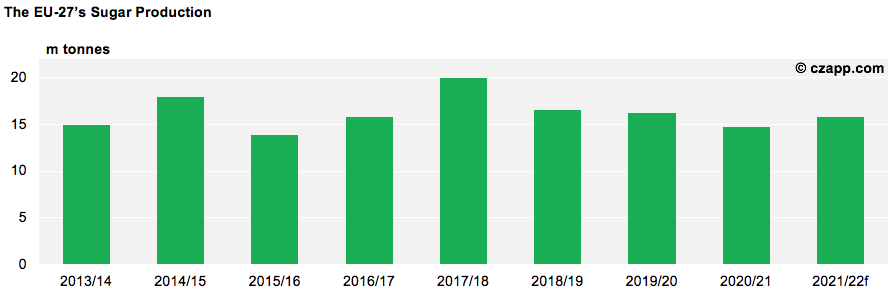

There’s similar uncertainty for EU production in the coming season (2021/22). It looks like area will once again drop as beet returns are currently poor and don’t reflect the risk of growing the crop. Reportedly, much of the beet already sown in North-West Europe will need to be replanted due to heavy frosts earlier this month. This could hit up to 10% of the planted area in France, which is a further setback for farmers there.

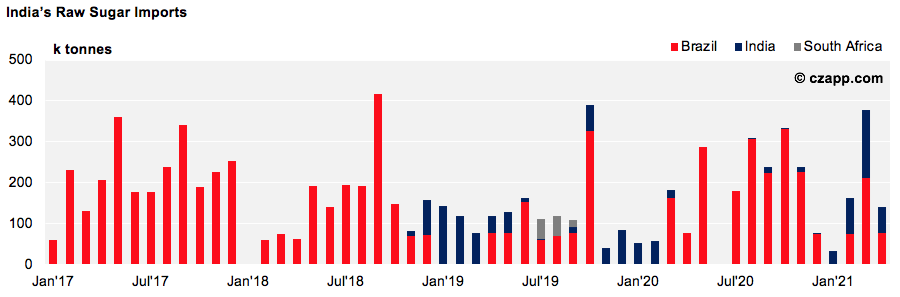

India’s Brazilian raw sugar offtake looks higher year-on-year because the export subsidy announcement only arrived on the 15th December (later than usual).

Looking closely, we can see that the majority of its Brazilian offtake (631k tonnes) came in Q4’20, around the time where the Government’s plan was still uncertain.

Having said that, since the subsidy was confirmed, India’s coastal refineries have imported 571k tonnes of raws; 285k tonnes (50%) of this has come from Brazil. This could be because the refineries had signed contracts prior to the subsidy announcement, which now need to be fulfilled.

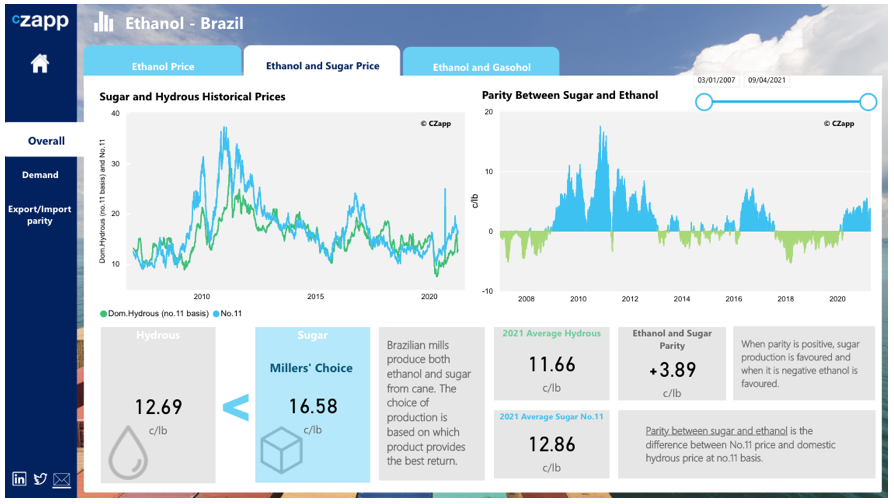

Most of Brazil’s mills seem to have hedged at 13-13.5c/lb with the BRL at around 5.4, giving them excellent returns and above what is expected from ethanol this season.

Therefore, in order for the production mix to change, ethanol prices would need to rise significantly and sugar would need to fall so the hedges can be unwound profitably.

If fuel demand is low, the expected price curve for ethanol remains on the lower end, which at this point, will not impact the sugar mix as maximising sugar production was already the plan.

You Can Monitor These Dynamics in the Interactive Data Section

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

- Czapp Explains: The EU’s Sugar Industry

- Czapp Explains: The Sugar Industry in Uttar Pradesh

- Czapp Explains: The Sugar Industry in Maharashtra and Karnataka

- Czapp Explains: CS Brazil’s Sugar Industry