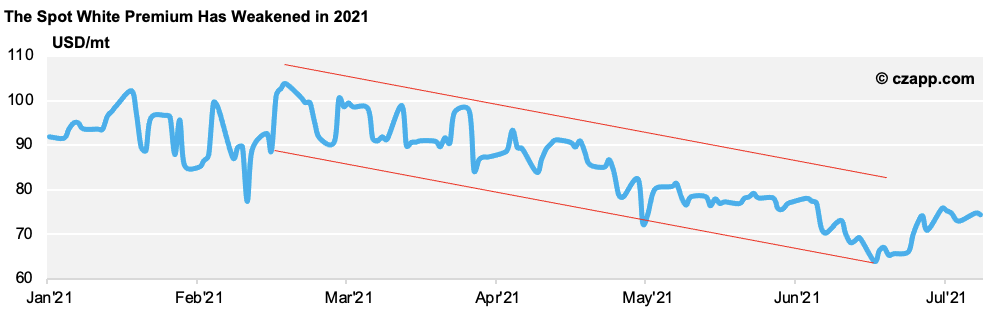

The refined market is weak, and this has hit the white premium.

In some cases, further COVID waves are hitting local sugar consumption as people are more restricted in their movements (e.g., Thailand and Indonesia). This means reduced demand for refined sugar (or in the case of Thailand increased supply).

We’ve seen more evidence of reduced demand for refined sugar in Africa; there are apparently some afloat breakbulk cargoes looking for buyers in the region, while refined sugar stock levels seem adequate elsewhere.

This has reduced the attractiveness of receiving the No.5 futures, as can be seen by the recent small delivery against the August’21 expiry.

Despite the poor demand, the refined sugar market is suffering from the logistics difficulties that have gripped the world in 2021.

These difficulties in sourcing suitable containers at an attractive price are being reflected in regional physical values rather than the white premium.

The net effect of the weak white premium is to signal to refiners in surplus regions that they need to reduce their throughput until demand recovers or stocks are run down. We think this should happen through the middle of the year and expect the white premium to recover towards the end of Q3.

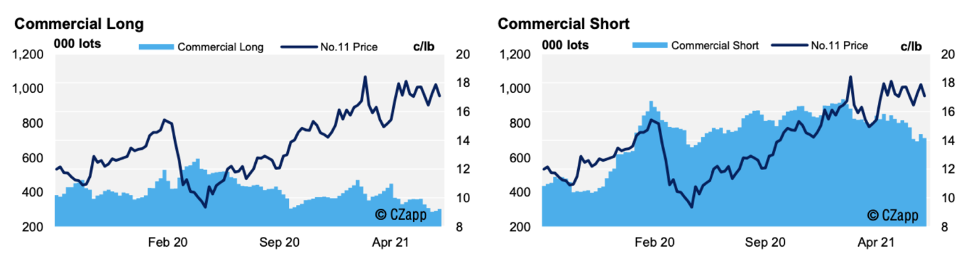

The commercial short is coming off a record position. This mostly comprised of hedged Brazilian sugar for the 2021/22 after the weak BRL offered near record pricing levels in BRL terms.

However, we’re two of the three contracts through the Brazilian crop so, naturally, these hedges have unwound and the selling to replace them hasn’t arrived in the same volume as last year.

There are a few potential reasons for this. Firstly, the price rallied significantly after the Brazilian mills priced last year, so they may be keen to capitalise if this happens again. Secondly, bullish energy markets are making Brazilian mills consider their sugar mix more carefully. Thirdly, the dry weather in Brazil will impact next year’s cane crop, so mills may be keen to avoid overcommitting in case of crop losses.

These dynamics mean we don’t think there’ll be another commercial short position over 800k lots, like we saw in the run up to Brazil’s 2020/21 crop.

In the last decade, industrial sugar consumers have grown accustomed to sugar as a bear market, so have traditionally left pricing to the last minute and still captured low prices. This has meant buying has been mostly concentrated in closer contracts and is easily discouraged by perceived high prices. What we’re seeing now with the very low commercial short is a result of this.

With short term physical demand weak around the world, these consumers don’t have much buying to undertake in the October and the high prices mean they’re reluctant to buy for 2022. However, with the fundamentals looking bullish for 2022 and beyond, the consumers may need to develop a more long-term pricing approach. Sugar will ultimately need to be bought, but we may see further drops in the short term. Long term, we may see larger commercial longs as more positions are held down the board.

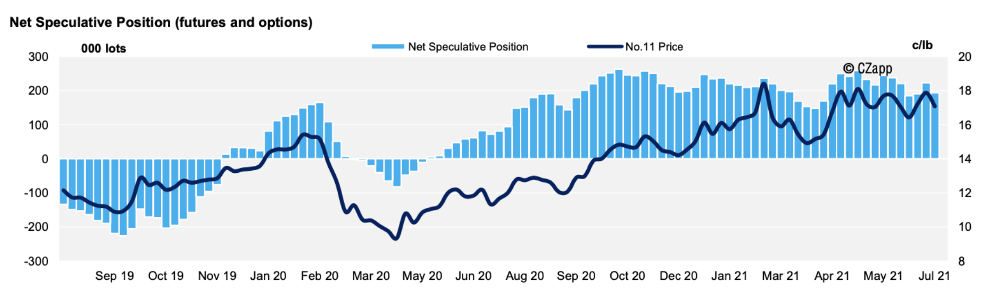

This recent net spec long was initially supported by significant commercial buying in 2H’20, with prices dropping below 10 c/lb after COVID hit the market.

As that dissipated in early 2021, there was widespread speculative buying of commodities in response to the belief that we are entering a commodity ‘supercycle’.

Today, concerns around the impact of dry weather and rallying energy markets on the Brazilian crop are driving sentiment.

For this to change, we’d need some fundamental news that would alter sentiment, but with India and Thailand seemingly unable to produce large enough volumes to flood the market, there won’t likely be any fundamental bearish developments that could drive specs towards a net short.

However, a macroeconomic change could curtail the keenness of speculators in the market.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…