Insight Focus

- Energy prices more than double EU sugar cost of production.

- Sugar producers find ways to reduce natural gas usage.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

The news is full of stories about the spiralling cost of energy, in particular natural gas in Europe.

By now you are likely aware that natural gas prices are at least 10x higher than they were in 2021.

Source: Refinitiv Eikon

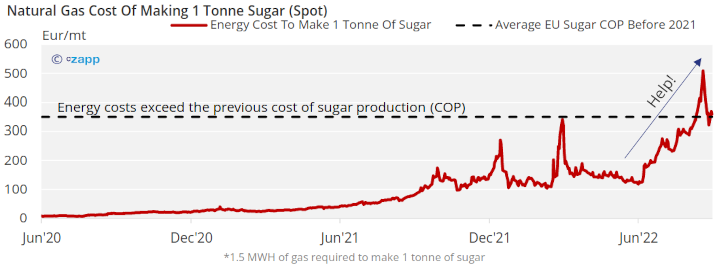

So what does this mean for EU sugar producers who rely heavily on natural gas to power their factories?

In short it doesn’t look pretty: we estimate that producers buying spot natural gas would need to pay around €350/mt of sugar. It says something about the volatility that just over a week ago this would have been over €500.

To put this in context, the EU’s most efficient producers could make sugar for €350/mt in 2021 and earlier. Or put another way, the EU cost of sugar production has more than doubled.

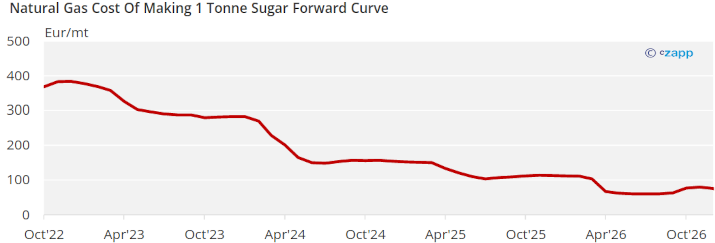

The forward curve is not much better for those looking to buy energy for later in this year’s campaign or next year.

Due to the volatility of prices, it will also be very difficult for producers to effectively hedge and manage their energy price risk going forward. This may mean that energy costs may differ hugely between different producers.

It’s not just the price that producers are having to think about: there’s a real risk that certain countries impose restrictions or rations on energy usage, which could slow or halt beet processing.

To combat this, the French beet harvest has begun early and producers are giving farmers incentives to lift their crop early. By doing this, the size of the beet (beet yield) will be smaller, especially in a drought affected this year. Less sugar will be produced, and processing will be less efficient.

German producers are equally worried about being able to fulfil their contracts and have agreed to combine their processing capacity if gas supplies run short in the coming months. There’s also been success for some factories in converting to run on oil rather than natural gas.

How We Can Help?

The energy price volatility has meant that processors are less likely to leave refined offers on the table for extended periods of time. The Czarnikow team provide a service to producers and or consumers which gives both parties the ability to separately manage and hedge the energy component of sugar and other products. Please contact Max Kirby (mkirby@czarnikow.com) if we can help!