Insight Focus

- Mills in Centre-South Brazil hedge most of their sugar against July and October futures contracts.

- Usually, mills can hedge for the next 12 months.

- Their view for sugar prices and ethanol parity will determine their pricing pace.

Although the Centre South (CS Brazil) cane crushing season extends from April to March, the bulk of sugar production is from April until October.

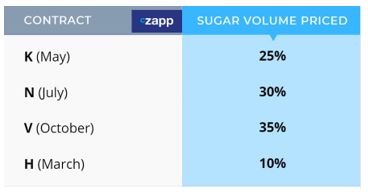

And this is reflected in the volume of sugar hedged against each futures contract:

We can see more pricing pressure from Brazil against the July and October contracts.

But how do mills decide how and when to price these volumes?

Mills also speculate while hedging…

Usually, mills negotiate physical sugar sales up until September each year, selling their sugar to Trade Houses who in turn then offer futures market access to enable mills to hedge. Most mills can price 12 months forward, while 30-40% can access pricing up to 18 months ahead.

However, it’s common for Brazilian mills retain a high degree of flexibility by not hedging their full sugar volume far in advance, especially when they believe sugar prices will rise.

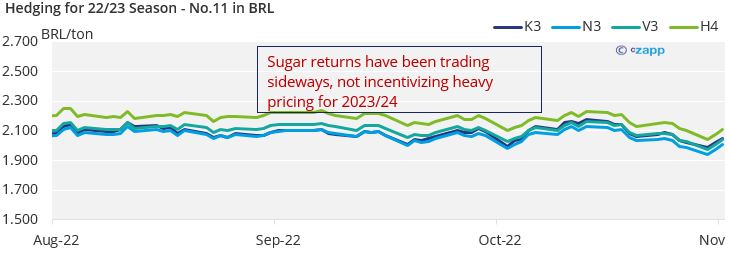

In the past couple of years, we saw mills heavily hedging the upcoming season. Although hedging levels were providing good margins, some mills were left with a bitter taste once the market kept rising and felt that they could have captured better returns.

This is particularly evident with pricing action for next season, where mills are choosing to have a higher flexibility to hedge more on a spot basis which they believe will result in higher returns.

Another interesting dynamic that has impacted the mills’ view is the rise of demurrage costs.

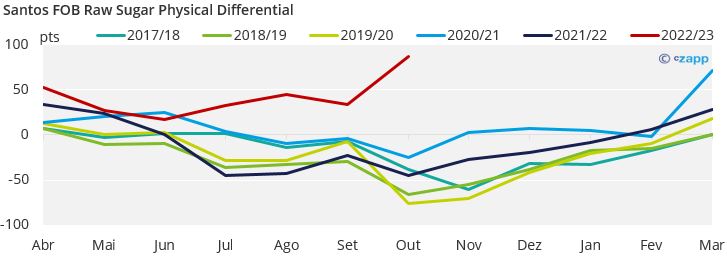

Demurrage costs have doubled since last year, going from $20k/day to $40k/day. This combined with strong global demand for raw sugar has kept Brazilian FOB physical differentials high.

Usually, physical contracts between trading and mills are flat. Therefore, mills are choosing to remain more exposed to the spot market in the hope of being able to capture the strength in the physical market.

And of course, the sugar and ethanol parity

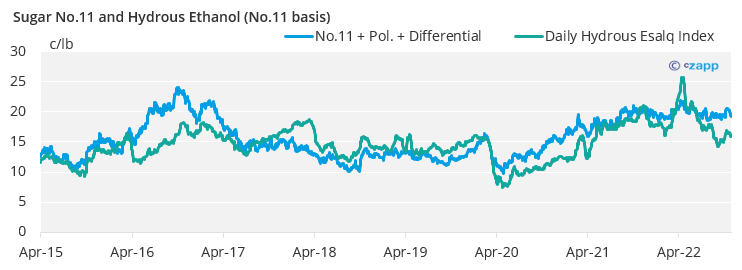

In life, everything is relative. And for Brazilian millers, sugar prices need to be not only high but higher than ethanol returns. Mills in Brazil can produce sugar and ethanol, and the amount of cane allocated to each is dependent on the sugar and ethanol parity. If sugar is paying more, a higher sugar mix will be expected for the season. If ethanol has a more favourable return, then sugar mix will be reduced in favour of the biofuel – think of seasons 2018/19 and 2019/20.

Unlike sugar though, ethanol is not a product mills hedge so it is sold mostly on a spot basis. During the season if parity is favouring ethanol, then mills could washout their sugar contracts and try to make more ethanol.