Insight Focus

- CBIO are similar to a carbon credit and are traded in Brazil as a part of the Renovabio program.

- Certified mills in Brazil can issue CBIOs by selling ethanol.

- This makes ethanol more attractive through additional revenue; but how much?

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

Since 2020, CBIOs have been traded on B3 (Brazilian Stock Exchange). On one side, are millers selling what they have been able to issue – based on their efficiency grade – and on the other, fuel distributors having to purchase a set volume to meet their Renovabio mandates.

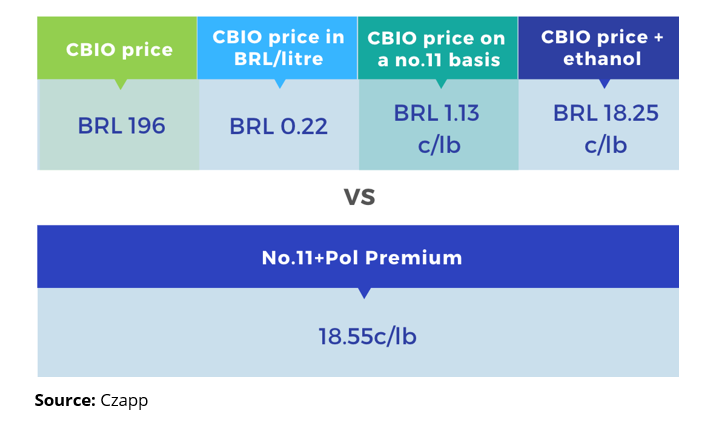

With CBIO prices having tripled since January, suddenly the extra revenue can represent 100pts extra for ethanol parity.

How is CBIO prices added to the sugar or ethanol parity?

Since virtually all mills in Brazil are now certified within the Renovabio program, and any chance of extra revenue is not something to be sneezed at, they are including the CBIO price when comparing returns from ethanol and sugar.

Up until end of May, CBIO was pushing up the ethanol parity by 60 points. That has now risen to over 100 points.

So, when comparing sugar and ethanol prices in Brazil don’t forget to factor in CBIOs!

Other Opinions you might be interested in