Insight Focus

- The world needs more sugar to be produced.

- Sugar prices are close to decade highs.

- How quickly can sugar producers increase output?

High Sugar Prices Take Time To Reach Farmers

It was mainstream news towards the end of April that sugar prices reached decade highs as supply of sugar will struggle to meet demand over at least the next 12 months. Even though prices have cooled off slightly since then, prices are still higher than they have been for most of the last 50 years.

Source: Refinitiv Eikon

This should encourage producers to increase their sugar output which can be done in 3 ways:

- Get farmers to plant more cane or beet

- Reduce how much sucrose is diverted to ethanol

- Increase yields

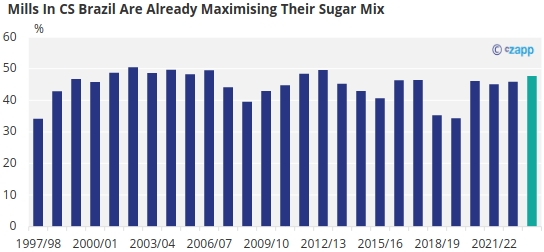

Option 2 is not available this year as mills in CS Brazil are already maximising their sugar mix for this season; In India the government sets ethanol prices derived from sugarcane to a level that it is more competitive than making sugar to help achieve the E20 blending mandate.

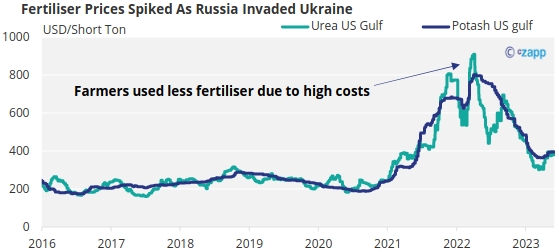

The fastest way that farmers can react to higher prices would be to try to increase yields by trying to increase yields. Better returns from the crop may encourage the use of more fertiliser, especially as farmers dramatically reduced fertiliser usage over the last year due to high prices. This year, it’s likely that farmers apply more fertiliser, due to lower prices and better returns from sugar, which all things being equal will increase yields. However, it’s difficult to determine how much of an affect this will have on sugar production.

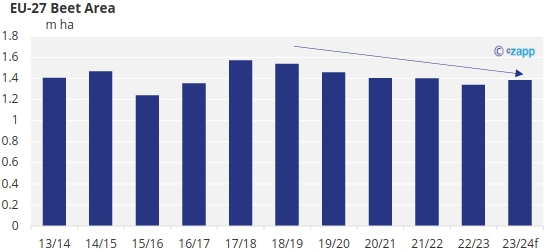

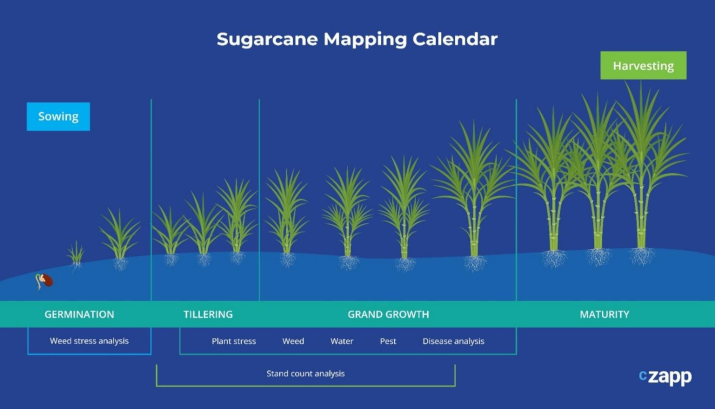

Planting more cane or beet is a more obvious way to increase production but is not a quick process. With a 6 month growth cycle, beet producers are able to respond faster than cane producers who need to let the cane mature for 12-18 months.

So far, there’s little evidence of beet producers responding to higher prices. Beet prices in Europe are usually set by yearly negotiations between farmer and producer which means that farmer returns are slow to react to world market sugar prices. Beet prices this year are 50% more than previously yet there’s little of evidence sugar beet areas expanding.

The risks associated with growing beet have increased dramatically in recent years with the banning of neonicotinoids (a pesticide used to protect beet against yellow virus) and more frequent hot dry summers that harm beet growth. We think high beet prices need to be sustained for growers to commit further to the crop; it won’t be until 2024/25 that there’s a chance to see an increase in European beet acreage.

The next crops (2023/24) from key cane producing countries such as India, Thailand and the US are already planted. Given cane’s long maturing period, planting for CS Brazil’s next crop (2024/25) is already underway with planting decisions already made. This means it could be almost 18 months until there is a significant increase in sugar production because of an increase in area.

It Usually Takes 12 Months For Sugarcane To Grow

Even if farmers can plant and grow more cane or beet, there needs to be sufficient crystallisation capacity produce the sugar.

Producing Sugar From Cane

As we have been suggesting for quite some time now, there has not been much investment in this capacity for several years meaning that global sugar production has stagnated at 175m tonnes per year, plus or minus 15m tonnes.

In Brazil, some investment has begun to renovate cane fields and increase crystallisation capacity ahead of the 2024/25 season. However there are difficulties in sourcing the equipment needed as many of the companies that provided the materials for sugar mill construction and expansion have closed down due to the financial difficulties and debt in the Brazilian cane sector.

Elsewhere, today’s prices are not enough to maintain sugar production so there is little hope for new investment in the sector. For example, In Thailand, cane is losing acreage to better paying crops like Cassava.