Opinion Focus

Across Latin America, sugar production issues persist. Mexico continues to have the worst harvest in the last 10 years and Guatemalan production dropped by 5% due to the climate and yields. Colombian sugar production has also dropped but exports are expected to remain stable.

What’s Happening in Mexico?

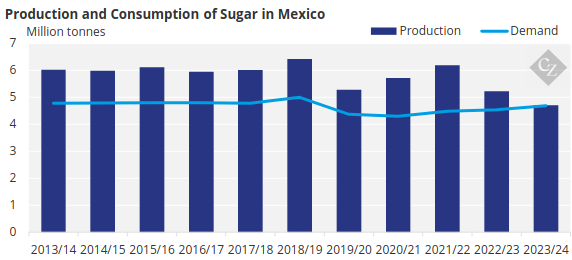

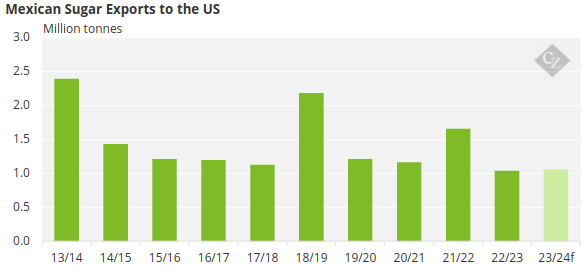

Mexico is set to have the worst harvest in the last 10 years due to adverse weather and poor yields.

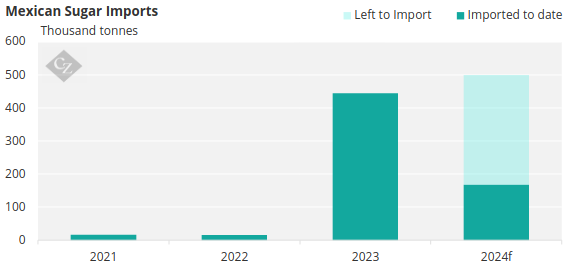

Mexico is going to try to export as much sugar to the US as possible. As a result, it will also have to import sugar, which will come mostly from Brazil and Central America.

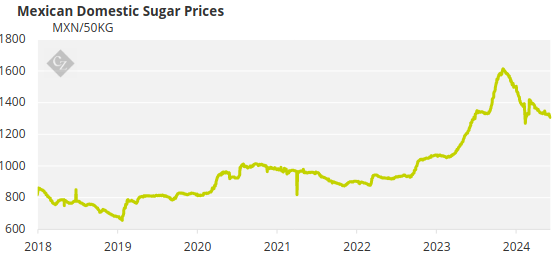

As a result, domestic prices remain very high, and this is something that is going to continue.

With lower domestic production and availability of sugar from Mexico, the US has to look elsewhere in the world for sugar.

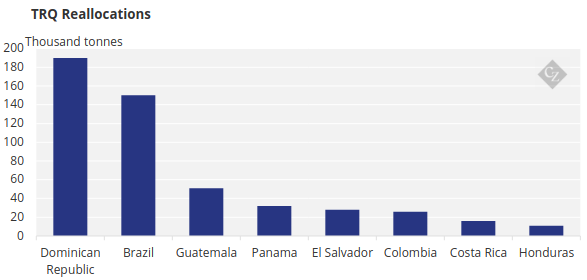

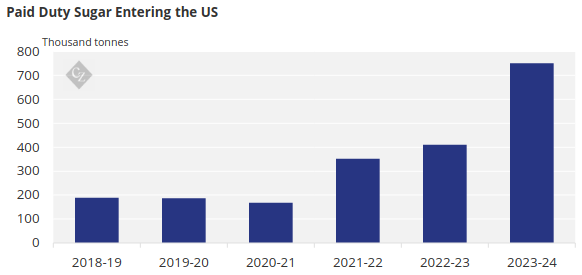

As a result, we have seen several reallocations in the duty-free raw sugar TRQ program and increases in imports entering paying full duty.

Production Forecast for Central America

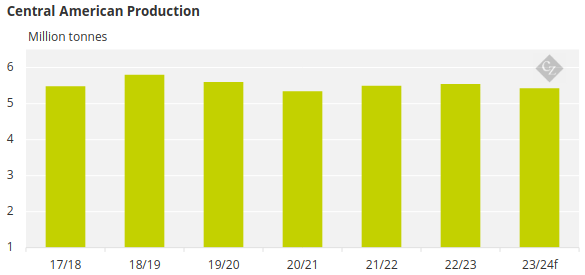

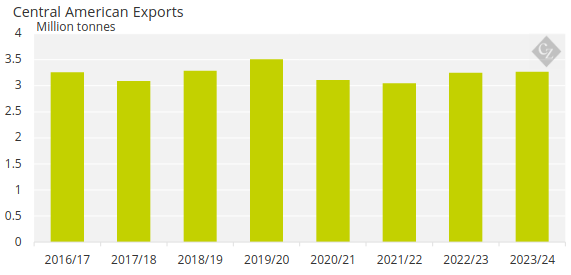

Sugar production across Central America remains steady.

Exports from Central America also remain in the usual range.

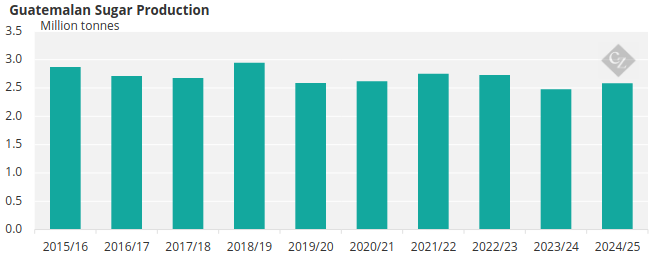

However, Guatemalan production dropped by 5% due to unexpected rains that interrupted the harvest and lowered yields. We expect production to recover for the next harvest.

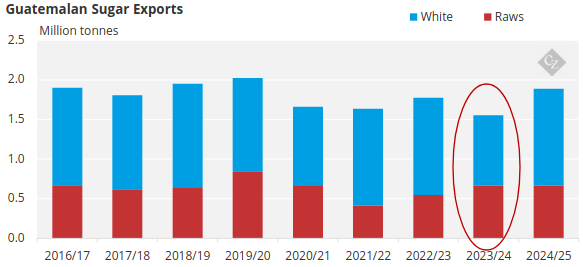

As a result, we expect exports to drop this season.

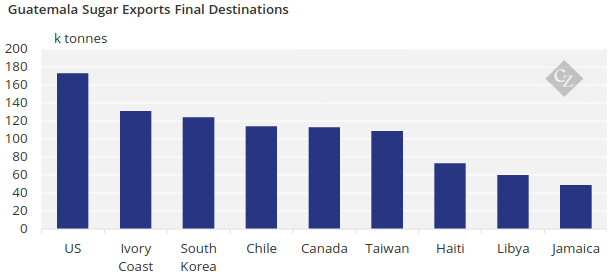

Most of this sugar is going to go to Mexico and the US. Although Mexico does not appear on the list of exports by country, some of Guatemala’s exports are headed there.

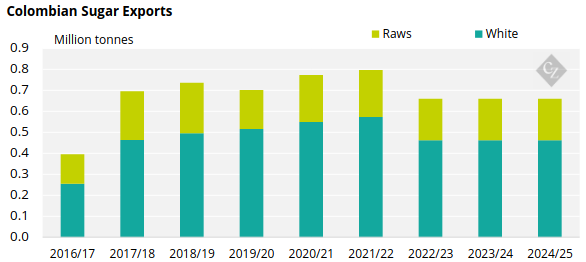

Production Forecast for Colombia

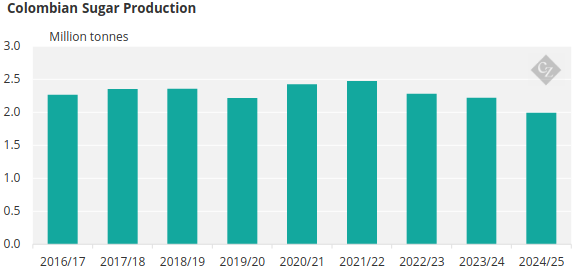

In Colombia, production has been stable over the last 10 years. However, for the last two years Colombia has faced increased precipitation levels, which have negatively impacted production. High precipitation levels have decreased yields and affected harvesting.

Excessive rainfall has led mills to stop operations early or for longer periods of time, which lowers sugar production. We expect rainfall volumes to normalize during the summer and this will help production recover and return to normal for the following harvests.

Even with a decrease in production we expect exports to remain the same. Colombia produces more sugar than what it consumes and has enough sugar to continue exporting regularly.