Opinions Focus

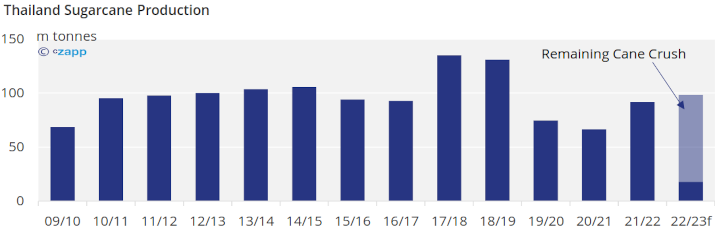

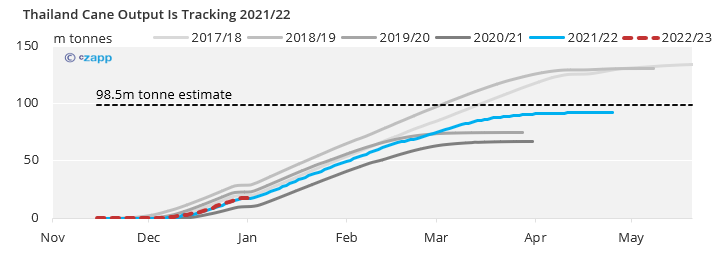

- Thailand should crush 98.5m tonnes of cane this season.

- Crushing is going to plan but there are a few warning signs.

- Any hint of lower sugar output might lead mills to buyback futures hedges.

So Far So Good

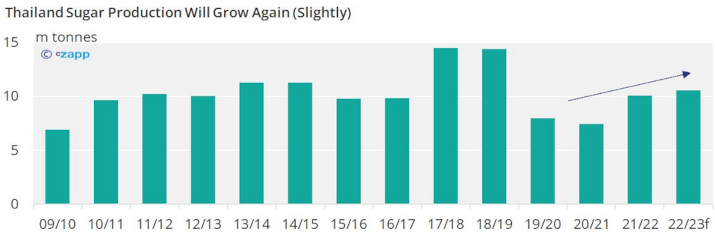

For the 3rd season in a row, we think Thailand sugar production will edge higher and should reach 10.5m tonnes. However, it’s possible there could be some downside to this estimate: mills in some areas are reporting that cane yields are worse than they expected.

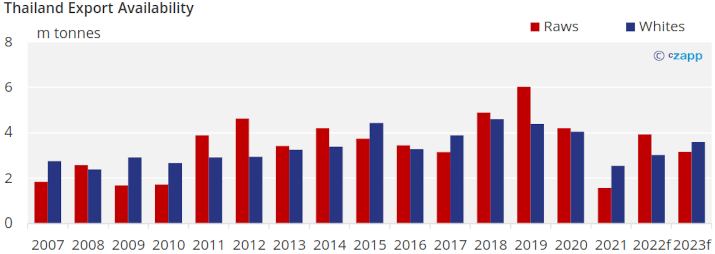

This is something to watch: the sugar market is poorly supplied in 2023 and cannot afford to lose availability from Thailand. Thai mills have already hedged 85% of their crop, based on a cane estimate above 100m tonnes. This leaves little room for shortfalls. If mills are forced to buy back futures hedges, this could be a trigger for sugar prices to break higher.

As the cane crush starts its second month there is no reason to be alarmed yet. Mills have now crushed 17.9m tonnes of cane, 18% of our 98.5m tonne estimate, to make 1.8m tonnes of sugar.

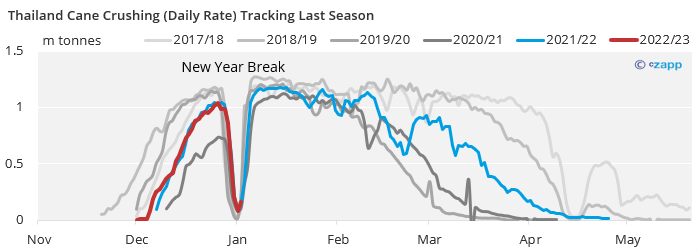

The rate of crushing has been almost identical to last season (2021/22), where 91.7m tonnes of cane was crushed.

Crushing reached just over 1m tonnes a day before mills paused for New Year. The pace of crushing will need to improve a little compared to last year once mills resume operations after their New Year Break.

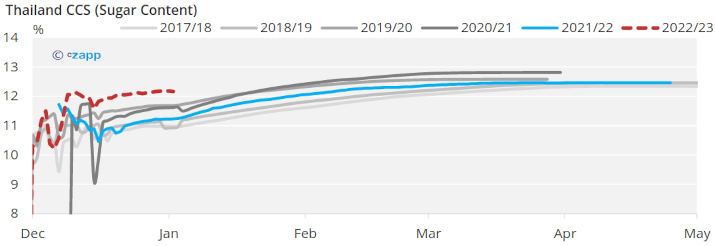

The average sugar content (CCS) of the cane has been better than usual for this time of the crush – It’s the best in the last 5 seasons for this stage of the crush. This is due to a slower start in the central areas of Thailand, where the clay soil can hold much more water, diluting sugar content. With 56 mills in operation and only 1 left to start operations, it’s likely the gap in sugar content will close.

If you have any questions, please get in touch with us at Jack@czapp.com.