Regístrate ahora!

Insight Focus

- Drought continues in Mexican cane states.

- Mexico will produce under 6m tonnes of sugar for the second year in a row.

- There will be less sugar available to export to the US.

Mexico Continues to Face Drought

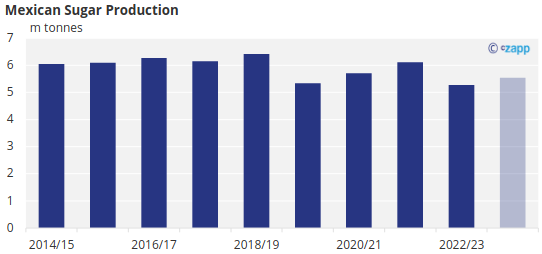

We think Mexico will produce 5.5m tonnes of sugar in 2023/24. Our forecast is also a best-case scenario; we don’t think there’s upside potential. This will be the second year in a row that Mexico produces under 6m tonnes. Mexico usually produces around 6m tonnes of sugar each year.

In 2022/23, Mexico produced 5.2m tonnes of sugar due to lack of rain. This was the worst crop in the last decade. Since Mexican cane isn’t fully irrigated, it’s rainfall dependent. This year we have continued to see a prolonged drought in the cane producing regions of San Luis Potosi, Veracruz and Jalisco.

If this drought continues, we could see Mexican sugar production falling below 5.5m tonnes.

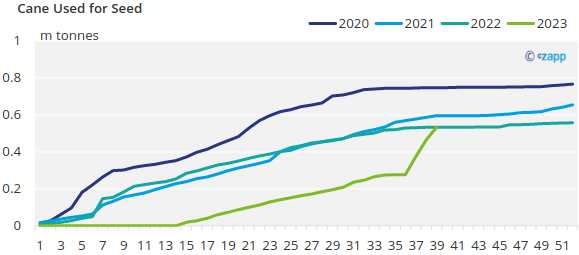

Sugar Production also Threatened by Poor Plantings

We are also hearing reports of limited renovation of cane fields, lower reseedings, less cane being set aside for seed and less fertilizer use. The amount of cane used for seed is similar to last year’s, which was below 2021 and 2022.

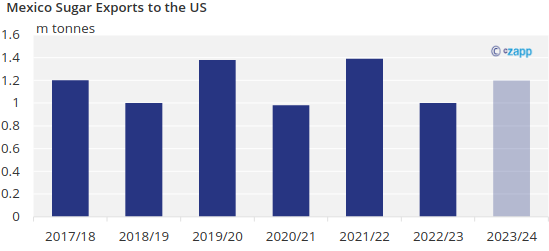

What does this mean for Sugar Exports to the US?

With production at 5.5m tonnes of sugar, this still means that there will be less sugar available to export to the US than in a normal year. This past season, we saw around 1 million sugar flow to the US from Mexico. In the coming season, with only a slight increase in production, we are expecting to see no more than 1.2 million tonnes of sugar exported to the US.

In 2022/23 the USDA announced two TRQ re-allocations to ensure sugar supply. Even though we think exports to the US will increase in 2023/24, there is still potential that Mexico’s cane underperforms. If this is the case, we could see the US continue to get sugar from other origins to ensure supply.

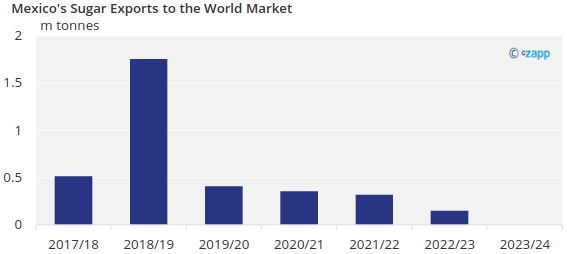

What does this mean for World Market Exports from Mexico?

Currently, we are forecasting Mexico will not export any sugar to the world market. Given the decrease in production over the last two crops Mexico will focus on exporting as much sugar as they can to the US leaving little to no volumes to export to the world market.