Insight Focus

- The world will need Indian sugar later in the year.

- In this week’s Ask the Analyst, we show how we calculate whether exports will be possible.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

The World Will Need Indian Sugar

We expect the raw sugar market to tighten towards the end of the year when Centre-South Brazil enters its off-crop. The 2022/23 Indian crop will start shortly afterwards and the world will need this new crop Indian sugar to avoid a large deficit forming.

Since it is very unlikely that the Indian government would restore any export subsidy, world market prices will need to encourage mills to export sugar, rather than sell domestically.

Keeping an eye on the export parity in the coming weeks and months will help inform future price movements. Let us break it down for you.

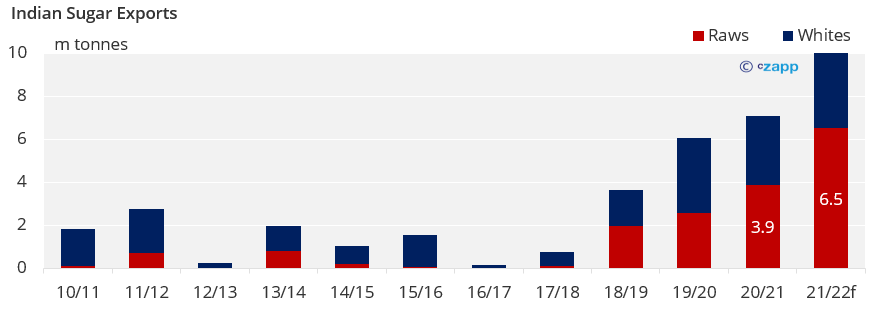

Recent Background on Indian Exports

The Indian government capped sugar exports for 2021/22 at 10m tonnes from June. This was to ensure the necessary stocks to manage through the festive season later in the year.

Whilst the Indian Sugar Mill Association (ISMA) is currently lobbying for an additional 1m tonnes of raw sugar exports for 2021/22, we don’t think this is likely to be granted. Though the government has extended a grace period for 800k of sugar exports to the 20th of July.

The export ban is likely to be only a temporary measure and we expect exports to be permitted for the 2022/23 crop.

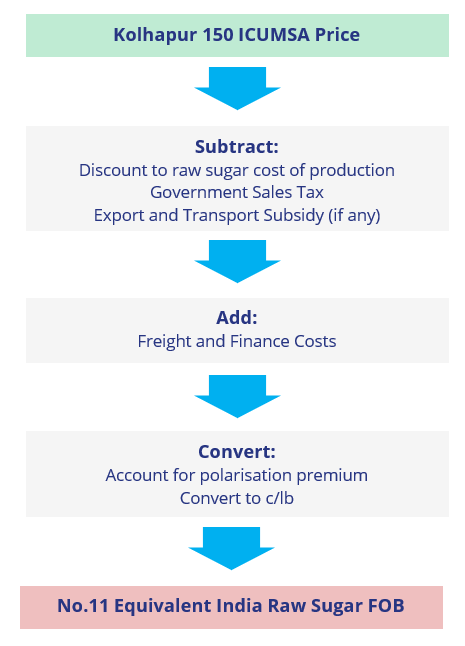

How We Calculate the Export Parity

Kolhapur 150 ICUMSA sugar prices are the most representative starting point since Maharashtra is a major coastal sugar exporting region.

150 ICUMSA sugar is higher quality and more expensive to produce than the sugar produced by the mills so first we discount this price to equate to the cost of production of raw sugar.

From this we subtract the Government Sales Tax along with any export or transport subsidies, converting these prices to ex-mill sugar for export.

Adding average freight and finance costs gives us the FOB cost of Indian sugar.

Converting this to c/lb and accounting for the polarisation premium (since this sugar is higher quality than specified for the No.11) gives us the Indian raw sugar price in No.11 terms.

With the domestic price currently at 33,500 INR/mt, this equates to an export parity in No.11 terms of 18.4c/lb.

Our latest Indian raw sugar export margin is published weekly on Thursday, here is the latest.

Domestic Price Floor

Regional governments also enforce a minimum domestic price to ensure sellers can earn a fair income. In No.11 terms this informs us to the real level the No.11 could fall to before exports from India are guaranteed to not be possible.

The price floor for is set at 31,000 INR/mt ex-mill, which at present puts the export parity floor at 17.1c/lb.

Other Insights That May Be of Interest…