Raw sugar consumers haven’t bought enough for 2022 yet.

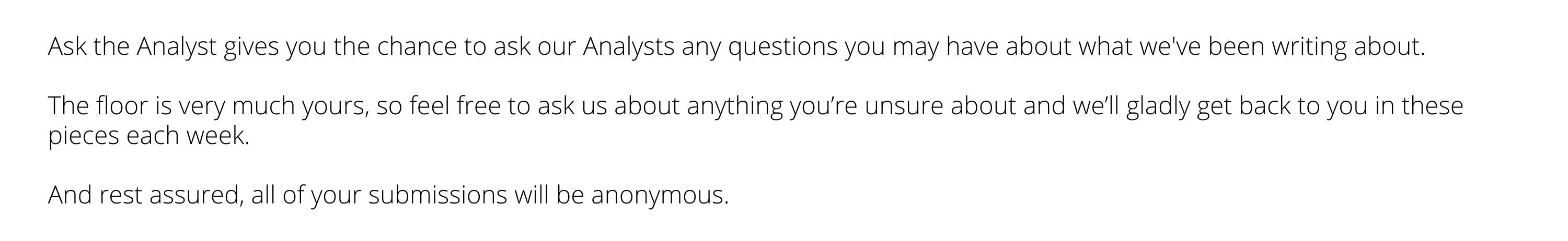

Poor physical refined demand, backwardated spreads and a high flat price has discouraged long term pricing.

However, market conditions are beginning to improve for consumer buying; the No.11 spreads are becoming increasingly neutral and flat price has been trading down gently. This means sugar is both cheaper against domestic prices and the incentive to buy later is diminished, which is good news for raw sugar demand.

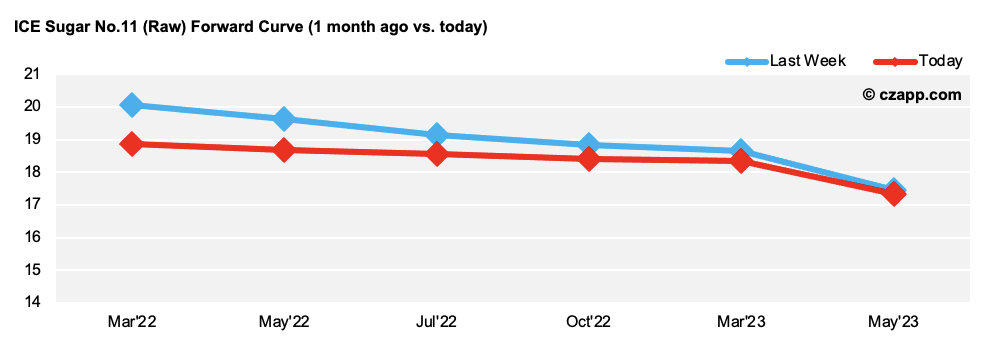

Also, the white premium is showing strength, which is good news for re-export refiners. We estimate that the No.11 + 120 USD/mt is required for refiners to operate profitably. Prices are still a way off that, but we think cash premiums will help make sales. If this is the case, it’s positive for raws demand.

Other Opinions You Might Be Interested In…

- Raw Sugar Hedging Update: October 2021

- October Trade Flows: Excess Raw Sugar

- Market View: Beware of Speculator Exit