Insight Focus

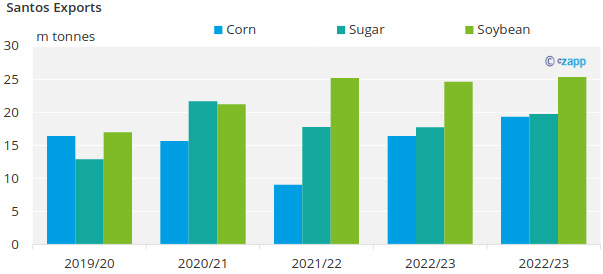

- Brazil is expected to export 93mi tonnes of soybeans and 45mi tonnes of corn this season – record volumes.

- Over 35% of this will ship from the port of Santos.

- This will limit how much sugar can be exported in the coming months.

Given the expected record crops for grains and sugar in Brazil, we have been warning about logistical constraints. This is because the port terminals that elevate sugar also load grains. We have received several questions asking if the terminals can switch product quickly and if we could expect another terminal to load sugar this season.

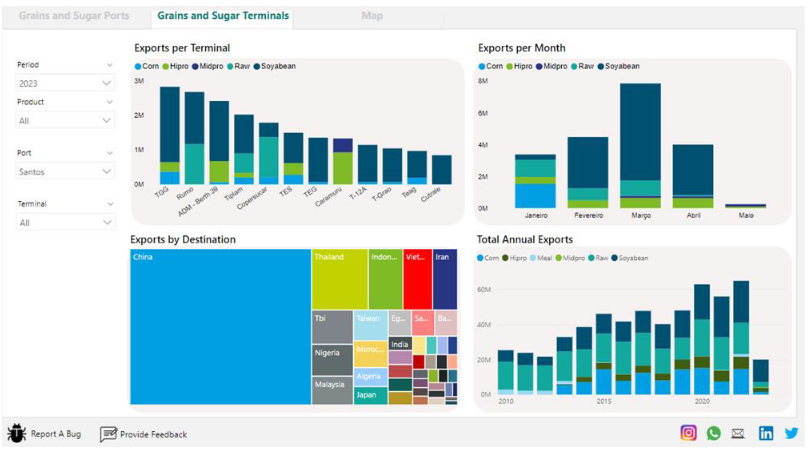

Most terminals solely elevate grains and not sugar. Some sugar terminals (Rumo-CLI, Tiplam and Copersucar) also elevate grains but won’t have flexibility to change products at short notice this season.

You can follow the movements from terminals and product on our Port Logistics Interactive Section.

This is because elevation capacity is contracted ahead of time and allocating more volume to grains in detriment to sugar (or vice versa) could be a breach of contract. Only uncontracted capacity (spot elevation) could be switched. Although we don’t know the percentage, given grains and sugar record crops we assume there is very little spot elevation available.

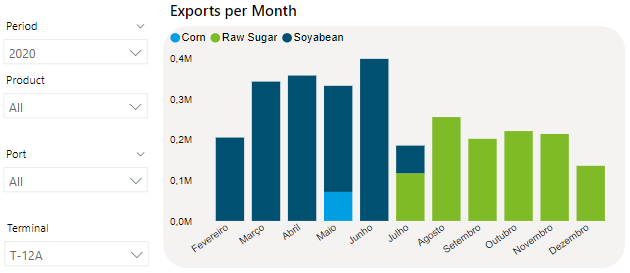

One terminal is under scrutiny, a sort of will it won’t it, is terminal T-12A. This terminal elevates grains and sugar, though not both at the same time for operational reasons.

Although that was a season of large export volumes (and the year that CS Brazil produced a record amount of sugar at 38.5m tonnes), a shift between terminals was agreed to free up for sugar in T-12A. We don’t believe it to be possible this season given that grains exports are expected to be at least 24% higher than in 2020/21.