Brazil may export a significant amount of Corn to China this year.

- What does it mean for corn prices?

- If you would like us to answer one of your questions in an upcoming edition , please email will@czapp.com.

First Significant Brazilian Corn Export to China

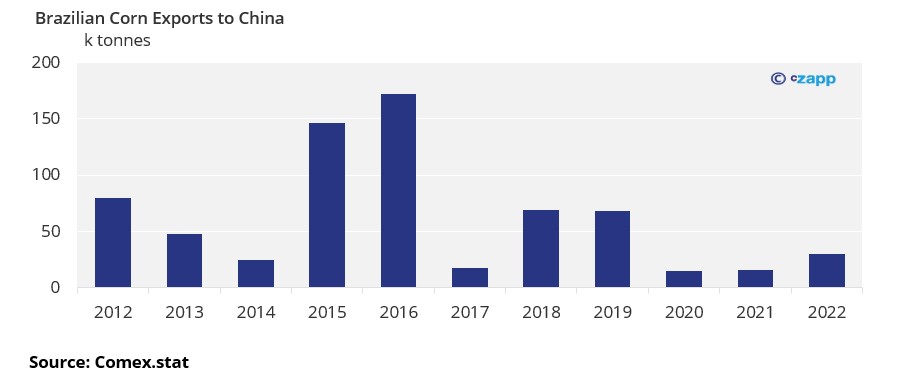

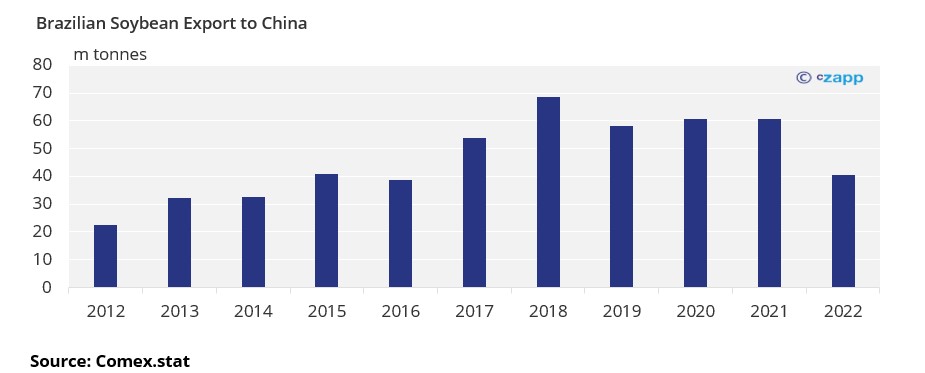

Although China is one of the largest importers of soy, meat and sugar from Brazil, the situation is different for corn.

Corn exports to China are practically inexistent due to phytosanitary reasons. Which means that corn exported to China must be free of live insects and 18 quarantine pests.

The two countries had already signed a protocol of phytosanitary requirements for corn exports from Brazil to China in 2014 that, in theory, would open Brazilian corns to China. But little trade happened due to complex inspection requirements, quarantines, certificates and permits.

The largest corn exports to China in the last ten years was in 2016 when China imported 172.5k tonnes of corn to China. For comparison, last year China imported 60m tonnes (350 times more) soybean from Brazil.

However, this might change soon…

The cereal trade agreement between these two countries is evolving so we might see the first significant corn export from Brazil to China still this year.

The Ministry of Agricultureof mentioned that the export of Brazilian corn to China could start in the next two to three months.

The ongoing conversations could loosen the current restrictions and simplify the overall process.

The deal between the two countries, which seeks to further strengthen trade ties, comes as China seeks to replace the corn it would normally buy from Ukraine, the second largest corn supplier to China after the US.

What does it mean for domestic corn prices? What about Corn ethanol?

The historic corn crop failure in Brazil in 2020/21, due to drought and frost, combined with the macro fundamental of this year helped corn prices reach more than 100 BRl/bag.

Now prices have decreased and are being traded around 80 BRL/bag. (Cepea esaql)

However, additional corn exports to China may trigger domestic corn prices to move higher once again?

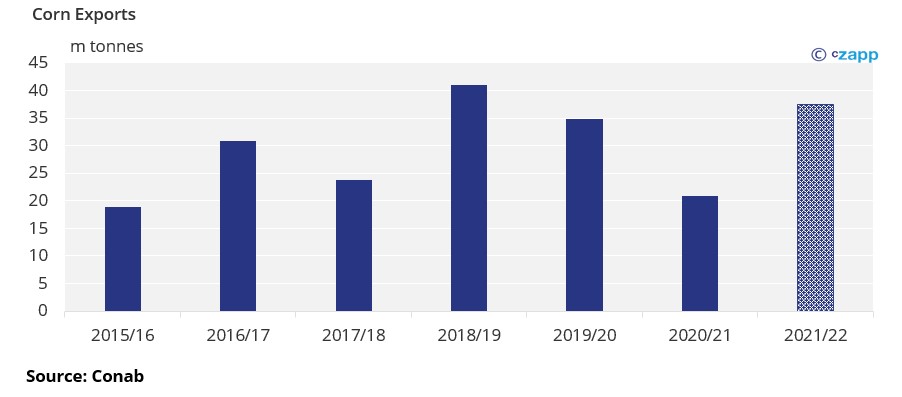

According to Conab, Brazil is expected to export 37.50m tonnes of corn this year. If the agreement with China materializes, this number could increase even more.

The market assumes that China could buy from Brazil between 2 and 4 million tons of corn this year. As a result, corn ending stocks will drop from 10.46m tonnes to 6.46m tonnes. Volume that does not generate concerns about the availability of the commodity in the country.

So, even if Brazilian corn exports to China increase, the market believes that in the short term, this could be offset by the record corn crop expected this for this year in Brazil.

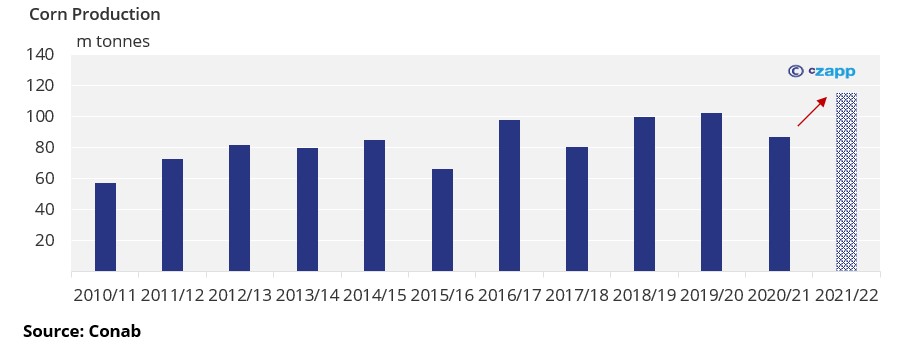

It is estimated by Conab that 115.66m tonnes of corn will be produced this crop (2021/22) – a growth of 32% compared to the previous crop.

As for corn ethanol, even if corn prices rise a little, the high this year will be probably short lived. Also corn ethanol mills don’t believe the higher corn prices could be a problem this year since most of the corn had already been bought in advance.

For more information about Grains exports access our Grains Panel in the interactive data session on Czapp

Other InsightsThat May Be of Interest…

- Brazil’s Corn Farmer Selling Picks Up, But Record Production Still Weighs on Prices

- Will Tankage Availability Become an Issue for Brazilian Ethanol?

Interactive Data Dashboards you might be interested in…