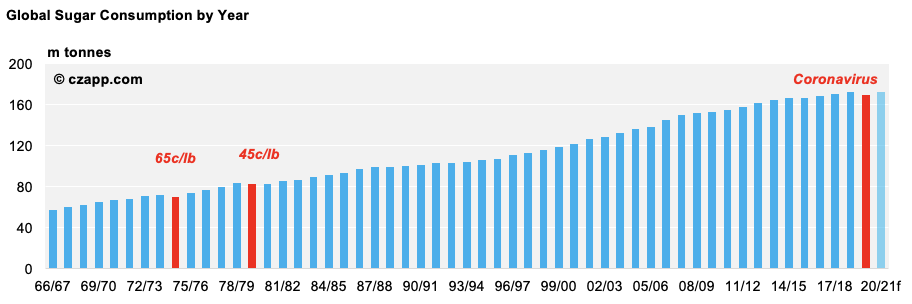

In the early stages of the pandemic, sugar consumption fell in many countries as governments enforced lockdowns to stop the spread of the virus. This killed out-of-home sugar consumption in places like bars, restaurants, cinemas and sports events.

In particular, soft drink consumption was hit hard. It’s socially acceptable to drink a litre of soda while watching a film at a cinema, but strange to do so at home. This sugar consumption decline was most obvious in countries with severe lockdowns (e.g., Europe, China) and in countries where soda is sweetened with sugar (we didn’t see a significant decline in the USA, where HFCS is the dominant sweetener for soft drinks).

After the initial lockdowns ended, sugar consumption seemed to rebound in many countries. Consumer patterns have adapted to the ‘new normal’. We are perhaps also finding people treating themselves to small luxuries more during the pandemic. Sugar is cheap and tastes good, which is an ideal combination. We think 2021 sugar consumption shouldn’t be as weak as it was in 2020. However, it’s not yet clear if sugar consumption in 2021 will be as strong as it was in 2019; we are keeping an open mind.

To convert from c/lb to USD/mt, multiply by 22.0462.

It’s possible, but not likely.

Retail investors can buy the sugar market by using one of several ETFs, of which the largest is Teucrium’s CANE fund. At present, this ETF is relatively small, with around $14m assets. However, this could grow if sugar attracts investors’ attention, and the ETF is optionable too. One feature of the GameStop short squeeze was retail investor call option buying through brokerages such as Robin Hood. The scale of the buying meant option market makers had to buy increasing volumes of underlying shares as a hedge (the famed “gamma squeeze”).

Source: Refinitiv Eikon

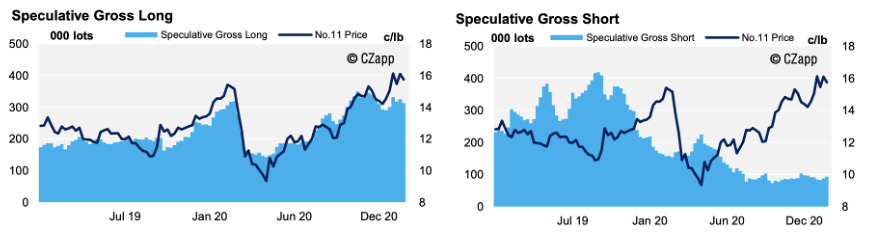

The reason a retail squeeze is unlikely to succeed is that there isn’t a weak short to squeeze in the sugar market. Speculators are already long the sugar market, not short. Trade houses also seem to be bullish sugar. The short side is dominated by producer hedges, which are usually held and managed by trade houses. If the trade houses are bullish, I assume they have found ways to manage the risk of being squeezed on their producer shorts.

Commodity markets are also more liquid than smaller stocks like GameStop and so are better placed to absorb the buying. On any given day, around 100k lots of raw sugar trade with a nominal value of $1.8b. At the start of the GameStop squeeze, 10m shares traded daily with at $20 for a nominal value of $200m.

Source: Refinitiv Eikon

Silver’s short squeeze appears to have failed this week, in contrast with the fireworks seen in GameStop and other Reddit names.

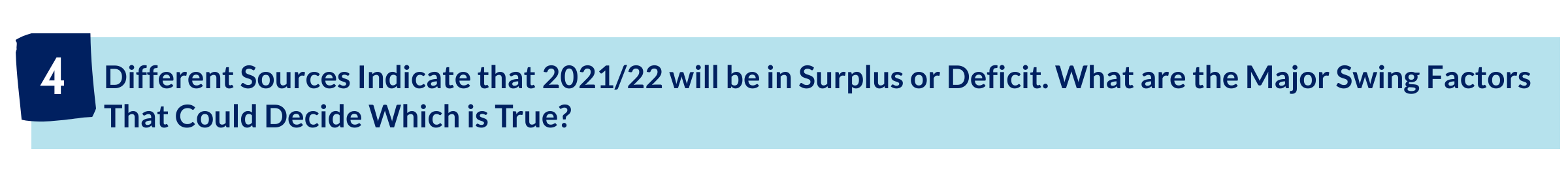

On 2021/22, at the moment we think the world will produce around 5m tonnes surplus sugar.

It’s likely Brazil continues to maximise sugar production and Indian cane acreage remains high, so the swing higher should be led by Thailand and the EU, which both had poor crops this year.

In the EU, beet yields were hurt by outbreaks of Beet Yellows Virus. This is spread by aphids and the mild winter of 2019/20 meant aphid numbers in 2020 were high. In addition, farmers were not allowed to use neonicotinoid pesticides to control aphid populations. However, things should improve next year. Many countries are now allowing emergency use of neonic pesticides and, so far, this year’s winter has been colder, which should reduce aphid numbers. Premium Czapp users can read more on this here.

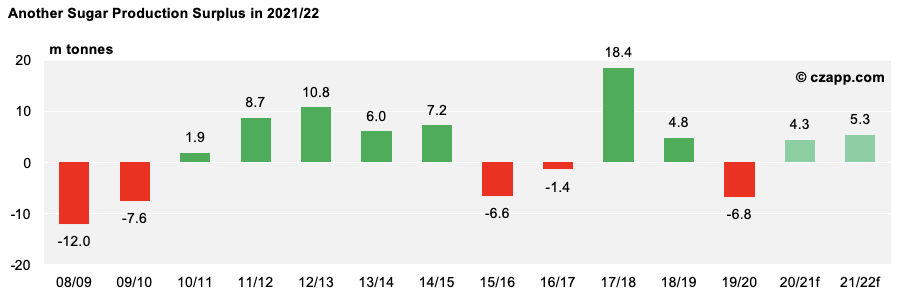

In Thailand, the shortfall of sugar cane this year has been so severe that mills are paying record cane prices to farmers. This should incentivize farmers to plant more cane for next year. You can read more here.

Fortunately, the question wasn’t “why did the Sao Paulo government increase ICMS tax on ethanol and not gasoline?” We don’t know the answer to that one.

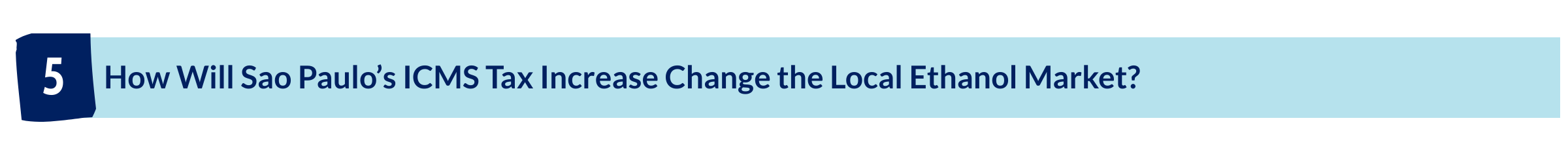

The ICMS tax increase on ethanol means it becomes more expensive at the pumps relative to gasohol. Many Brazilian drivers choose the cheapest fuel (not all, some will always choose ethanol because it’s a renewable fuel; some prefer gasohol because it results in fewer trips to the filling station). Ethanol is less energy-intense than gasohol and so prices need to be <70% gasohol prices for price-sensitive drivers to use ethanol.

Therefore, in the longer term, the ICMS tax increase could reduce demand for ethanol and increase demand for gasohol instead.

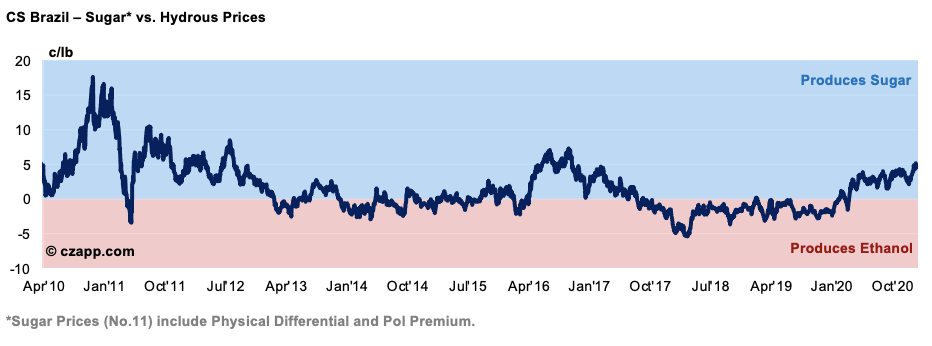

Looking at this problem from the supply side is more difficult. It depends on the tax regime chosen by each mill (why does the Brazilian tax structure have to be so complicated…?). Increased taxation on ethanol makes it less likely that mills will want to produce it, but sugar today pays a lot more than ethanol does anyway, so the tax increase probably doesn’t change anyone’s production decisions.

If you’re interested in learning more, we’ve written three different articles on this tax increase recently:

- Brazil: Starting the Year with News of Ethanol Tax Increase

- Protests After Sao Paulo Government Ups Ethanol Tax

- Brazil Ethanol: Oil Rallies, But Sugar Still Pays Mills More

Opinions You Might Like, Based on These Questions…

- French Sugar Production Falls to 10-Year Low

- Thai Mills Pay Farmers Record Cane Prices

- Brazil: Starting the Year with News of Ethanol Tax Increase

- Protests After Sao Paulo Government Ups Ethanol Tax

- Brazil Ethanol: Oil Rallies, But Sugar Still Pays Mills More