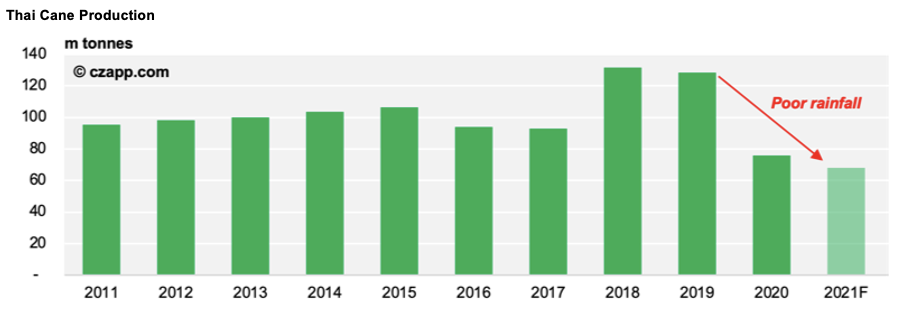

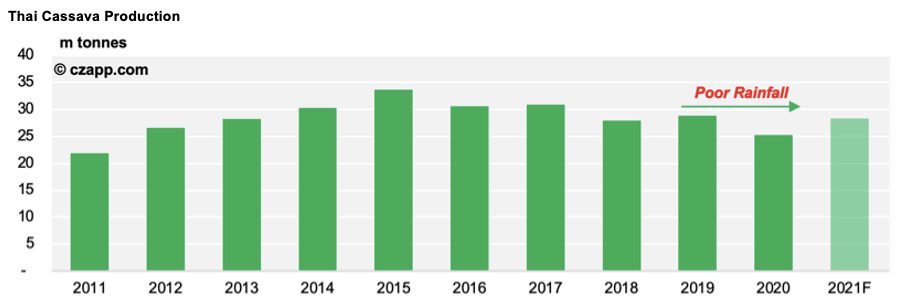

The Thai crop will be heavily scrutinised this year.

Over the last two seasons, we’ve seen a significant decline in cane production across the country.

The major factors contributing to this have been poor rainfall and increased competition from the more profitable cassava.

However, we think the Thai cane crop will rebound in 2021/22, but for this to occur, we must see high plantings and consistent rainfall, both of which we’ll be monitoring closely.

Cassava’s returns have been falling across the last few months, whilst those for sugar have been increasing. At today’s prices, farmers are strongly incentivised to plant more cane, and we believe many will. However, Thailand’s cane farmers are usually responsible for very small farms, meaning it’s hard to 100% rely on their operations running smoothly…

On the weather front, the Thai Meteorological Department thinks rainfall between February and April to be 20% above average. This bodes well for cane development and yields in the 2021/22 season. The only exception to this is in the Northeast, where rainfall should only be 10% above average; the Northeast is Thailand’s main cane-producing region.

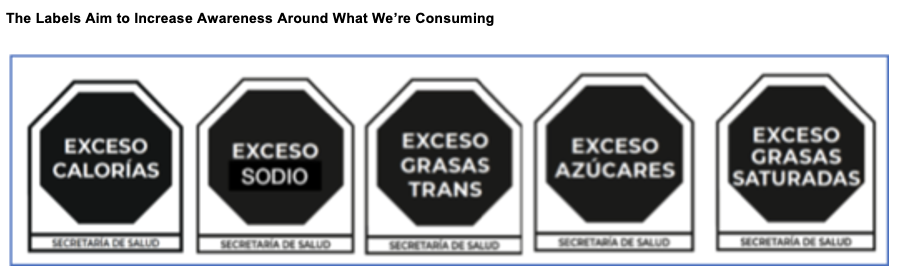

In 2016, the Mexican Government introduced a 10% tax on soft drinks containing sugar. This was followed by new labelling laws in 2020, which are applied to processed foods containing sugar.

So far, it’s been hard to measure the impact these measures have had on Mexican sugar consumption, but it looks as though there’s mixed results.

When the tax was first introduced, we noticed a dip in consumption as prices for these products increased. We’ve also saw some product reformulation, as soft drink producers started using HFCS in their recipes, rather than sugar.

In the longer term, soft drink consumption seems to have recovered. This may be because consumers have grown accustomed to the new prices and decided the product is not too expensive to dissuade purchase.

The labelling laws are perhaps too recent to properly assess, but sugar consumption did decrease in 2020. How much of this was due to consumers’ reacting to the label, we do not know. Mexico’s domestic sugar price was at a record high, though…

It’s poor 2019/20 cane crop meant sugar prices shot up, which is the likely reason we saw reduced consumer demand back then.

The change in Petrobras’ CEO should only impact Brazil’s sugar and ethanol industry if its fuel price policy changes.

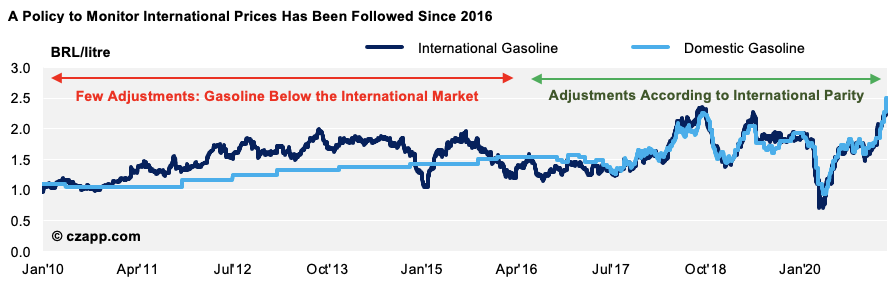

Since 2016, Petrobras has used international gasoline prices as a benchmark for Brazil’s own gasoline price; this is known as the International Parity Policy. When oil and gasoline prices rose in 2017, Brazil’s gasoline price was able to rise and, by doing so, gave room for hydrous ethanol prices to climb and remain competitive.

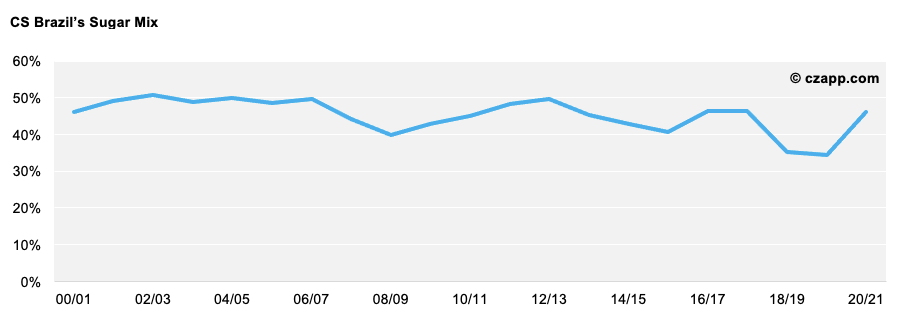

The result was two seasons of heightened ethanol production. Of course, low No.11 (raw sugar) prices contributed towards this too, but if the International Parity Policy was not in place, ethanol prices would not have been able to climb.

Whether this policy will change is unclear, but we can see the pressure is rising from all sides.

The worst-case scenario is gasoline prices could be capped by the Government. This would have little impact on the 2021/22 season, as the mills have already committed to maximised sugar production. However, ethanol returns could be hit and reduce the millers’ potential revenue.

In the long run, any strength in the energy market won’t likely be reflected in Brazil’s ethanol prices, and large swings in its production mix could become a thing of the past.

Opinions You Might Like, Based on These Questions…

- Hydrous: The Mills’ Sector and Interventionism in Petrobras

- Thai Mills Pay Farmers Record Cane Prices