- The ethanol import tariff has been suspended until December 2022.

- In this week’s Ask the Analyst, we discuss how this might impact Brazil’s sugar and ethanol industries.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

How Will the Removal of Brazil’s Ethanol Import Tariff Impact Prices?

On the 21st March, the Brazilian government announced that it would suspend the 18% ethanol import tariff until the end of the year. The government hopes that, by doing so, domestic ethanol prices will fall due to fresh supply coming in from the US, and consequentially, gasoline prices for consumers would fall as well. This is because Brazil has a 27% ethanol mandate in all gasoline sold.

With the rise of oil prices and a weak Real, domestic gasoline prices have been rising since October 2020 becoming the main driver of higher inflation. Thus, the government is seeking all means possible to reduce fuel prices, apart from actually being able to change the Petrobras price policy.

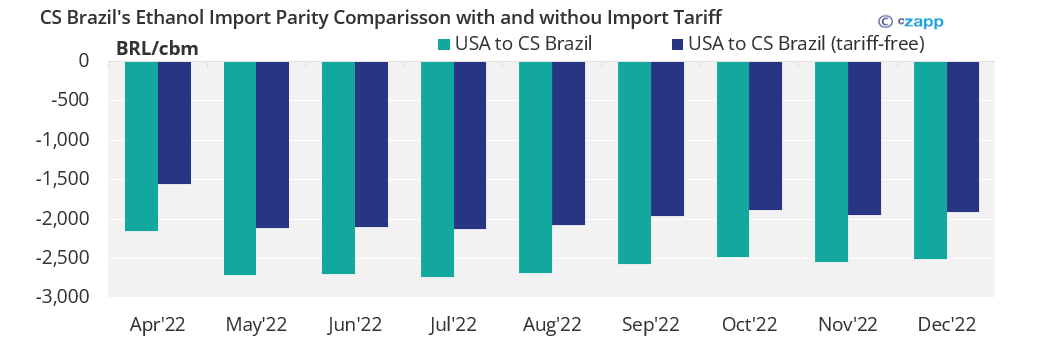

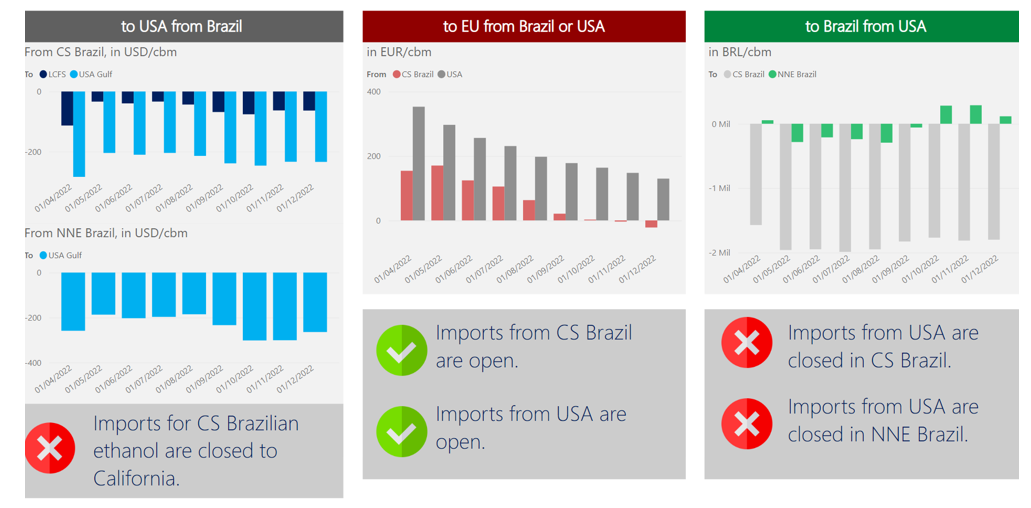

Even with the tariff exemption, the window for imports has not opened in Centre-South Brazil. Tax structure and port costs in the region makes ethanol imports expensive, arriving at a higher price than the domestic market. It would take a significant fall in US ethanol prices, a much stronger BRL or anhydrous prices to soar in order to transform these negative margins. Don’t hold your breath…

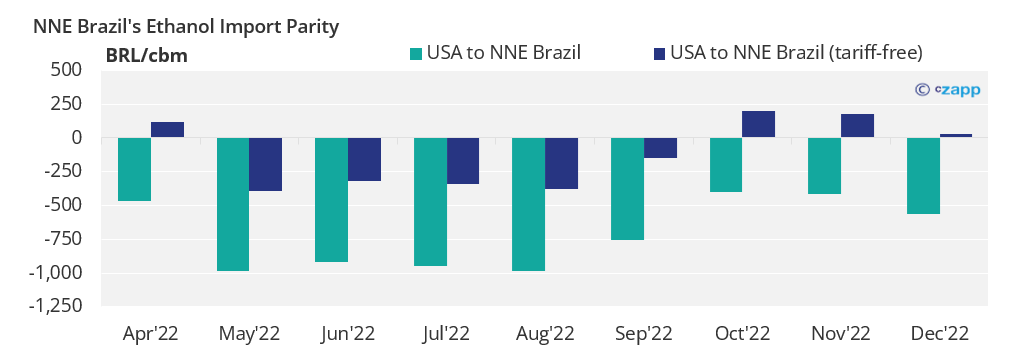

On the other hand, in North-Northeast Brazil, margins look a bit more attractive because, in some states in the region, there are import taxes exemptions (like import ICMS tax). However, margins are still narrow, meaning this announcement should have a minimal effect on imports.

If the BRL continues to strengthen against the USD, import parity could open up, creating more opportunities for North-Northeast Brazil to import ethanol. Fresh supply entering the market could drive ethanol prices down, closing the window of opportunity once again.

One interesting dynamic to briefly mention is between CS and NNE Brazil. If NNE Brazil starts to be supplied with imports, CS Brazilian ethanol transfers to the region will fall. Larger than expected ethanol stocks could pressure anhydrous ethanol prices in Centre South.

If you’d like to review import and export parity for Brazil, the US and the EU on a weekly basis, this Interactive Report is for you.

Other Insights That May Be of Interest…

Interactive Reports That May Be of Interest…

Explainers That May Be of Interest…