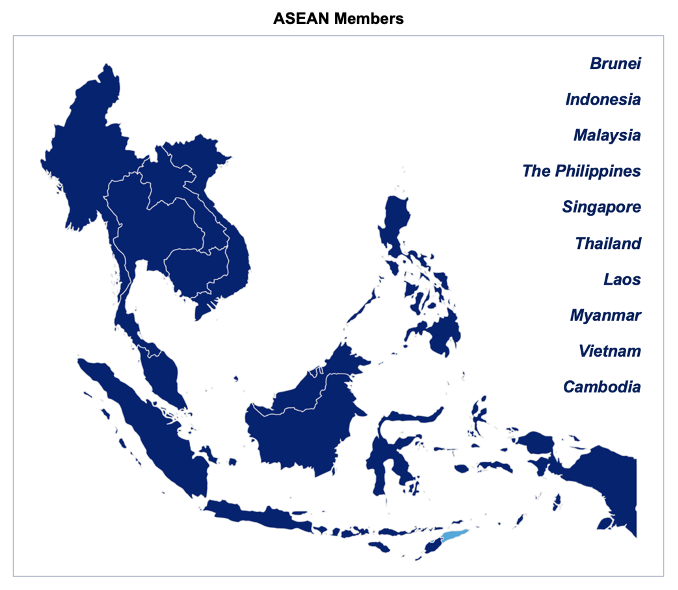

All of Asia’s raw sugar importers, apart from China and Taiwan, have some form of trade agreement in place for sugar, which means they’ll only turn to Brazil in rare circumstances.

One example is the ASEAN Free Trade Agreement (AFTA), whereby member countries enjoy just 5% duty on sugar imports.

However, there are some exceptions.

If the sugar is destined for a re-export product, it will not be subject to any duty, meaning the origin matters less.

Also, Malaysia’s sugar imports don’t incur duty, meaning it’ll assess all options. Often, its refineries actually favour Brazilian raws due to their higher quality.

The others either have trade agreements in place or quality restrictions, which mean they’re unable to import from Brazil (e.g. Japan).

Having said that, in Q1’21, 425k tonnes of Brazilian raws went to Indonesia, even though these imports incurred a higher duty than Thai ones.

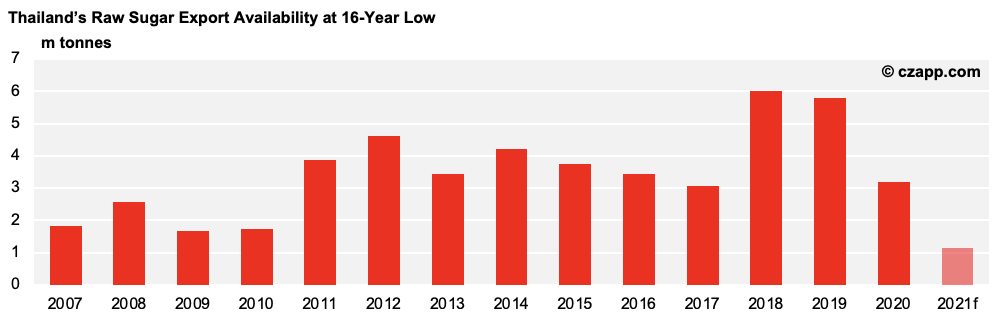

This happened because Thailand’s raw sugar availability is at a 16-year low, following decade-low cane and sugar production.

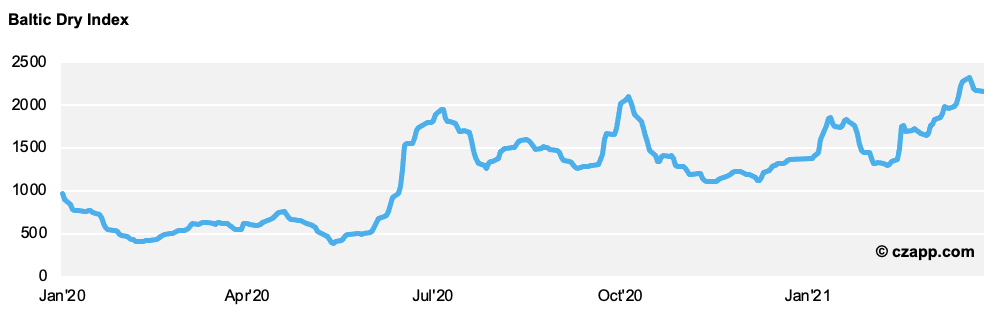

It ultimately costs a lot more to ship Brazilian sugar to East Asia. With the current strength in bulk freights, the difference in shipping costs is even more stark. Therefore, Brazilian sugar becomes less attractive, all other things being equal.

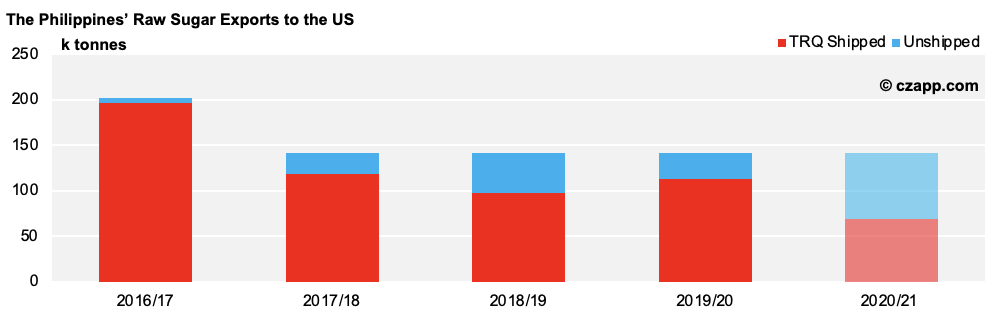

As for the US, the Philippines’ inability to ship its full US quota means the unfilled tonnage will be allocated to other suppliers.

This includes Brazil, but also those in Central America, Argentina, and others that have quota access.

Other Opinions You Might Be Interested In…

- The Philippines Won’t Ship Full US Sugar Quota

- Market Talk: The Philippines to Ship 70% of US Sugar Quota?

Explainers You Might Be Interested In…