Insight Focus

- The Ukraine conflict has been making the headlines for a while now.

- In this week’s Ask the Analyst, we discuss what this might mean for commodities.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

How Could the Ukraine Conflict Impact Commodities?

Energy markets have already strengthened since the start of December following Russia’s military build-up on the Ukrainian border; Brent crude oil is up 30% in this time.

Source: Refinitiv Eikon

Any further escalation in the crisis could risk further crude oil strength, which might be positive for the whole commodity sector.

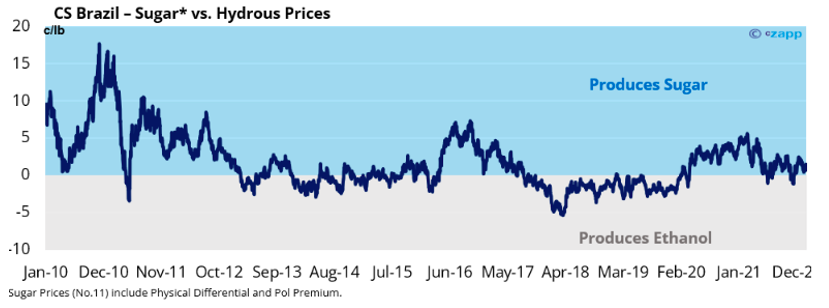

The sugar and energy markets are linked through ethanol production. Mills in Centre-South Brazil (the world’s largest cane-growing region) can choose whether to make sugar or ethanol based on relative returns.

The next cane harvest will begin in May, so spot values today aren’t important for mills’ decisions, but if the crude oil price strength is sustained into the middle of the year, we could see some sugar production being diverted to ethanol production.

Based on today’s values, mills would prefer to make sugar, not ethanol, but the sugar price has been falling while energy prices have been climbing…

Source: Refinitiv Eikon

Russia is also a major agricultural exporter, shipping everything from grains to fertilizer. Further escalation in the region risks higher grains prices (also positive for the wider commodity complex), and possibly higher fertilizer prices as well. Russia has already been restricting fertilizer exports in the past year, nominally to reduce the risk of inflation.

However, more costly fertilizer around the world either means a higher cost of sugar production or reduced yields if fertilizer application is reduced.

In short, the current situation in Ukraine is short term bullish for the sugar market, but de-escalation could quickly remove some of this bullish support.

Other Insights That May Be of Interest…

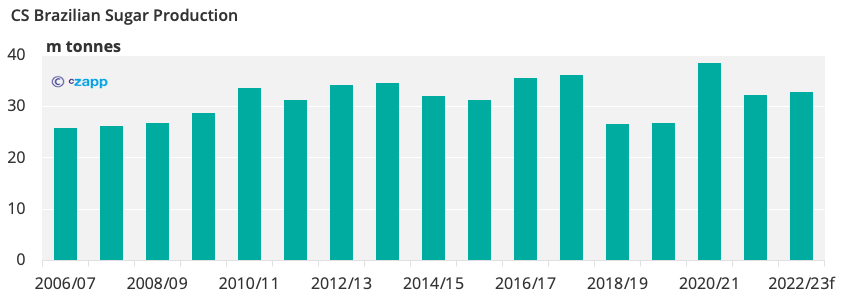

The World Needs More Sugar…Can Brazil Help?

Conflict Continues Between Key Grains Suppliers

Explainers That May Be of Interest…

The Brazilian Ethanol Industry