Insight Focus

- The October raw sugar futures expired at a premium to the March.

- This is unusual; it’s not happened in 11 years.

- Is a premium expiry positive for prices in the future?

Up or Down?

This question seems to appear with each futures expiry. An expiry is the only time when sugar’s physical and futures market align and so everyone wants to know what they mean.

The simplest (and least useful) answer is that an expiry neither bullish nor bearish. Expiries are just transactions matching buyers and sellers at a price. While this is true, in many transactions one party has the upper hand and this has consequences.

What Happened Ahead of the October’22 Raw Sugar Expiry?

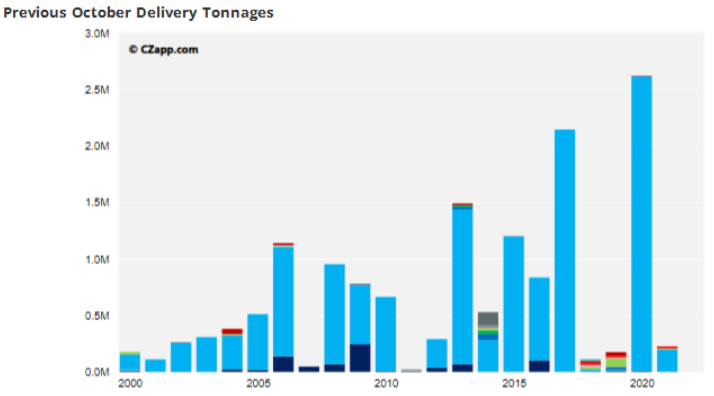

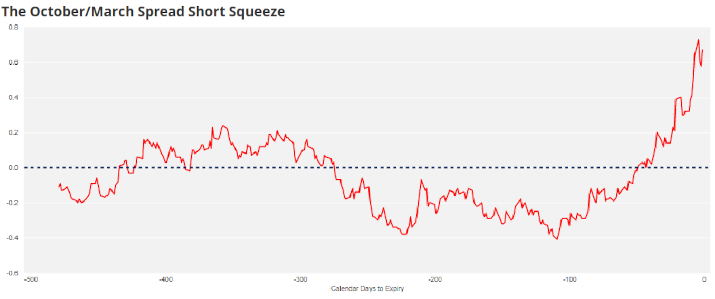

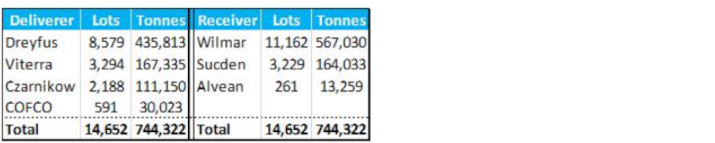

The October’22 raw sugar futures contract expired last Friday at a 74-point premium to the March’23 futures. Nearly 750k tonnes of raw sugar was delivered, all from Brazil. This is a respectable volume for an October expiry.

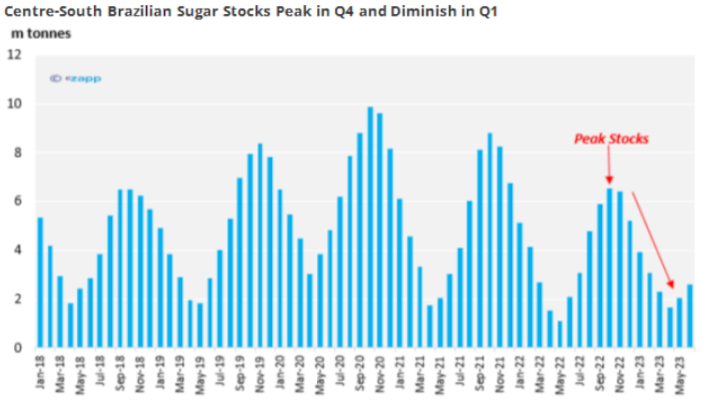

The sugar delivered must be available between October 1st and December 15th. This period is when stocks at the world’s largest sugar exporting region, Centre-South Brazil, peak. Meanwhile, the March’23 futures expire during the Brazilian offcrop when supply is scarce.

Under normal market conditions, the October futures should expire at a discount to encourage traders to carry sugar forward from the time of plenty to the time of scarcity. This didn’t happen this time around, which is often a sign that sugar supply is being disrupted.

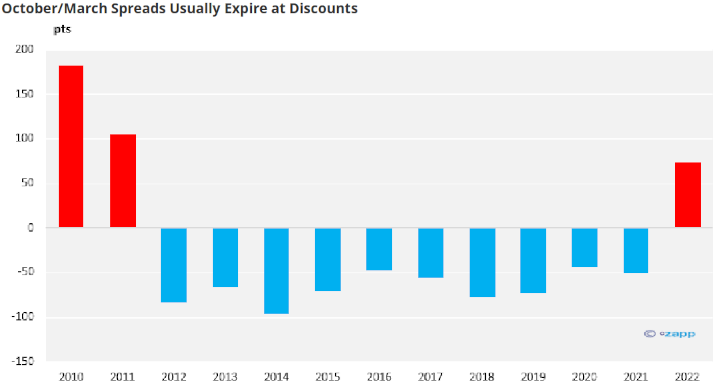

Indeed, it was the first October futures contract not to expire at a discount to the March since 2011, when the flat price was 27c/lb.

Source: Refinitiv Eikon

This is strange because there’s no indication that the sugar market is as undersupplied today as it was at the peak of the 2009-2011 bull market. The flat price is only at 18c/lb today. The ‘scarcity’ in the sugar market is technical.

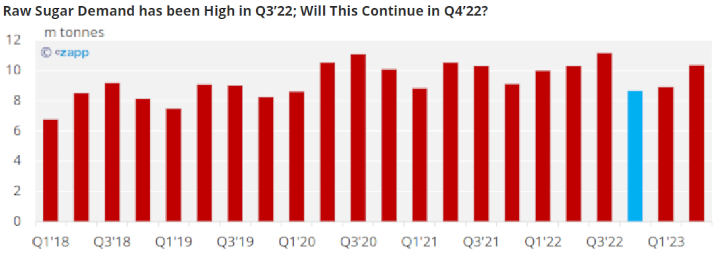

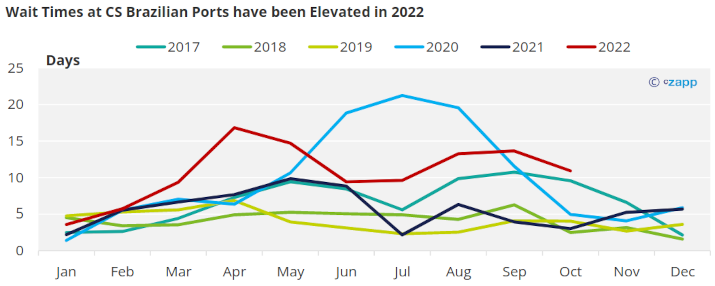

A queue of vessels waiting to berth at Brazilian ports has become self-feeding. Trade houses are nominating vessels earlier and earlier so that they ultimately berth on time. This has been supported by strong, possibly record, global raw sugar demand in Q3.

Traders have had to pay a premium to jump the queue. There’s no shortage of sugar but there has been a shortage of prompt berthing slots at Santos and Paranagua ports.

This left the October’22 futures vulnerable to a short squeeze.

Source: Refinitiv Eikon

At the end of June, when the wait time at Santos port to load sugar was 10 days and so roughly comparable to 2021, the October/March spread was at -40pts. This is a normal level for that time of year; not quite at the cost of carry in Brazil, but heading in the right direction.

However, unlike in previous years when the vessel queue diminished, the wait time grew through Q3, and the October/March spread began to strengthen. It moved from discount to premium at the end of August.

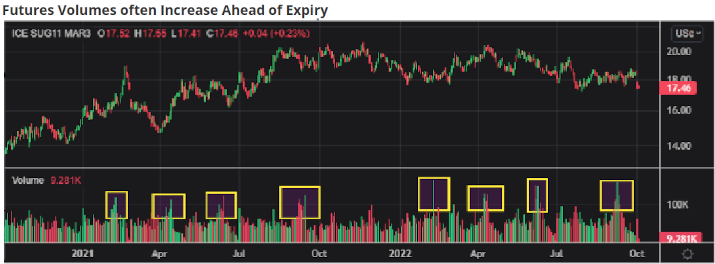

A month before expiry, many traders who don’t intend to participate in delivery roll their futures positions out of the front contract. For the first week of the month this leads to elevated volume in the market. At the same time, traders who do wish to participate in the delivery start to position accordingly.

Source: Refinitiv Eikon

During September we heard rumours that several trade houses were buying up Q4 raw sugar, effectively removing it from the market and making it unavailable for delivery. Still the October/March spread strengthened. This gave spread shorts a difficult decision: buy back or find sugar to deliver.

Ultimately, we believe that the trade house caught short the October/March spread bought back their position before expiry, driving the spread up to 74pts premium.

Was It Bullish Because the Receivers Won?

At first glance it looks like Wilmar, the main receiver, won. They secured physical supply for Q4, squeezed the futures and now control most of the “spare” raw sugar for the rest of the year. A strong receiver should be bullish for the market.

Indeed, they have already started offering Q4 physicals at a premium to the expiry spread, at H+100pts.

But look again…..

Or Was it Bearish Because Deliverers Are Advancing Supply?

The trade house that we believe was squeezed ultimately didn’t participate in the delivery. Many of the traders who did deliver did so opportunistically. The October/March spread blew out to such a high level that they advanced sugar that they’d originally earmarked for Q1’23 sale/shipment and delivered it against the October futures. The deliverers weren’t operating from a position of weakness.

Meanwhile, in the background the ongoing Centre-South Brazilian cane harvest motors on, with mills maximizing sugar production. Estimates for the total amount of sugar produced in 2022/23 keep creeping higher. The receivers need to be confident that global raw sugar demand will continue to be firm as we approach the end of the year.

The Macro-Economic Outlook is Poor

Then we need to overlay the current macro-economic situation. This is becoming complicated.

The strength of the US Dollar has been so extreme that many markets have been hit hard.

Source: Refinitiv Eikon

Crude oil is down 33% from 2022’s high. So is copper. The Federal Reserve have indicated they will keep raising rates until inflation is under control. Their target is 2%; the latest Consumer Price Index print was 8.3%. Many equity and commodity markets have bounced this week, perhaps on the hope that the Federal Reserve may slow its rate rises. After all, the Reserve Bank of Australia only raised by 25 bps this week, which was less than expected. And the Bank of England found itself in the strange position of raising rates and buying bonds at the same time last week. But the Federal Reserve’s signalling in recent months has been clear: they will slay inflation even if ither things break.

Source: Refinitiv Eikon

Our best summary (and it’s only an educated guess) is that the expiry is slightly bearish. Q4’22 looks better supplied today than it did a month ago when the short squeeze began and the macro-economic outlook is poor.