Insight Focus

- Sugar conference delegates struggle to determine price direction.

- Sugar trade houses become increasingly Brazilian.

- Indian Ferrari in the workshop this year.

“Once you leave, you’ll be more confused about the sugar market than when you started. In fact, that’s the main aim of the conference.”

With these words Jamal Al Ghurair opened the Dubai Sugar Conference 2024.

He turned out to be correct. This year’s event was marked by a complete lack of conviction in sugar price direction.

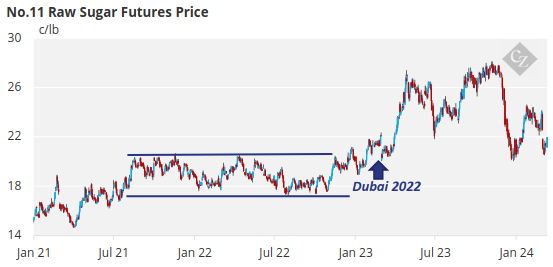

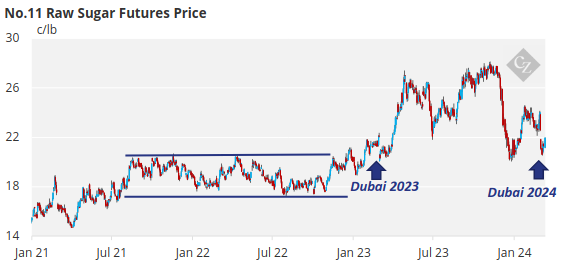

In October 2022 speculators had bought into the sugar market, lifting it from 17c to 20c. The trade had become bullish shortly afterwards and then arrived in Dubai in February 2023 shocked to discover everyone else was bullish too. This set the scene for the rally to 28c.

This year was different. December’s sugar price collapse had been difficult for the trade, with some houses losing everything they’d made in 2023 in a couple of weeks. As a result, there was a divergence of trade views and deep unease at Wilmar’s relentlessly bearish tweeting. Dimitri Varsano from Sucden acerbically observed on the trade panel that he’d prefer Wilmar nominated vessels against the March’24 raw sugar futures expiry rather than post on social media.

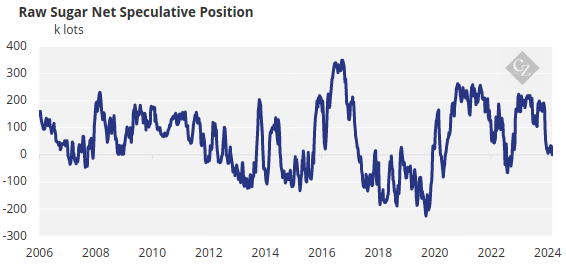

One major problem for the sugar market today is that the story is well-known. Everyone is aware that we are dependent on Centre-South Brazil for the huge majority of global sugar supply. Everyone knows the port of Santos is a key bottleneck and potential supply risk point. Everyone could therefore conclude a problem at Santos would drive sugar prices higher. This is a good story but it’s not going to be enough to get commodity funds back into the sugar market, especially when cocoa prices are rocketing to all-time highs and grains prices keep sinking.

All of this made for a lot of intriguing conversations in Dubai’s hotels, coffee shops, bars and restaurants, but not concrete price view.

Strangely, this was fine for us. We attended the conference partly to present on the European sugar market (you can see the presentation here), partly to catch up with old friends and customers and also partly to introduce our consulting capability CZ Advise to the market. A lack of compelling story in the sugar market might even have worked in our favour.

For a start, sugar producers around the world seem to now be thinking about what follows the current bull market. What would prices falling below 20c/lb mean for their businesses? This meant many were talking again about revenue diversification: about ethanol, biomass, biogas, aviation fuel and bio-plastics. One of our new consulting services is to support customers as they invest in this transition.

It’s also notable how Brazilian the sugar trade has become in recent years. The trader panel featured Raizen, Alvean, Sucden, COFCO and Dreyfus, which at face value represents the Americas, Europe and East Asia. But 4 of the 5 executives on the panel were Brazilian, with only Dimitri Varsano of Sucden flying the flag for other countries. This means that the trade houses no longer take a diverse worldview. They have a Brazilian worldview: that everything is generally fine until it isn’t.

The trade did spend quite a lot of time sensibly talking the next CS Brazilian cane crop lower, which was prudent given this year’s blockbuster crop. But this also means indirectly they were attempting to talk the market up, with the lines between patriotic producer and ambivalent trader becoming increasingly blurred.

Then there was the Indian contingent at the conference. Last year the Director-General of the Indian Sugar Mills Association (as was) presented to the conference wearing a Ferrari t-shirt. The future for the Indian cane sector was supercharged! This year, Indian representatives were far lower profile after a poor cane crop. Delegates on the Indian trade panel were at great pains to compliment the representative from the Government of India’s Food Ministry on how well the civil servants have managed the sugar sector this year… the government’s main actions being to block the industry’s revenue-generating options by restricting sugar imports and sucrose diversion to ethanol!

India will always be important to the sugar market; it’s the world’s largest sugar consumer and one of the world’s largest sugar producers. But the Ferrari is currently in the workshop undergoing maintenance.

What does all of this really mean? As ever, much of the value of the conference lay in having several hundred of the sugar market’s most important people in the same location at the same time. The coffee shop speed-dating meetings continue for the full 3 days and even in an era of AI, Teams and virtual reality they remain a remarkably efficient way of doing business.

From a price point of view, we’ve been pondering what the market needs to do to inflict maximum pain. Because while a market exists to facilitate risk management, you shouldn’t make the mistake of thinking it’s there to help. Producers would clearly like to hedge closer to 28c. Consumers would prefer to hedge below 20c. The trade needs some form of volatility to manage their books properly. Analysts need a compelling story with which they can attract attention. Perhaps the most frustrating thing the market can do is to trade sideways between 20-24c for a few months?