Insight Focus

Over 1 million tonnes of raw sugar was delivered into the July expiry. Brazil continues to dominate the market. Raw sugar demand looks firm.

The July’24 Expiry

The July’24 raw sugar futures contract expired at the end of last week.

Expiries are consequential events for the raw sugar market: they’re the only times that the futures and physical markets need to align, and this only happens 4 times a year.

But they are also just transactions between buyers and sellers, so beware of reading too much into them.

Centre-South Brazil Dominates

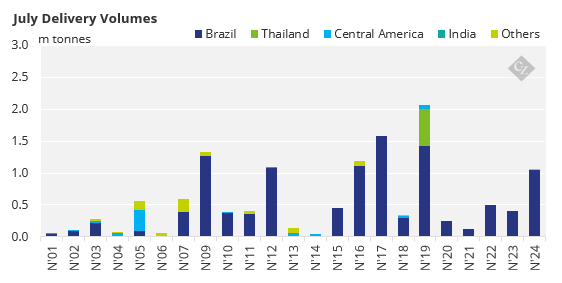

July futures expiries are usually all about Centre-South Brazil, the world’s largest cane grower and raw sugar supplier. Cane crushing normally peaks in Q3 each year. So does export flow at the port.

Meanwhile northern hemisphere cane and beet origins are in their off-crop periods. This means that July expiries tend to be dominated by Brazilian supply.

This year, The July’24 contract expired at a 1-point premium to the October’24 contract. Just over 1m tonnes of sugar was delivered by Wilmar, Enerfo, Olam and Macquarie to Alvean, Dreyfus and Raizen.

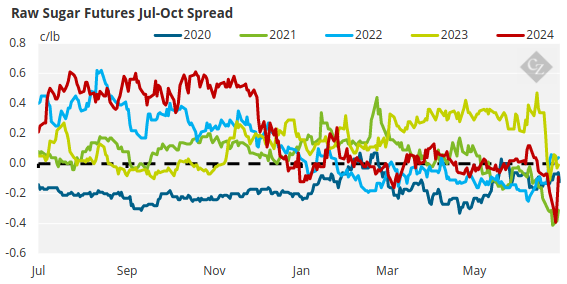

The Jul/Oct spread had been weak in the weeks leading up to expiry, trading at a discount as the sugar market transitions from undersupply to oversupply.

This showed that Brazilian sugar logistics were performing adequately in recent weeks even as the market worried about cane growth in the fields, which was more reflected in the flat price.

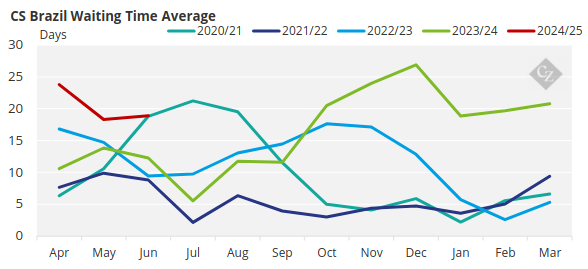

Indeed, the Jul/Oct spread traded out to cost of carry in Brazil until a receiver emerged in the final trading sessions. However, physical values in Santos remained firm in the month of June, reflecting decent end-user demand and the 20-day vessel queue at the port.

This means that in the run-up to expiry the market felt finely balanced.

Trade House Positioning

The recent trade fuss about slow loading and short delivery at the May’24 expiry also didn’t put any of the big trade houses off being involved in the July expiry either. Wilmar were the dominant deliverer, accounting for around 60% of the tonnage. They’ve been vocally bearish the sugar market all year; this was their 3rd heavy delivery in a row and they’re clearly still keen to show there’s oversupply in the market.

But where Wilmar seem to have moved away from receiving from the expiry, others have stepped into the breach. Alvean were the major receiver, with Raizen accounting for a fair chunk of sugar too.

This was the first expiry for Raizen since their senior sugar team left the company, so it’s quite a bold statement: the team may have changed but the strategy to extend from being a Brazilian producer to a sugar destination business remains the same.

Both Alvean and Raizen would be keen to show that end-user demand is decent.

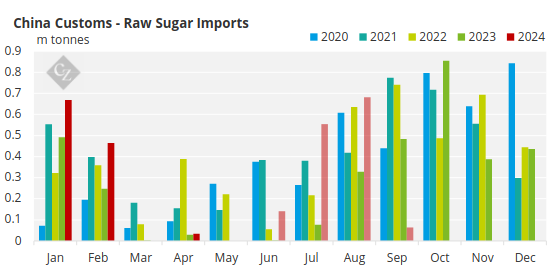

This demand probably doesn’t come from the large Chinese refiners, who we think have already covered most of their 2024 needs and won’t be back in the market unless the flat price weakens significantly.

More likely the current strong demand comes from the world’s re-export (toll) refiners.

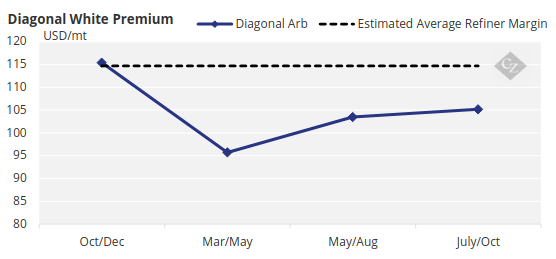

For them, H2’24 represents a big opportunity. The raw sugar October/March spread is in carry: it’s cheapest to buy raw sugar today. But the refined sugar market is backwardated: it’s best to sell white sugar today too. This is a good combination for them.

In 2025 nearby raw sugar is expensive, which is less appealing.

So, what do we make of this all. A few conclusions:

- The world remains utterly dependent on CS Brazil for supply.

- Raw sugar demand remains decent even at 20c.

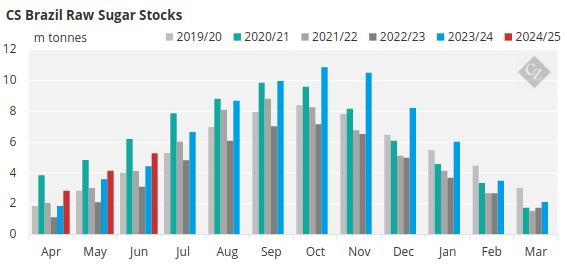

- Brazilian logistics are coping with this demand even as there are worries about the health of the cane crop.

Everything is therefore finely poised as we move into the second half of 2024.